Rates and FX

Rates and FX continue to drive uncertainty throughout financial markets. On the FX front, the market is trying to figure out forward interest rates and where they will be, as these differentials drive FX moves. Tariffs have also been influencing FX movements worldwide. On the rates front, markets are trying to identify the new "neutral rate." In this post, we will explore these factors and try to predict what lies ahead for markets, particularly for FX and interest rates going forward. It seems that, at present, there are opportunities to be made in the FX market. Let’s break it down.

Interest Rates

The first place we will start is interest rates. In the United States, we are seeing a relatively linear pricing of rate cuts. The overall outlook suggests that the United States will be an outlier in the G7, with the exception of Great Britain, which also seems reluctant to reduce rates quickly. As it stands today, the United States is experiencing significant growth, and as a result of elevated growth expectations, inflation expectations are also high. Given this, rates are expected to decline steadily over the next year, with around 100 basis points of cuts being priced in for the United States. However, this may be an overestimation given the current backdrop. If growth surprises to the downside in 2025, we would anticipate the rate cuts to materialize much quicker than the market is currently pricing in.

Now, looking at our neighbor to the north, things are changing very quickly. Canada has experienced extremely slow growth, with a rapid decline in inflation. Inflation expectations remain well-anchored, with 5-year/5-year inflation swaps for Canada priced at 168 basis points. Given the low GDP growth and increased debt-service ratios, it seems Canada will be quicker to cut rates. On the FX front, and we will discuss this further, that differential of, let's say, 100 basis points, will not have much impact on weakening the CAD.

Moving on to the ECB, it seems they will be an outlier in terms of expectations for how low they will go. Currently, in the G7 (excluding Japan), the ECB is priced as one of the nations with the lowest interest rates. Expectations are for the policy rate to be around 155 basis points for the ECB by this time next year. Europe has been plagued by lackluster growth dynamics as well as disinflationary forces, which could contribute to a lower policy rate for the region. However, this will widen differentials and likely come at the expense of the euro over the next few months.

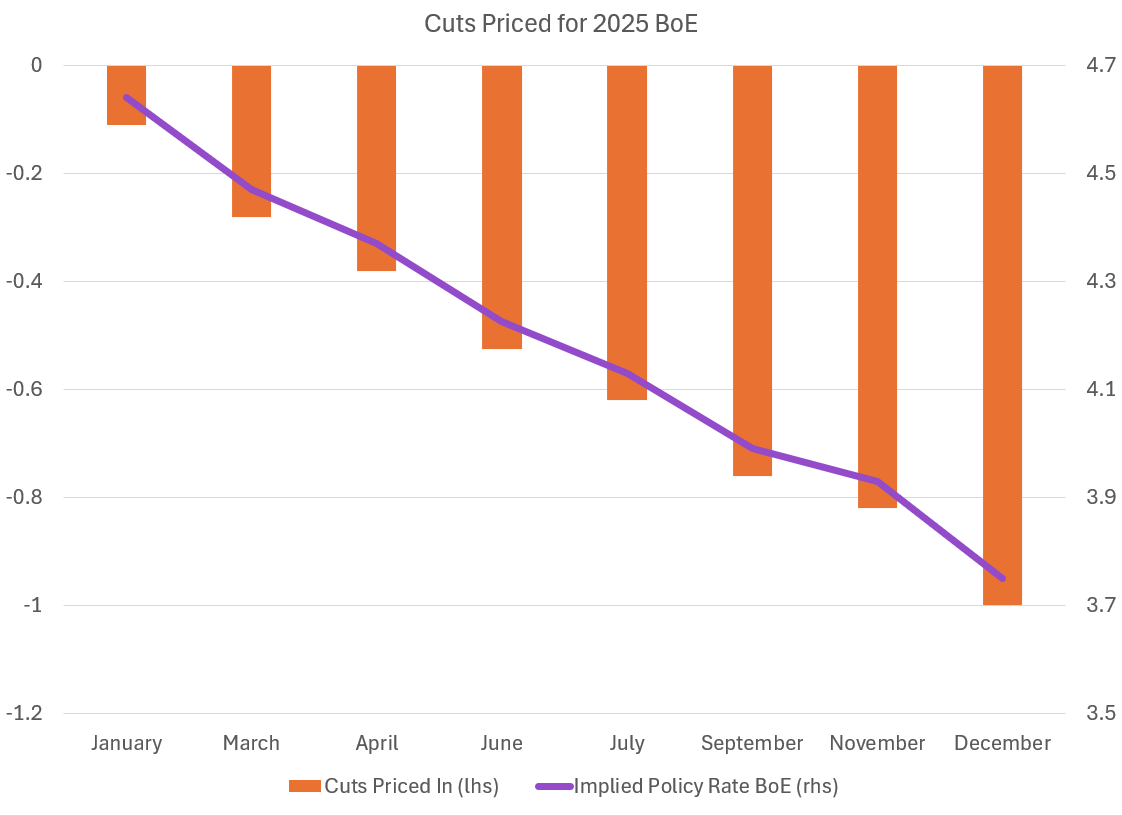

Looking ahead to the United Kingdom, they are experiencing weak growth, with real GDP growth year-on-year coming in at around 1%, and inflation growing at about 2.3%. However, it seems the Bank of England (BoE) is reluctant to reduce rates quickly, and much of this hesitation stems from the recent budget issues that have been discussed. In an article from Reuters, a quote states, “More borrowing in the Budget, a higher national living wage, and rises in employer National Insurance contributions have raised concerns that inflation could make an unwelcome return." Given this, the BoE is likely to move similarly to the Fed and has taken more rate cuts off the table. One year from now, the expectation is for the policy rate to be around 375 basis points, which is slightly below what is forecasted for the Fed.

Tariffs Implication on FX

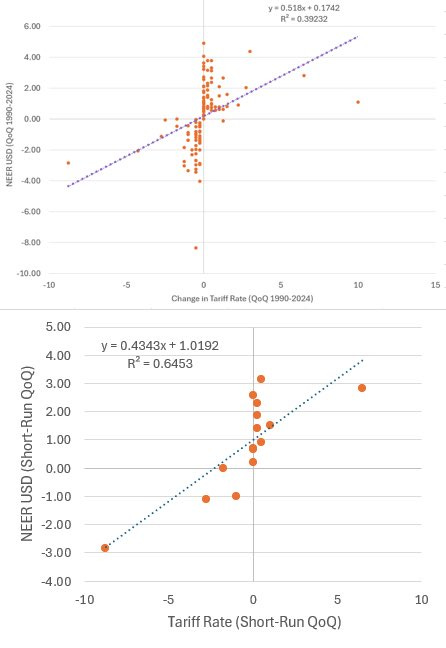

About half of the increase in the tariff rate is offset by changes in the nominal effective exchange rate (NEER), all else being equal. Thus, tariffs tend to have a significantly muted impact on the price of goods and services.

In the short run, the relationship between tariffs and the NEER is more easily explained by the regression model, as evidenced by the higher R². However, in the long run, this relationship becomes less explanatory, as other factors begin to influence the NEER in addition to changes in tariff rates.

This dilution of the tariff's impact leads to a lower R² over time. Despite the lower R² in the long run, the p-value remains statistically significant, indicating that tariff rates still have an impact on the NEER, even over a longer time horizon.

This suggests that, while the relationship becomes more complex, the model's coefficient remains statistically significant, and the effects of tariffs on the NEER are both real and meaningful in the long run.

In the short run, the smaller p-value can be attributed to greater volatility in the effects, which increases the degree of noise and variation in the model. This higher variability reduces the p-value relative to the long run. Nevertheless, the regression results confirm that this relationship remains important.

The p-value in the long run is 0.00000603, which indicates a very high level of statistical significance. This small p-value suggests that there is a very low probability that the observed relationship between tariff rates and NEER occurred by random chance, allowing us to conclude that the tariff rate has a meaningful effect on the exchange rate.

The t-statistic of 4.73964 further supports the statistical significance of the relationship, confirming that it is not due to random variation.

The coefficient is 0.51, meaning that for each 1% increase in the tariff rate, the effective exchange rate increases by 0.51%, holding other factors constant. Therefore, we can reject the null hypothesis.

Null hypothesis (H₀): The coefficient of the tariff rate (X) is zero, implying that tariff rates have no effect on the NEER, and there is no relationship between the tariff rate and the NEER.

Alternative hypothesis (H₁): The coefficient of the tariff rate is 0.51, meaning that tariff rates do have an effect on the effective exchange rate.

In the short run, the p-value is 0.000256, which is again smaller than the significance threshold of 0.05. This indicates that the null hypothesis can be rejected, meaning there is statistical evidence that tariff rates affect the NEER even in the short run.

The t-statistic of 5.113183 is well above the threshold of 2 for the 95% confidence level, suggesting that the coefficient is significantly different from zero. We can conclude that the tariff rate has a substantial effect on the NEER in the short run, and the coefficient is not due to random chance.

The coefficient of 0.41 means that for each 1% increase in the tariff rate (X), the effective exchange rate (Y) increases by 0.41%.

DXY

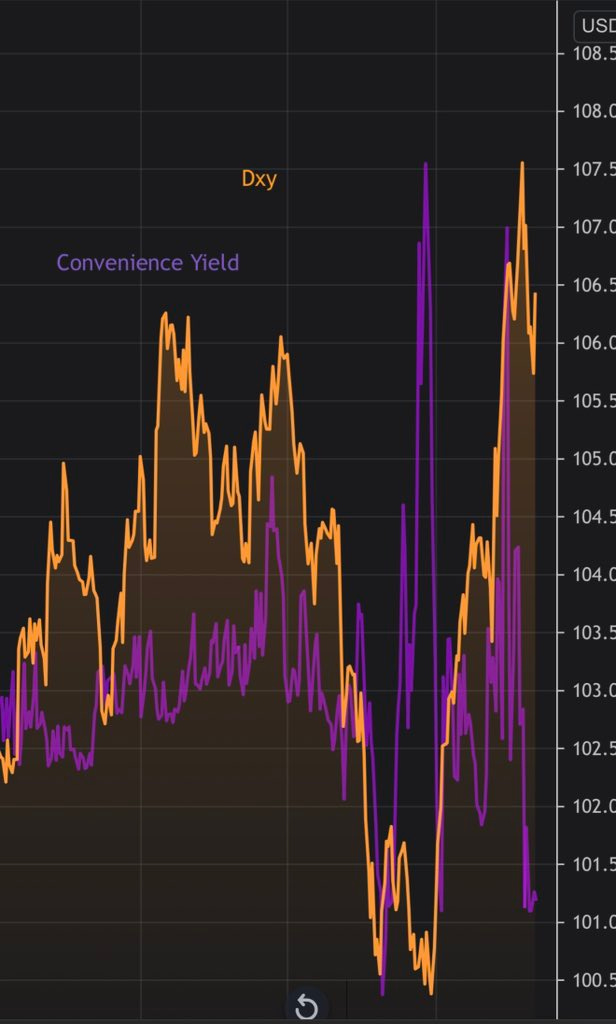

Dollar strength appears to be running out of momentum after the move driven by anticipated tariffs.

Recent dollar strength has been largely driven by the convenience yield, which reflects the benefits of holding the currency rather than investing in alternative assets. With the decline in the convenience yield, we could see some dollar weakness in the near term.

It’s unlikely that the dollar will break 107 significantly. The easing of the convenience yield provides valuable insight into the liquidity needs within financial markets. When the convenience yield is high, it indicates a strong demand for holding the currency, often due to increased market uncertainty or a higher demand for liquidity. As this yield declines, it suggests that liquidity conditions are improving and market participants are less inclined to hold excess cash, which can lead to a reduction in the demand for the dollar.

Thus, the convenience yield plays a critical role in driving dollar demand: when liquidity conditions tighten, the yield increases, boosting the dollar; when liquidity conditions improve, the yield declines, potentially leading to dollar weakness.

The relationship between macroeconomic risk and currency movements, particularly the U.S. dollar, is a key factor in understanding its strength. During times of heightened uncertainty or market turbulence, there is typically a "flight to quality," where investors move their capital into perceived safe-haven assets, such as the U.S. dollar. This demand for safety and liquidity results in dollar strength, as the currency is considered a secure store of value, particularly in global crises or financial instability.

Historically, the U.S. dollar tends to strengthen during periods of geopolitical uncertainty, economic instability, or when global risk aversion rises. This is often due to the dollar's role as the world's primary reserve currency and its widespread use in international trade and finance. When markets are uncertain, investors flock to assets that are perceived as low-risk, driving up the demand for the dollar.

However, the current macroeconomic backdrop suggests that this flight to quality dynamic may be starting to lose some of its momentum. As macro risks ease, especially with diminishing concerns around global trade tensions (e.g., tariffs) and a more stable global economic outlook, the need for investors to hold dollars as a safe-haven asset could lessen. Reduced uncertainty in markets would generally put downward pressure on the dollar, as liquidity conditions improve and investors feel more confident in taking on riskier assets.

Looking at the near-term outlook, particularly for Q1 of 2025, the U.S. dollar index (DXY) is expected to remain above 100, largely due to ongoing uncertainties around tariffs and other macroeconomic factors. While the level of uncertainty may have decreased compared to earlier periods, there are still enough factors—such as tariff dynamics and potential geopolitical tensions—that will likely keep the dollar supported in the short term. Additionally, interest rate differentials between the U.S. and other major economies could continue to provide some support for the dollar in the near term, especially if U.S. rates remain relatively higher.

That said, the overall outlook for dollar strength appears to be easing as macro risks subside. The reduction in uncertainty will likely limit further upside for the dollar, and as the global economic environment stabilizes, the demand for the dollar could gradually decline. The dollar's strength is expected to slow as market participants shift their focus toward riskier assets in an improving macroeconomic environment.

In summary, while there may be short-term fluctuations driven by interest rate differentials or ongoing uncertainty, the broader trend suggests that as macro risks ease, the upward pressure on the dollar should begin to ease as well. The DXY may still stay above 100 in Q1 2025, but the pace of dollar strength is likely to slow as global conditions stabilize and the flight to quality dynamic diminishes.

EM FX

Starting with Brazil, as of tonight, December 16, 2024, there has been downward pressure on the Brazilian Real (BRL). Despite the current probability of a 125 basis point hike being at 99%, rate hikes seem to be putting a strain on emerging markets. The BRL continues to weaken even after a $3 billion dollar auction with a repurchase agreement to stabilize FX rates. Concerns about a crisis of confidence are expected to continue weighing on the currency. There has also been chatter suggesting that the selloff is being driven by Lula’s comments, in which he essentially blames the Central Bank.

Interest rates are expected to rise by 125 basis points at the Banco Central do Brazil’s next meeting on January 29, 2025, with a current 99% probability of that hike. Regarding Lula, he has been blaming the Central Bank for high interest rates, stating that those rates “are the only thing wrong” with Brazil’s economy. Ironically, much of the market's concern seems to stem from Lula himself. At the last meeting on December 12, 2024, the Real actually strengthened following a hawkish decision to raise rates. The BRL strengthened by 100 basis points that day when the Bank implemented a surprise 100 basis point hike, which led to some positive momentum for the currency. However, that momentum has since faded due to concerns over political pressure, as highlighted above, raising worries that the Bank may ease before it is necessary.

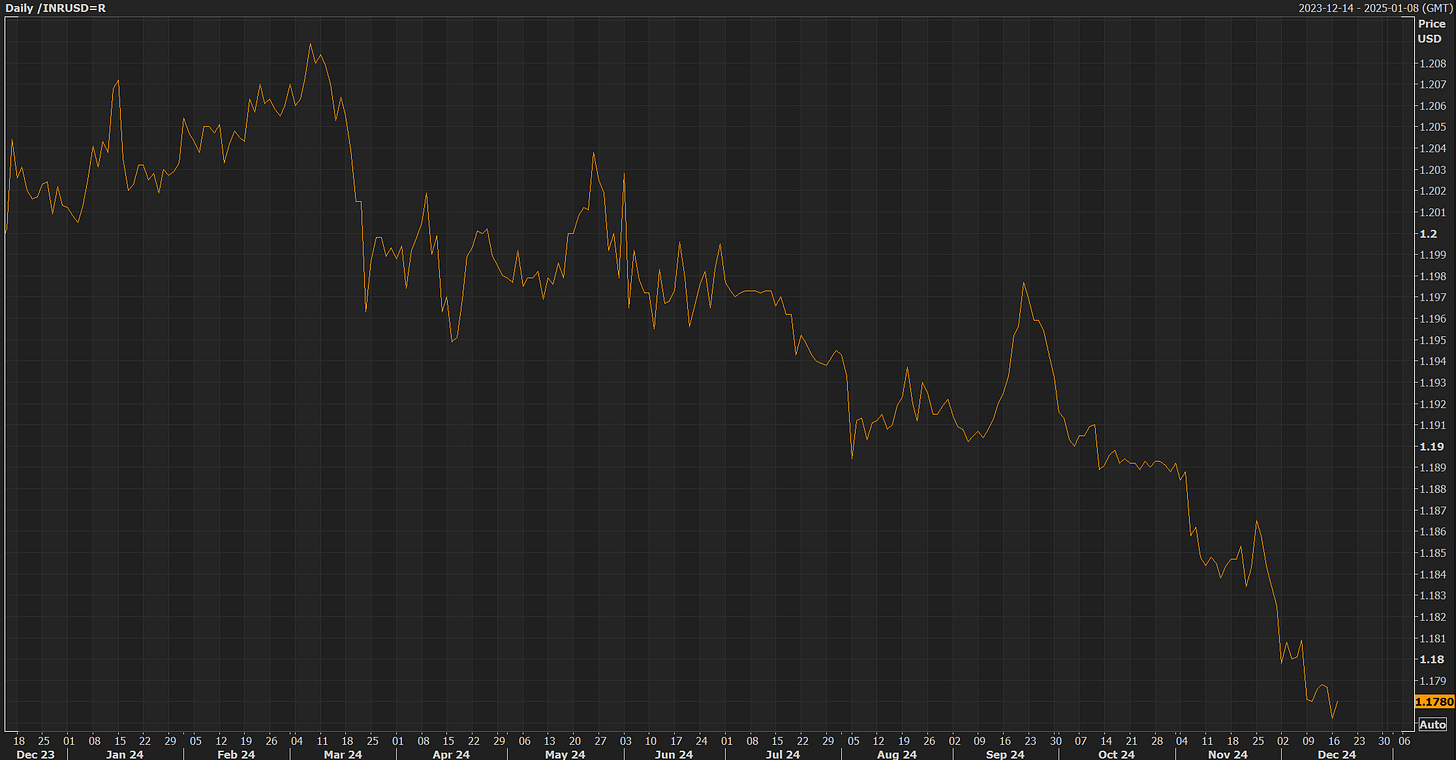

Now moving on to India, another country that has been hammered on the FX front tonight. The currency is currently slightly off its all-time lows against the dollar. Growth has been underwhelming, and equity flows have been weak for India. The trade deficit is expected to put further downward pressure on the rupee, as it has slipped to a record high. This trade deficit will likely continue to weigh on the rupee. Further deterioration, driven by the anticipation of tariffs, slowing economic growth, and lower capital flows, will add to INR weakness. Foreign investors are likely to continue being net sellers of Indian equities throughout the remainder of the year and into Q1 of 2025 unless there is a reversal in the trend.

On the rate front, there is currently no probability of a rate cut for India. For the next meeting on February 7, 2025, there is no probability of a rate cut. The probabilities are currently priced at a 78% chance that the Reserve Bank of India will keep rates unchanged, with the remaining probability suggesting a 25 basis point cut. I believe that a rate cut would be the wrong move for India and would further weaken the currency.

G7 FX

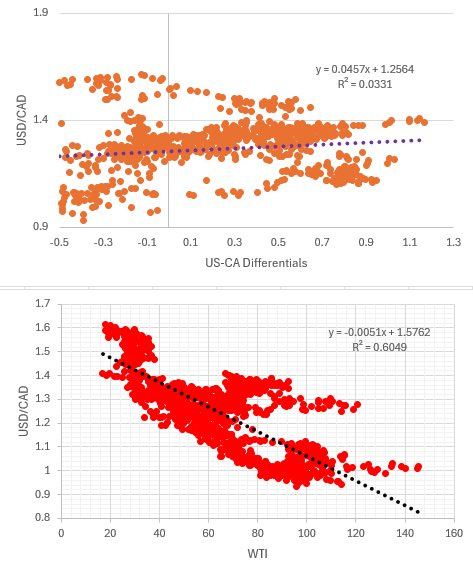

Lets start with with dispelling the myth of the CAD (loonie). Many have been worried that interest rate differentials and anticipated spread as shown above on the first part of this post is around 100bps. People have been worried this will drive the Loonie lower however, that is not the case.

USD/CAD has one of the weakest relationships among currency pairs when using the term structure to determine moves.

Therefore, the gap between the 1-year, 2-year, and 5-year US-Canada differential doesn't significantly impact FX moves.

The depreciation of the CAD is driven by three main factors, none of which are interest rates:

Decline in oil prices

Economic uncertainty

Tariffs

This is rarely explained in relation to the movements of the exchange rate.

Differentials tend not to be a good indicator for CAD, as it is largely a petrocurrency.

The B parameter in the regression for the currency is sometimes positive and sometimes negative, showing a lack of robustness.

Using the term structure of interest rates is not helpful in predicting movements in CAD. The appearance of comovement is transient.

The larger variable explaining moves is oil. This relationship is much more statistically robust. However, here we show that as oil prices increase, the dollar tends to decrease and the CAD appreciates.

This explains the negative correlation; nevertheless, oil remains the largest determinant of USD/CAD movements.

More on differentials not impacting CAD: Below is the β parameter. One can see there is a lack of robustness, with the slope tending to take a random walk between positive and negative values. This exhibits a lack of consistency between the forward premium and exchange rates. As a result, one can deduce that when trading FX pairs, these factors must be carefully investigated. The term structure is not the right place to look. This work has been updated from the research of W. Antweiler, PhD.

One risk I do see is what we observe within the options market. For two years, I’ve highlighted the implicit uncertainty around the CAD, which is reflected in the term structure—specifically the 25d call vs 25d put vs ATM. The term structure only widens further out the maturity curve, reflecting the inherent macro risk. This has been a significant mover of FX pairs. As more uncertainty is priced into CAD, given the macro backdrop, this uncertainty will most definitely drive the Loonie lower. However, I am skeptical, empirically, that any of this weakening is being driven by differentials.

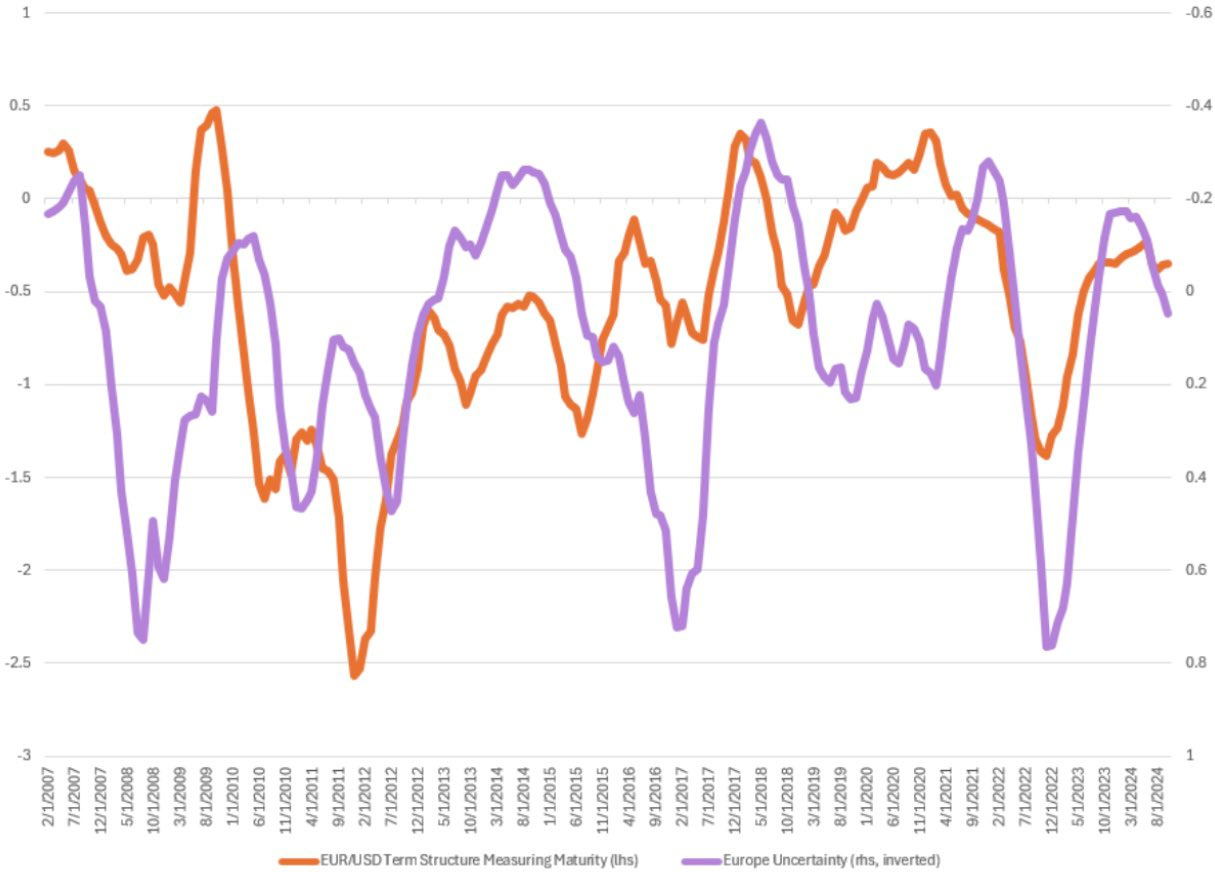

Moving on to the EUR, CAD is not an outlier in what we are seeing expressed in the term structure. The EUR has experienced much the same, and this is driven by heightened economic uncertainty, which has been pushing the EUR lower. The term structure for EUR/USD is pricing in uncertainty and macro risk within Europe. This will put more downward pressure on EUR/USD, with a minimum price target remaining around 1.02 over the next year. Europe's growth expectations and differentials play a significant role.

The term structure for EUR/USD isn’t looking favorable, with 1-month risk reversals at the 25D level rolling over. We are seeing a shift towards more put buying relative to calls, signaling increased bearish sentiment in the market. Implied volatility has been elevated relative to historical norms, suggesting that market participants are pricing in higher uncertainty and potential downside risk for the EUR.

Additionally, interest rate differentials are exerting significant downward pressure on the EUR, particularly as the ECB's policy stance diverges from that of the Fed, with the US expected to maintain a relatively tighter monetary policy. This further exacerbates the EUR's weakening outlook.

From a technical perspective, the EUR/USD pair is struggling to maintain bullish momentum, with recent price action showing signs of a breakdown below key support levels. The minimum price target for EUR/USD is sitting at 1.02, as downward pressure from both the term structure dynamics and economic fundamentals in Europe continue to weigh heavily on the currency. Market sentiment remains cautious, and without a significant shift in the macroeconomic outlook, the pair could face further downside risk in the near term. The combination of elevated implied volatility, risk reversals, and widening differentials all point to a continued bearish outlook for EUR/USD.

Looking at the Japanese front, there has been a strengthening of the USD12X15F relative to the JPY, signaling expectations of growing differentials favoring the US. This shift has occurred as markets ease their anticipation of an increasingly hawkish BoJ. Following this, we saw the JPY weaken against the dollar, with the dollar continuing to move higher. Unless the BoJ changes its policy and adopts a more hawkish stance, it seems that differentials will continue to drive the JPY lower. However, there could be some downside moves if options pricing starts to ease.

The long end of Japanese volatility has seen significant overpricing following a period of extreme underpricing. FX volatility has remained elevated recently, with interest rate volatility now starting to manifest in options pricing, particularly for long-dated yen volatility. A bearish stance on long-dated yen volatility remains attractive, as implied volatility is expected to ease. The excessive downside risk currently embedded in the market suggests that volatility will begin to normalize.

Historically, during periods of market stress, we tend to see massive overpricing of volatility. As this stress subsides, the pricing of JPY volatility is likely to revert lower. This easing of volatility could provide some relief to the yen, as implied volatilities unwind from their elevated levels. Given the current market dynamics, once volatility begins to ease, we can expect a corresponding pullback in the implied cost of hedging JPY, potentially supporting the currency in the medium term.

Moving on to the GBP, interest rate differentials have eased slightly, and we have seen some momentum revived in the pound recently. However, the growth dynamics should continue to weigh on the pound for the remainder of the year. While interest rate differentials are useful for day-to-day spot moves, they do not provide the full picture of the long-term trend in the currency's movement. After differentials strengthened in favor of the USD, we have seen some unwinding of these differentials. Currently, it appears that rates have swung in favor of the GBP, providing a slight boost to the pound.

On the economic data side, the UK continues to surprise to the downside relative to the United States. As highlighted earlier in this article, there is significant economic uncertainty within the UK. Real GDP growth has been extremely weak, and data outside of inflation has been underwhelming. Currently, the economic surprise gap is widening in favor of the United States. Despite differentials, this could lead to some weakness in the pound over the medium term.

The correlation is not perfect, and as mentioned, when analyzing currencies, there are factors that may drive short-term fluctuations. However, the long-term trend is influenced by multiple factors, including inflation, interest rates, GDP, capital flows, and other variables. These factors can cause correlations to be strong in certain timeframes and weaker in others. Outside of 2022, economic surprise has typically been a useful indicator for predicting potential moves in the GBP.

Given this expectation is for pound to see cyclicality, but looking for some short-term weakness over the next quarter.

Conclusion

Given all of these factors, FX moves continue to present significant opportunities and challenges throughout the year. The elevated levels of volatility indicate that we will likely see considerable swings in currency prices, driven by a complex interplay of factors. Macroeconomic conditions, geopolitical developments, and shifts in global interest rate expectations all contribute to the dynamic landscape of foreign exchange markets. These factors create an environment where currencies can move sharply in response to changes in the global economic and political backdrop.

From a tactical standpoint, this volatility offers opportunities for well-informed traders to capitalize on short-term price movements, while also providing risks that need to be carefully managed. As economic growth diverges across regions, with the US, for example, benefiting from stronger growth dynamics compared to other economies like the UK or Japan, currency pairs are likely to continue reflecting these disparities. The impact of central bank policies, particularly with the US Federal Reserve and the European Central Bank, remains a key determinant in shaping market sentiment.

Additionally, the ongoing uncertainty around geopolitical events and trade policies could further exacerbate volatility in the FX market, offering both opportunities and risks. As interest rates fluctuate across different economies, the relative strength of currencies will continue to shift, creating profitable trades for those who can accurately anticipate these movements.

Ultimately, the FX market remains an attractive space for tactical plays, especially for those with a deep understanding of the underlying macroeconomic factors. However, this also comes with the need for a careful approach, as the volatility and uncertainty present can lead to both substantial gains and losses. As we move forward, staying agile and informed will be key in navigating the fluctuating currency landscape.