I have been speaking about a Fed pivot for a while now. One of the biggest reasons for a Fed pivot is deteriorating liquidity conditions and how that will affect global liquidity within the US and abroad. There are certain things that I will be discussing in this post in terms of what I use to measure liquidity stress conditions, the first being failures to deliver from the primary dealers. After this, I will discuss eurodollar futures, cross-currency basis swaps, money market funds (MMF) funding, forward rate agreements minus overnight index swaps, forward rates against forward rates, credit default swaps, and LIBOR (and other rates) minus the overnight index swap. All the factors mentioned will give some insight into what I am seeing and their implications while providing insight into how we are seeing massive liquidity tightening.

We will first examine what is happening with the primary dealers. Liquidity is starting to deteriorate, which is not a surprise given the title of this article, and a great insight into this is the Repo market. Failures to deliver (Bonds used as collateral in Repurchase agreements) have been elevated and are up 22% on a WoW basis. This is a good indicator of the growing liquidity event and that a liquidity event is starting to brew within the global financial system. This chart can be seen below in chart 1.

The next thing is looking at Eurodollar futures and the spread between them. Now I do not think that Eurodollars should necessarily be used to say that the Fed will cut rates or to try to project rate cuts. The spread and the inversion we see on the spread indicate that a liquidity event is brewing. The Eurodollar is telling us a couple of things: looking at the spread below, it is telling us that we should see roughly three rate cuts into next year, the actual inversion tells us something about the outlook of growth which is negative, and that liquidity conditions are deteriorating. What I do like about the ED is that the reason that we are seeing a rate cut start to be priced in is due to deteriorating liquidity conditions, and the curve is saying that because this liquidity event will cause stress within financial markets that the Fed will have not choice but to cut. This curve can be seen in chart 2.

Many things are signaling policy error, and increasing volatility will require a more dovish Fed to stabilize financial markets. Let us look at money market volatility and what it has meant over the past couple of years. When the trade war began (2019), we saw a small spike in 3m-10y swaptions volatility. This saw a relatively small spike in money market volatility. Moving forward to covid, when global financial markets got hit by rising uncertainty, we saw a massive spike in volatility again. The Fed had to step in and bring back stability within financial markets. Now volatility is extremely elevated, and the Fed continues to raise rates. This seems to signal a policy error on the part of the Fed. Volatility is surging, and this puts massive pressure on money markets. If stability is to be restored, the Fed has to change course. Hiking rates when volatility is this high could signal a bad omen for financial markets. This is seen in chart 3.

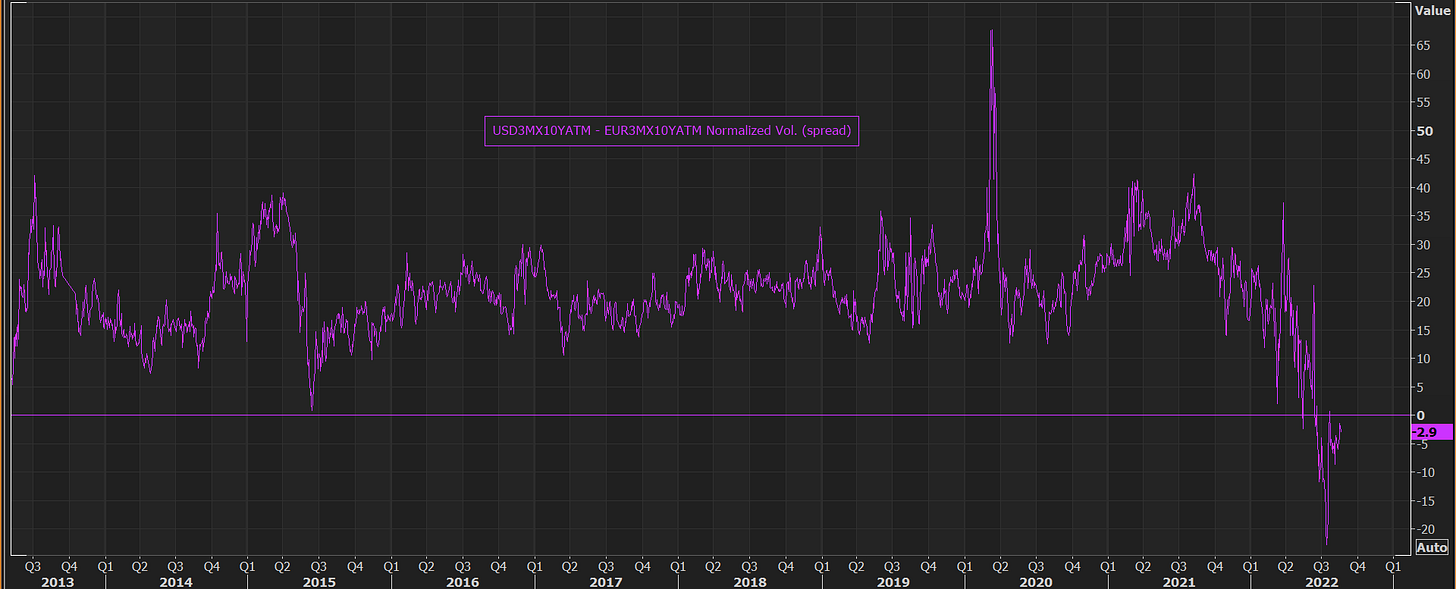

One of the first things I have noticed in the last couple of months, which is truly astonishing, is what is happening with rate volatility. Below in chart 4, you can see 3M/10Y EUR ATM swaption normalized volatility, which is against the USD. Euro rates volatility has now continued to stay elevated above USD rates volatility, which is extremely rare from a historical standpoint. As this is the first time, ECB has hiked since 2011.

Below you can also see the spread in chart 5. As one can see, there has been a persistent surpassing of EUR vol. relative to USD vol. This can be a function of many things, one being increasing hedging costs, and another a function of rates markets trying to sniff out what the terminal rate is going to do. Again, as pointed out in chart 3 above, higher rates volatility can start to cause issues within financial markets, and central banks possibly have to shift policy to stabilize markets.

As we are on money market funds (MMF), we should look at how MMF funding stress is looking. CAD money markets are seeing tremendous funding pressure, and the USD is also elevated from a historical standpoint. Money Market funding stress can affect access to short-term liquidity and funding. The MMF also play a huge role in funding for NFC and banks as they can provide credit (short-term) by buying commercial paper. If we see outflows and redemptions, that can start to stress MMFs to meet any margin they see from exposure on levered products and derivatives. Deteriorating liquidity conditions is my central thesis behind the potential for a pivot, shown in chart 6 below.

Now moving on to forward term structures and will be comparing the Bank of Canada Policy Rate and Fed Policy against the forward term. There are signs that the rate hikes' expectations are closer to over than just getting started. The curve continues to invert again and again. It is only up now about 30bps for US and 46bps for Canada. The constant inversion in the forward term structure signals that rate cuts could be on the horizon. This isn’t necessarily a sign of deteriorating liquidity conditions but is still showing term structures are not flashing good signs about the future. This is depicted below in chart 7.

However, the swap market tells us something about growth and liquidity. This is shown in chart 8, and the outlook is not good. Look at the 2s10s swap curve; this is the most inverted that it has ever been in the history of financial markets. The 10-year swap has fallen about 100bps in the last quarter, and when you look at the 2s10s swap , it is pricing in deflation, but it is also pricing in growth getting axed. The swaps tell us that economic growth and liquidity conditions are starting to deteriorate. The further that inverts, the worse the outlook will be.

There are further signs of liquidity issues. Take the three-month forward rate agreement (FRA) minus the overnight index swap (OIS). Since the beginning of 2022, the FRA - OIS has almost 4x. The FRA - OIS is also a measure of financial stress. The metric of financial stress brewing within the backing system is at levels we have not seen since the Great Financial Crisis (GFC). This could also be due to dollar hoarding stress and the inability to access wholesale dollar funding. This can further strain the financial system as the access to dollar collateral starts to dry up. Below in chart 9 is what we see in the FRA - OIS.

There is another interesting function that we are starting to see, and that is looking at the 2-year swap. This is essentially the spread of a fixed leg vanilla interest rate of a 2-year tenor, in this case, against a 2-year treasury. The 2-year swap has always closely followed the 3-month FRA - OIS. We are starting to see that the 2-year swap is beginning to move higher, and while the FRA-OIS, as pointed out above, is still historically elevated, it has started to come down. A higher 2-year swap spread is bad news if the correlation holds for the possibility of banking stress becomes even more elevated. We would want to see that the 2-year swap starts to come down due to demand for longer-dated treasuries (market assumption of rate cuts), which would lead to an easing of the FRA-OIS. This is shown below in chart 10.

Now on the aspect of dollar hoarding, I have talked about at tandem looking at the cross-currency basis swap (XCCY). This is shown below in chart 11, and if we look at different XCCY of a 5-year tenor EUR/USD, JPY/USD, CHF/USD, and finally GBP/USD, most are seeing a basis more negative than at the beginning of the pandemic. We are witnessing a massive hoarding of dollars and the inability of banks to access the wholesale dollar funding market. The XCCY becoming more negative indicates that counterparty risk on the part of banks is rising. This is a further indicator that liquidity conditions are deteriorating.

So far, we have looked at the FRA - OIS, how it relates to the liquidity crunch in the US and other factors that we see within the USA regarding liquidity effects. I have been primarily focusing on the USA, and I am sure people are asking if we see similar things elsewhere around the world. The answer is yes. We see similar stresses by looking at the 3m FRA - OIS (EUR) and comparing that against the European Financial CDS index. As banking stress is starting to build and the inability to access wholesale dollar funding markets, we have seen increases in the probability of defaults within the European financial sector. The stress we see within Europe can be seen below in chart 12.

In closing, there are signs of liquidity events brewing throughout the world and global financial markets. This is something to monitor moving forward and consider when thinking the Fed needs to be more “hawkish” this comes at a price. What is that price? The possibility of massive instability within global financial markets. While I am not a fan of the current monetary regime, it is the system and the cards we have been dealt. All one can do is understand this and look at these things regarding possible risks brewing within global financial markets.

I'm new to your newsletter which I found after hearing you on LEAD- LAG whereby I was impressed with the breadth of your data and hence curious to learn more. At first I was inclined to dismiss completely your views due to a great many editing errors but I believe it's apparent you're using speech to text to write with and it cannot tell the difference between excess and access.

William