Turkey Macro Outlook

Introduction

Geopolitical risk and the inability to control the ongoing devaluation of the Turkish Lira are becoming increasingly burdensome for the Turkish economy. The persistent depreciation of the currency has led to heightened inflationary pressures, eroding consumer purchasing power and adding strain to businesses that rely on imported goods and services. Additionally, investor confidence has been shaken as foreign capital outflows continue, with many global investors growing wary of the country's economic stability and policy direction.

Beyond economic concerns, Turkey is also grappling with a noticeable decline in the rule of law, which is further exacerbating its financial woes. The erosion of judicial independence, the curbing of press freedoms, and the increasing centralization of power have contributed to a challenging business environment, discouraging both domestic and foreign investments. As governance concerns grow, international institutions and credit rating agencies have expressed concerns about Turkey’s long-term economic prospects, warning that sustained political and legal instability could lead to further financial deterioration.

The broader economic and geopolitical backdrop looks increasingly bleak for Turkey. The nation faces mounting external pressures, including regional conflicts and strained diplomatic relations, which have further dampened its economic outlook. Without meaningful structural reforms and a stabilization of both political and economic conditions, Turkey could continue to struggle with capital flight, currency volatility, and slowing economic growth, leaving policymakers with difficult decisions on how to restore confidence and stability.

FX Markets

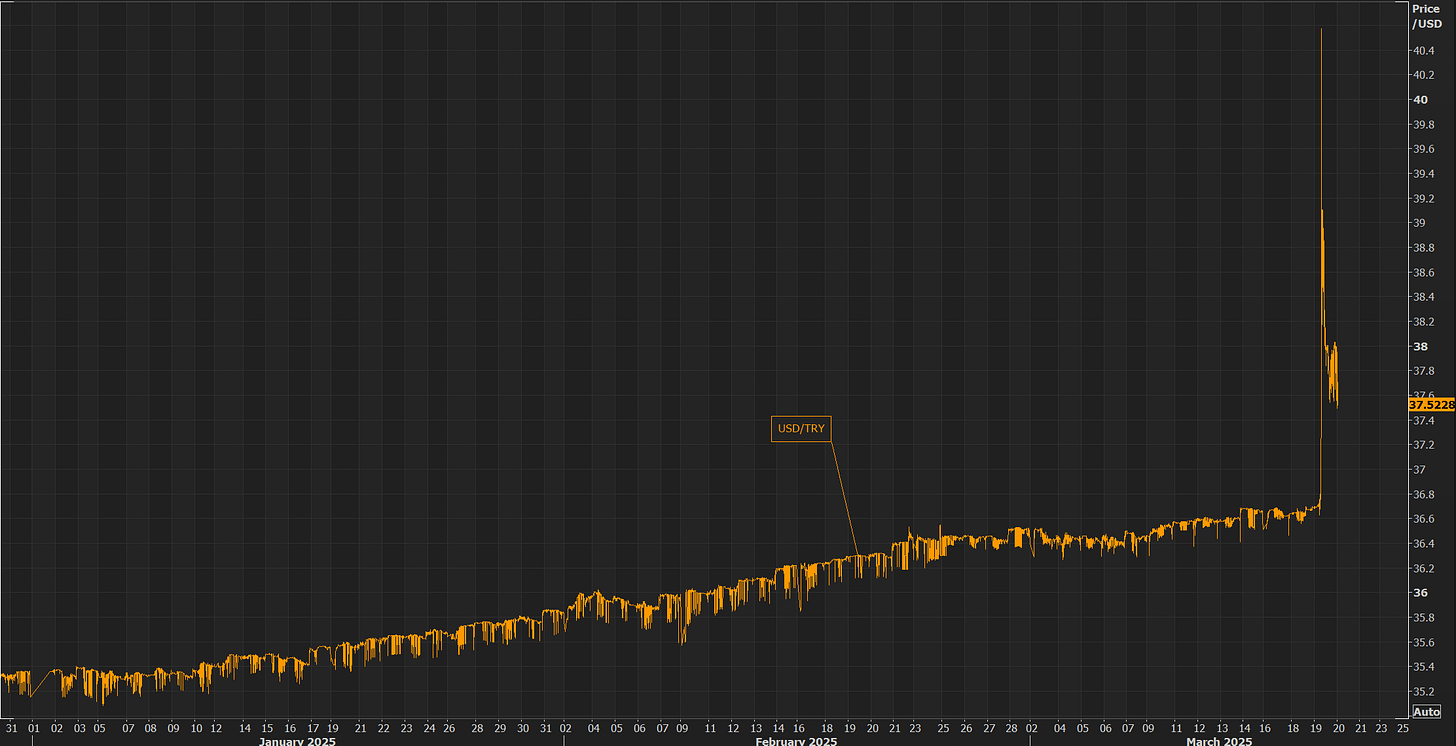

The first market we are going to look at is Turkey, where the detention of Istanbul’s mayor, Ekrem Imamoglu, led to people taking to the streets in unrest, the likes of which have not been seen in over a decade. This also had economic impacts, with financial markets falling sharply due to concerns about a deterioration in the rule of law within Turkey. The central bank of Turkey raised its overnight rate and spent about $10 billion in foreign reserves on Wednesday to stabilize the currency, which fell around 12% to an all time low that day.

All of this uncertainty and concern about the eroding rule of law in Turkey has led to a rise in sovereign credit risk once again. This is being driven by various factors, including political issues, the depreciation of the Turkish lira (TRY), the need for Turkey to raise its overnight rate, and the requirement to spend money on foreign exchange reserves to stabilize currency markets, as well as the potential halt in the rate-cutting cycle. Real yields in Turkey are still negative, and net reserves as a percentage of GDP are nearly negative, which is increasing the risk.

Turkey’s net reserves as a percentage of GDP being close to zero poses significant risks to the country’s financial and economic stability. Net reserves, which account for a country’s foreign exchange holdings after subtracting liabilities, serve as a critical buffer against external shocks, currency volatility, and balance of payments crises. When net reserves are close to zero, it signals a diminished ability to defend the Turkish Lira, meet external debt obligations, and stabilize financial markets in times of stress.

With net reserves near zero, Turkey lacks the capacity to intervene effectively in foreign exchange markets to support the Lira. Given the persistent depreciation of the currency and high inflation, the central bank has few tools left to prevent speculative attacks or capital flight. This exposes Turkey to the risk of further sharp devaluations, which can exacerbate inflationary pressures and erode purchasing power.

Turkey has a significant amount of external debt, particularly in the private sector, where many corporations have borrowed in foreign currency. With limited reserves, the country’s ability to service this debt in times of stress is compromised, increasing the likelihood of defaults. A rising risk premium on Turkish assets could lead to further capital outflows and rising borrowing costs for both the government and private sector.

Emerging markets with weak reserves are more susceptible to global financial shocks, such as rising U.S. interest rates, geopolitical instability, or a slowdown in global trade. If investor sentiment turns negative, Turkey may struggle to attract the necessary foreign capital to finance its current account deficit, exacerbating financial instability.

Net funding from the Turkish central bank represents the liquidity it provides to the banking system. When net funding is negative, it means that the central bank is either withdrawing Lira from the system or supplying less liquidity compared to previous periods. Conversely, when net funding is positive, the central bank is expanding liquidity, injecting more Lira into the economy.

Negative Net Funding (Liquidity Withdrawal):

Less Lira is circulating in the banking system, which typically tightens financial conditions.

If demand for Lira remains stable while supply shrinks, the currency should appreciate or at least stabilize.

This can also put downward pressure on inflation, as there is less money chasing goods and services.

In theory, reducing liquidity should help prevent further devaluation, assuming other factors remain constant.

Positive Net Funding (Liquidity Expansion):

More Lira enters the system, increasing money supply.

If the supply of Lira grows faster than demand, its value can decline, leading to depreciation.

Excess liquidity can fuel inflation, reducing real purchasing power and making the Lira weaker over time.

Historically, aggressive monetary expansion in Turkey has contributed to Lira depreciation and inflation spikes.

In theory, negative net funding (liquidity withdrawal) should slow or reverse devaluation by reducing Lira supply. However, if broader economic issues—such as low reserves, high external debt, or political instability—are driving Lira depreciation, tightening liquidity alone may not be enough to prevent further weakness. For monetary tightening to be effective, it must be accompanied by credible policy actions that restore investor confidence and address structural economic imbalances.

With the recent deterioration of the Lira, we have seen a sharp rise in expected volatility, signaling heightened uncertainty in the currency markets. This surge in implied volatility suggests that investors anticipate larger price swings in the coming weeks, driven by factors such as dwindling foreign reserves, policy unpredictability, and ongoing geopolitical risks. Market participants are likely pricing in potential central bank interventions, shifts in capital flows, or external shocks that could further destabilize the Lira. The increased volatility expectations also reflect broader concerns over inflation persistence, external debt servicing risks, and the overall fragility of Turkey’s economic outlook.

Equities

Following the arrest of Ekrem Imamoglu, the party he is a part of, the Republican People’s Party (known in Turkish as CHP), will convene an extraordinary party congress on April 6. This announcement came from chairman Özgür Özel, as the party faces broader legal crackdowns. We should monitor whether there is continued political stress within Turkey. If so, I anticipate more volatility. This opens up potential trades, such as shorting Turkish equity markets, specifically banks, as well as shorting the lira. Given the current situation in Turkey, I expect USD/TRY to break and hold above 40.00.

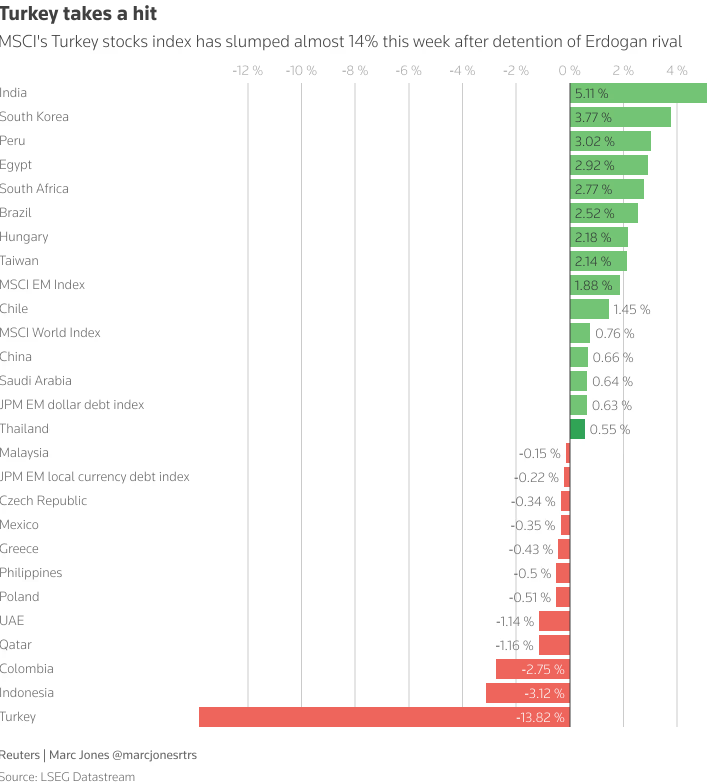

Below we can see a sector breakdown of how different sectors in Turkey have performed. We are seeing the Banking sector as well as the Real Estate sector taking huge hits. Turkish markets faced significant turmoil as stocks were set for their worst week since the 2008 financial crisis, driven by political instability following the detention of Istanbul Mayor Ekrem Imamoglu, President Erdogan’s main rival. The Lira slumped 4% despite central bank intervention, while the BIST-100 index fell 7.82% and banking stocks dropped 9.37%, triggering two market-wide circuit breakers. Protests erupted nationwide, with opposition figures calling the move a coup attempt. The BIST-100 is on track for a 15% weekly decline, its worst since October 2008.

Money flow, represents the net capital moving into or out of financial markets, providing insight into investor sentiment and liquidity trends. Currently, money flow stands at negative 2.2 trillion, indicating substantial capital outflows from Turkish assets, which have closely tracked the sharp sell-off in the Borsa Istanbul. This suggests that investors, both domestic and foreign, are reducing exposure to Turkish equities amid rising political and economic uncertainty. The outflows reflect growing concerns over the detention of Istanbul Mayor Ekrem Imamoglu, heightened geopolitical risks, and the broader deterioration of market confidence. With the Lira weakening and stock prices plunging, sustained negative money flow signals continued selling pressure, reduced liquidity, and the potential for further volatility in Turkey’s financial markets.

Economics

Turkey's negative output gap, where actual GDP is below its potential, signals weakened economic activity, reduced demand, and underutilized resources. This slowdown naturally eases inflationary pressures, as lower consumer and business spending curbs price growth. When demand weakens, firms face reduced pricing power, leading to slower price increases or even deflation in some sectors. While easing inflation may provide short-term relief, a prolonged negative output gap suggests underlying economic weakness, rising unemployment, and declining investment. For Turkey, this dynamic indicates that while inflation might moderate, it comes at the cost of slowing growth, reflecting the broader economic fragility caused by currency depreciation, investor uncertainty, and external financing challenges.

In Q4 of 2024 Turkish quarter-over-quarter growth was relatively decent. Despite tight monetary policy, Turkey's growth has remained relatively steady, supported by strong demand in certain sectors and resilient production trends. However, as the country moves into 2025, economic risks are mounting. Growth forecasts currently stand at 3.1%, but this outlook could deteriorate given rising political uncertainty, sustained capital outflows, and weakening domestic demand. The shift to orthodox economic policies, which prioritize inflation control over rapid expansion, marks a stark departure from years of loose monetary policy aimed at fostering growth through low interest rates. While this shift was intended to restore investor confidence, concerns over political stability, currency volatility, and governance issues have contributed to foreign and domestic capital flight.

If these trends persist, Turkey could face a sharp slowdown, as reduced investment, lower consumer confidence, and tighter credit conditions begin to weigh more heavily on economic activity. With the Lira’s depreciation and high borrowing costs making imports more expensive, businesses may struggle with cost pressures, leading to slower expansion and potential layoffs. Additionally, ongoing uncertainty regarding political developments—such as the detention of opposition leaders—could deter further foreign direct investment (FDI), exacerbating economic fragility. If investor sentiment continues to deteriorate, Turkey could see growth slow significantly, potentially falling well below the projected 3.1% for 2025, creating further strain on employment, inflation, and overall economic stability.

Turkey's PMI has fallen below expansion territory (50), and industrial production has also started to decline, signaling weakening demand. This aligns with the concerns mentioned earlier about the potential for slowing economic growth. As Turkey has long been seen as a manufacturing hub for certain goods, a downturn in industrial production and a continued contraction in PMI suggest that economic activity could weaken further. Unless there is a rapid policy overhaul or a resurgence in demand, growth is likely to slow significantly throughout the rest of 2025, exacerbating existing economic challenges.

Conclusion

Turkey's economic outlook for 2025 appears increasingly fragile, with multiple indicators pointing toward a potential slowdown. The Lira's sharp depreciation, rising political uncertainty, and sustained capital outflows have severely impacted investor confidence, triggering volatility in financial markets. The negative money flow, along with a negative output gap, suggests that demand is weakening, which, while helping to ease inflation, also raises concerns about sluggish growth and rising unemployment.

The decline in PMI and industrial production further underscores these risks, particularly given Turkey’s role as a manufacturing hub. With monetary policy tightening to counter inflation, domestic demand is likely to remain under pressure, and without a clear shift in political stability or economic strategy, growth could fall well below the projected 3.1%. Unless Turkey can restore investor confidence, stabilize its currency, and implement policies that support both price stability and sustainable economic expansion, the country may face a much deeper economic downturn in the coming year.