Zynergy: The Smokeless Catalyst Behind Philip Morris’s Next Chapter

Introduction

As the world moves away from combustible tobacco, Philip Morris International (PMI) is undergoing a transformation that few legacy tobacco companies have managed to pull off. At the heart of this evolution is Zyn, a discreet nicotine pouch that's quickly becoming the crown jewel of PMI’s smoke-free portfolio. With demand for nicotine pouches growing over 30% annually and Zyn commanding a dominant — yet supply-constrained — position in the U.S. market, investors may be overlooking a powerful growth engine hiding behind the Marlboro shadow.

In this post, we’ll break down why Zyn is more than just a niche product, how it's unlocking a new generation of revenue, and why it could propel Philip Morris into a new phase of high-margin, smoke-free dominance — one pouch at a time, as well as the overall outlook for the company.

Zyn/HTU/Traditional Tobacco

Philip Morris is currently the world’s largest tobacco company by volume; however, this is rapidly evolving due to the company's shift toward smokeless products. The primary catalyst behind this transformation is Zyn, a reduced-risk product intended to eventually replace traditional cigarette sales. As of Q1, approximately 42% of the company’s revenue came from reduced-risk products, and Philip Morris has set a long-term goal for two-thirds of its revenue to be derived from these products by 2030. Given current growth rates and Q2 projections—where reduced-risk products are expected to account for 43% of revenue—it is reasonable to expect that Philip Morris could surpass the 50% mark by the second half of 2027.

ZYN demand in the U.S. remains strong, and sales volumes continue to be constrained by production capacity. Going into Q2, this is expected to remain a key theme in the upcoming earnings report. While there has been some increase in production output and a pull-forward of distributor replenishment at the end of Q1 2025, the flow-through to retail stores remains limited. In Q1, only 202 million cans of ZYN were shipped to U.S. distributors, and on the earnings call, Philip Morris stated that they do not expect supply to normalize until the end of the year.

Nicotine pouch sales volumes are currently growing at around 35-40% despite the supply shortage, Philip Morris expects ZYN sales to grow relatively rapidly as the in-store availability improves. Expectation going forward is for gradual offtake acceleration coming in the next few months.

For those who are new to the nicotine pouch space, there has been an explosion of new players entering the market. As a result, Philip Morris International (PMI) has lost some ground in terms of market share. Competitors include British American Tobacco with Velo, Turning Point Brands with FRE and ALP, as well as other brands like Rogue and ON!.

While the market has become increasingly competitive, ZYN holds a significant advantage: it has evolved into a cultural reference point. In other words, ZYN is not just a product—it's part of the culture. Because of this brand strength, ZYN commands a premium price, currently averaging around $5.50 per can in the U.S.

For those unfamiliar with nicotine pouches, it's worth noting that ZYN contains only 15 pouches per can, compared to many competitors who offer 20. ZYN also tends to have lower nicotine content than some of its rivals. However, this hasn't significantly impacted its popularity.

ZYN has faced persistent supply chain constraints, and the imbalance between supply and demand has contributed to its higher retail price relative to competitors. That said, ZYN is currently the only FDA-approved nicotine pouch on the market, which gives it a strong regulatory edge. As production capacity improves, PMI is likely to find the right balance between price and supply, eventually restoring market equilibrium.

Philip Morris’ smoke-free business now makes up 44% of total gross profit, driven by its multi-category strategy and expanding market reach. IQOS grew nearly 10% year-over-year in heated tobacco unit (HTU) sales, showing resilience in Japan and Europe despite regulatory headwinds, with growth expected to double in the second half of the year.

Philip Morris’s heated tobacco unit shipment volumes continue to show strong resilience as well. The smoke-free business (IQOS) account for 9.5% billion dollars relatively to the 10.2 billion dollar revenue that was generated. They did this in under a decade. Currently the demand for PMI HUTs has been large, and PMI HTU is currently the second largest brand in market at 9.2%. A large fraction of that shipment volumes for HTUs was from Europe where around 13.1 billion units were destined for Europe for Q1 of 2025.

I expect HTU products to be a relatively strong contribution to PMI, especially as it pertains to the potential growth we are seeing from European and Japanese markets.

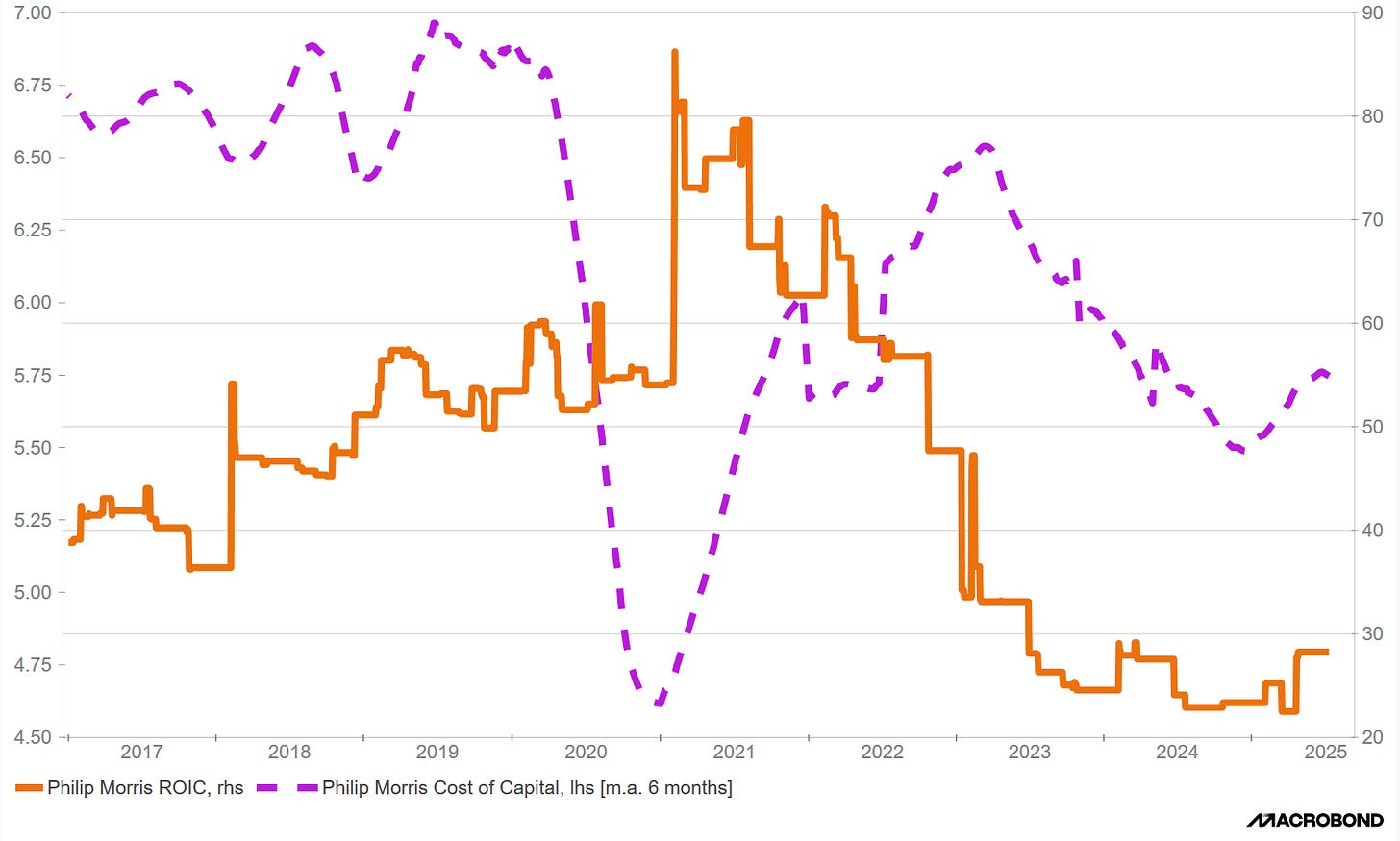

There has been some concern as cigarette volumes have declined — falling by around 33% since 2012 — but given the ROIC and cost of capital (discussed more in next segment), we still see room for the company to continue generating strong returns despite the global decline in cigarette volumes.

Quantitative Evidence and Valuation

Right now, ROIC sits at nearly 30%, which is well above the company’s estimated cost of capital, currently around 575 basis points.

It comes as no surprise that nicotine is an addictive substance, and as such, we would expect it to exhibit relatively inelastic demand. However, a key headwind is the possibility that, at some point, consumers may become less willing to absorb further price increases. This would result in a rise in the price elasticity of demand — meaning that even small price hikes could start to meaningfully reduce consumption. As elasticity increases, the company may begin to experience compression in gross profit margins, particularly if it can no longer pass through price increases as effectively.

Another challenge to sustained pricing power comes from regulatory pressure. High excise taxes, nicotine content limits, and public health initiatives aimed at reducing tobacco and nicotine usage — as seen in Australia, New Zealand, and Canada — can limit the ability to raise prices further.

That said, historical evidence from these countries also suggests that there is still headroom to increase prices without triggering a sharp decline in demand. Inelastic demand has historically allowed companies to raise prices and expand gross profit margins — and, barring an inflection point in elasticity, this trend could continue in the near term.

Going into Q2 we are looking for EPS of 1.85.

From mid-2023 into early 2024, consensus EPS estimates across all quarters declined. This downward estimates were particularly sharp for 4Q’25 and 2Q’25. The declines likely stem from:

Currency headwinds, especially from emerging markets

Regulatory pressures, including flavor bans and nicotine taxes

Slower-than-expected growth in new product categories

These revisions point to a period of cautious sentiment among analysts, as visibility into future earnings became more clouded.

Fast forward to mid-2024 and into 2025, we see stabilization and a modest rebound in EPS expectations. Notably, the light blue and teal lines—1Q’26 and 3Q’25 forecasts—move upward and remain elevated compared to 2Q’25 and 4Q’25.

This rebound could reflect:

Improved margin outlook as cost pressures ease

Operational efficiencies from the growing scale of IQOS and ZYN

Resilient consumer demand, even amid macroeconomic volatility

The graph provides a comprehensive look at key metrics surrounding each quarterly EPS report. A striking pattern emerges from the data. In most quarters, the actual EPS surpassed even the highest analyst estimates. For instance:

In 2Q23 (July 20, 2023), the actual EPS of $1.60 beat the high estimate of $1.51, resulting in a +$0.12 (+8.4%) surprise.

This trend continued, with 1Q25 (April 23, 2025) showing an actual EPS of $1.69 against a high estimate of $1.66.

These positive EPS surprises often translated into favorable stock price movements. Notable reactions include:

A robust +12.5% jump in 3Q24 (October 22, 2024) and a +13.4% increase in 4Q24 (February 6, 2025), reflecting strong investor approval.

Even smaller gains, like +3.6% in 1Q25, suggest consistent market confidence.

However, there were exceptions. Despite positive EPS surprises, minor declines occurred, such as -1.3% in 2Q23 and -0.6% in 3Q23, hinting at other market dynamics or external factors influencing the stock.

The overall trend is clear: the stock tends to rise after EPS reports, with the largest gains in 3Q24 and 4Q24. This indicates growing investor trust in the company’s financial health and future prospects. The consistent outperformance of EPS estimates likely plays a key role in driving these reactions.

This analysis underscores the importance of EPS reports in shaping stock performance. As we move forward, it’ll be interesting to see if this positive momentum holds.

Currently PM is trading at a premium relative to the market. The company’s forward 12-month price-to-earnings multiple of 23.2X remains above the industry average of 17.75X. However, given the current share of the US market for nicotine pouches, growing size of HTU (second largest brand), and being one of the largest cigarette producers in the world, I would argue that this multiple is justified.

Now as it relates to the current valuation I expect given the inputs into the DCF that currently PM is trading at a 15.5% discount to intrinsic value. This does not really leave a lot of room from margin of safety at current prices. From a value standpoint would wait for a pullback before entry.

Conclusion

Fundamentally, I believe Philip Morris is a solid business that continues to make meaningful progress in shifting its portfolio toward smoke-free and non-combustible products. The company remains a leader in the industry, supported by strong and capable management.

This post is not intended to serve as an in-depth equity research report, but rather to provide a high-level overview of the strategic changes underway, along with key quantitative and valuation metrics. A more detailed analysis of Philip Morris will follow in future posts.