Introduction

As we approach the end of 2024, it's time to turn our focus toward what lies ahead in 2025. This post will primarily focus on developments expected in the United States. We'll explore what to watch for in the coming year and provide context for the current growth environment. By doing so, we aim to shed light on the factors shaping the future and offer insights into how the landscape may evolve.

GDP

I do not yet see a compelling bearish case for U.S. economic growth, at least not in the immediate term.

While economic forecasts are inherently subject to revision and can change based on unforeseen circumstances, the current outlook appears relatively robust, suggesting a continuation of moderate growth. This is especially true when considering the potential impact of forthcoming fiscal and trade policy adjustments.

If tax cuts are implemented as proposed, they are likely to provide a significant boost to both domestic investment and consumer spending. Lower taxes can incentivize businesses to expand their operations, invest in capital goods, and increase productivity. At the same time, households may experience a rise in disposable income, leading to higher consumption levels. This dual effect could further stimulate economic activity, supporting growth across various sectors.

On the trade front, the introduction or continuation of tariffs could serve to mitigate the negative drag on net exports. By reducing imports and encouraging higher domestic production, tariffs can help shift the balance toward a more favorable trade position. This shift could stimulate sectors such as manufacturing, which might experience a resurgence in domestic production in response to reduced foreign competition.

However, an increase in domestic production, driven by such policy shifts, will require an expansion of both labor and capital. As businesses ramp up output, they will need to hire more workers to meet growing demand, which would result in lower unemployment rates. Higher employment levels generally lead to increased wages and, subsequently, higher consumption, creating a virtuous cycle that further strengthens the economy.

Thus, while there are risks and uncertainties ahead, the combination of tax cuts, potential trade policy shifts, and increased production could support continued U.S. economic growth, driving higher employment and consumption over the near to medium term.

Rates

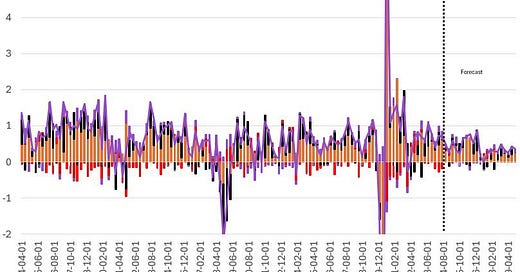

Looking at the United States, growth remains resilient. The above forecast is, of course, subject to change, as forecasting GDP is extremely difficult. If the Federal Reserve gets its projections wrong, I would not expect the outcome to be any more accurate. Nevertheless, the current backdrop points to sustained growth. When growth remains relatively high, inflation tends to become stickier. This will make it harder for the Fed to ease inflation back to their target. As a result, policy rate cuts should continue to be discounted, unless something drastically changes.

U.S. Treasury yields had consolidated until the recent hawkish shift by the Fed, which signaled that fewer rate cuts would be delivered than expected. This led to a significant sell-off in rates. The drivers of stronger GDP and stickier inflation suggest that the long end of the yield curve will likely need to adjust further. This is especially true if the output gap continues to persist as a positive percentage of GDP.

Looking at implied rate cuts for 2025, we are already starting to see this theme play out. Nearly 240 basis points of expected cuts have now been revised down to around 50 basis points of cuts for 2025.

We can also view this through the lens of the implied probability of rate cuts to be delivered. As markets adjust their expectations, an increase in the probability of future rate cuts typically leads to a rally in the 10-year Treasury yield, and vice versa. When investors anticipate that the Federal Reserve will lower rates, the demand for longer-duration bonds increases, pushing their yields lower. Conversely, when expectations shift towards fewer rate cuts or a more hawkish stance from the Fed, bond yields tend to rise as investors adjust their portfolios to reflect the new outlook.

Currently, the market is pricing in a relatively high probability that the Fed will deliver two 25-basis-point rate cuts. As a result, we have seen the 10-year Treasury yield move higher. This is largely due to the shift in market sentiment, where investors have recalibrated their expectations for the Fed's actions. With fewer rate cuts expected, particularly in 2025, the demand for longer-term bonds has decreased, leading to an increase in the 10-year yield.

This dynamic highlights the sensitivity of bond markets to changes in the anticipated path of monetary policy. The bond market closely watches the Fed’s guidance and the economic data that influences their decision-making. As the Fed signals a more cautious approach to rate cuts, particularly as inflation remains sticky and growth resilient, yields on longer-term Treasuries are likely to remain elevated or continue to rise, reflecting these updated expectations

The Federal Reserve's dot plots also seem to support this outlook, as we have observed a shift in the projections following the most recent meeting. The dot plot, which represents individual FOMC members' expectations for future interest rates, provides valuable insights into the Fed's anticipated policy path. Looking ahead to 2025, the dot plots indicate that the Federal Open Market Committee (FOMC) expects two rate cuts to be implemented. This expectation aligns with the broader market view that the Fed may begin easing its policy if economic conditions warrant it.

However, it's important to note that these projections are not set in stone and remain highly sensitive to changes in key economic data. The trajectory of monetary policy could shift if the labor market begins to deteriorate significantly, economic growth slows more than expected, or if inflation shows a sharp and sustained decline during the first half of 2025. These developments would likely prompt the Fed to reassess its strategy and potentially accelerate rate cuts.

That said, such a scenario is not the base case at this time. Current forecasts are based on the assumption that the economy will continue to grow at a moderate pace, inflation will remain somewhat sticky, and the labor market will stay relatively strong. If these conditions hold, the Fed is likely to follow through with its current projection of two rate cuts in 2025. However, if the economic landscape changes unexpectedly—whether due to a significant downturn in employment, a dramatic slowdown in growth, or an abrupt decrease in inflation—the Fed may revise its outlook accordingly.

In summary, while the dot plots suggest that the Fed is leaning toward a more accommodative stance in 2025, this expectation is contingent on a variety of factors that could change over the next year. Therefore, it remains important to closely monitor economic indicators, as any significant deviation from the current trends could lead to a shift in the Fed's policy path.

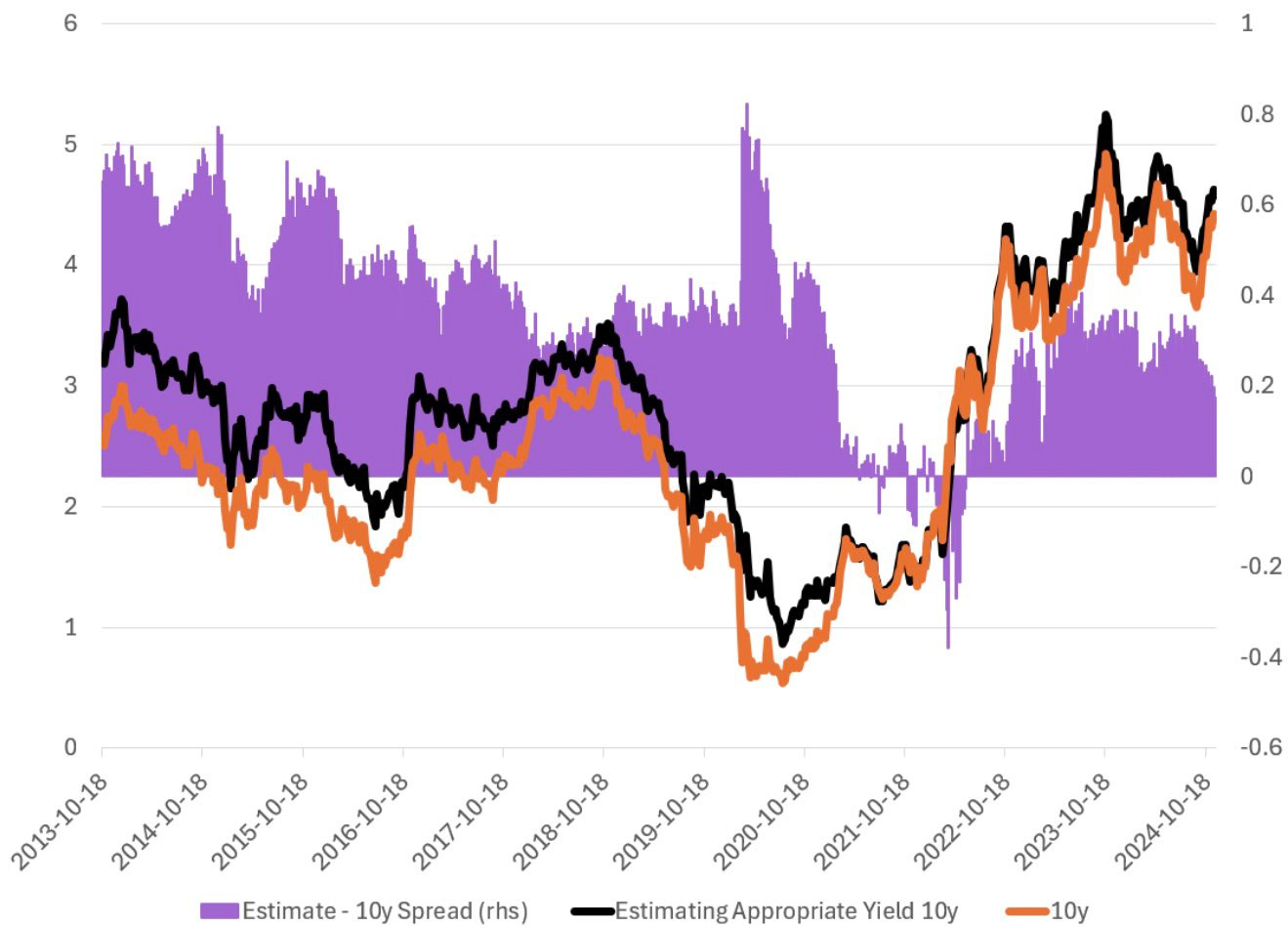

Estimating the fair value of the 10-year Treasury yield involves considering several key factors, such as potential output, inflation expectations, and the broader economic environment. Currently, with the 10-year yield hovering around 4.60%, it's important to note that various models for estimating fair value can fluctuate significantly. These models often incorporate potential output (the economy's maximum sustainable output), inflation expectations, and real interest rates. The fair value of the 10-year yield can sometimes deviate widely from the actual rate, depending on changes in these factors, but it can also trade within a tighter range when economic conditions remain relatively stable.

Looking at the current growth expectations, inflation trends, and the potential for additional fiscal stimulus, there is still a strong argument that the 10-year yield could have more room to sell off. Although inflation has shown signs of being stickier than anticipated, growth in the U.S. economy remains resilient, which could continue to exert upward pressure on yields. Moreover, if fiscal policies become more aggressive, with increased government spending or tax cuts, this could further contribute to higher growth expectations, which typically leads to a rise in long-term interest rates.

In this context, even though the 10-year yield is already at relatively elevated levels, the combination of sustained growth, inflation pressures, and fiscal stimulus could push yields even higher. If the economy continues to outperform expectations and inflation proves more persistent than anticipated, we could see the 10-year yield move even further away from its current level of 4.60%, potentially leading to a further sell-off in the bond market.

This outlook suggests that investors should continue to monitor economic indicators closely, as shifts in growth or inflation expectations could lead to further adjustments in the fair value of the 10-year Treasury yield. Ultimately, the yield may continue to rise as long as growth remains solid and inflationary pressures persist, supporting the case for additional sell-offs in the bond market.

Even given the above analysis, current polling indicates that the maximum expectation for yields is above 5%. While I do not think this is highly likely, I wouldn’t rule out the possibility of yields moving toward or testing levels close to 5%. It is entirely possible that yields could rise further, given the analysis on growth and inflation dynamics. This scenario should not be discounted, but I still believe that yields have more room to sell off in the near term. This is especially true if the Federal Reserve adopts a more "hawkish" stance than expected during its next meeting in January.

Equity Markets

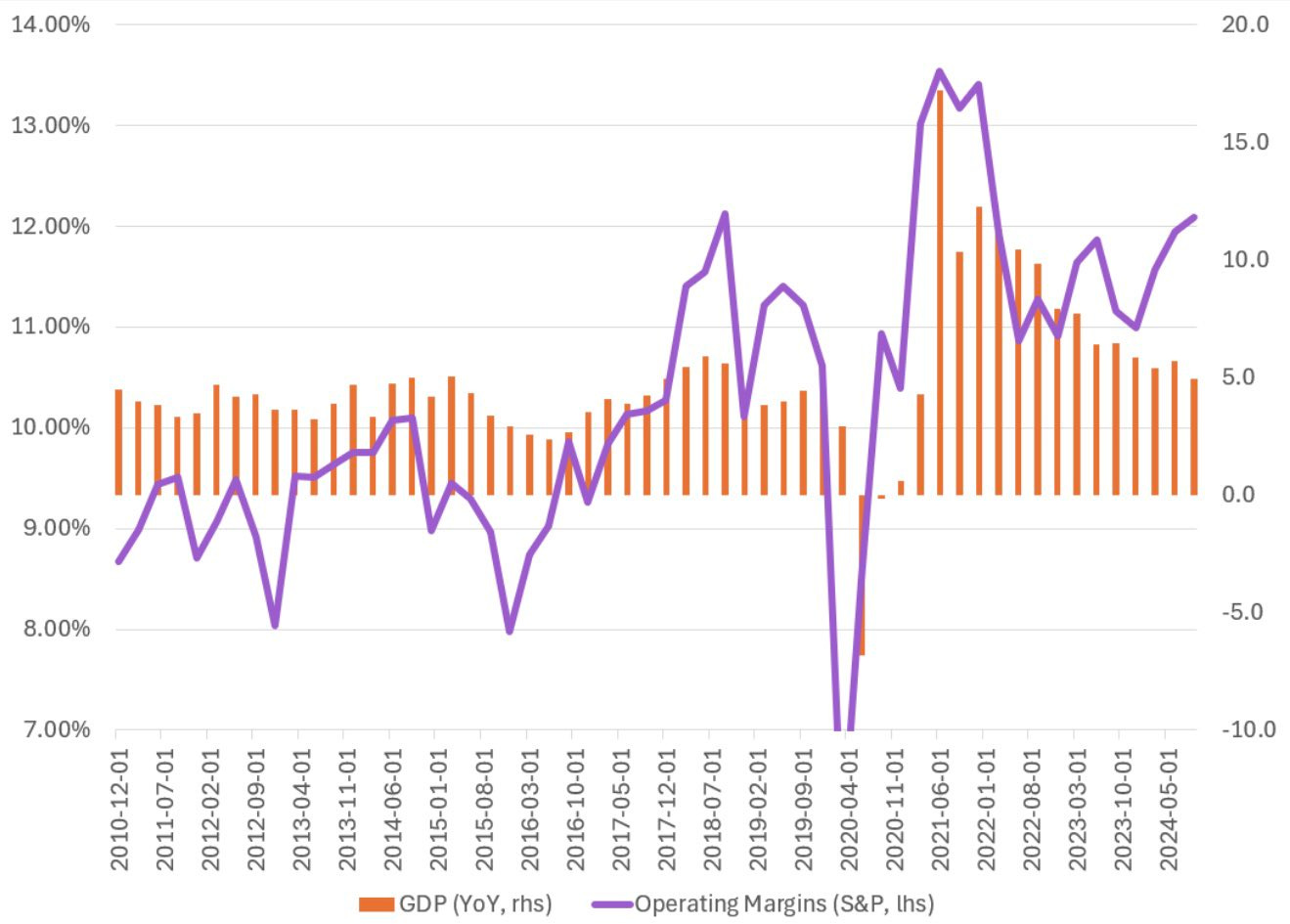

The S&P 500 appears poised to move higher, driven by several key factors that are likely to support continued growth in corporate earnings. The first round of tax cuts has already contributed to an increase in operating margins, as lower taxes have allowed businesses to retain more of their earnings and reinvest in growth. This boost to profitability has provided a strong foundation for the market's upward momentum.

Looking ahead, the prospect of a reduction in the corporate tax rate (C-Corp tax rate) and further deregulation is likely to provide additional support to operating margins. Lower corporate tax rates directly reduce the tax burden on companies, increasing their after-tax profits, while deregulation can lower compliance costs and make it easier for businesses to operate efficiently. Together, these factors should help sustain or even accelerate the growth in corporate profitability.

In addition to these policy changes, if the economy continues to experience robust GDP growth, this will further bolster corporate earnings. A growing economy typically drives higher consumer demand, increased business investment, and stronger overall economic activity, all of which translate into higher revenues and profits for companies. If these trends materialize, we can expect to see the S&P 500 continue its upward trajectory, supported by both favorable policy changes and solid economic fundamentals.

In summary, the combination of tax cuts, deregulation, and strong economic growth is setting the stage for higher operating margins and sustained corporate profitability, which should drive the S&P 500 higher in the coming months and potentially through 2025.

Higher Total Factor Productivity (TFP) plays a crucial role in boosting economic efficiency, as it reflects the ability to produce more output with the same or fewer inputs. An increase in TFP leads to reduced costs for businesses, which allows them to pass on savings to consumers or reinvest in their operations to drive further innovation. As companies become more efficient, they are also better positioned to improve their products, services, and processes, ultimately contributing to overall economic growth.

Technology companies, which are often at the forefront of advancements in productivity, stand to benefit the most from improvements in TFP. These companies can leverage enhanced efficiency to increase profitability while scaling their operations more rapidly. For instance, by utilizing more advanced technologies, optimizing supply chains, and automating key processes, tech firms can reduce operational costs and accelerate their growth. The ability to innovate faster and more effectively is a key competitive advantage for these companies, allowing them to capture market share and enhance their profitability.

Among the leading beneficiaries of this productivity boost is Taiwan Semiconductor Manufacturing Company (TSMC), a global leader in semiconductor manufacturing. As a key player in the technology sector, TSMC stands to gain significantly from innovations that enhance productivity in chip production and manufacturing processes. With the growing demand for advanced semiconductors, particularly in fields such as artificial intelligence, 5G technology, and the Internet of Things (IoT), TSMC is positioned to benefit from the increased efficiency and cost reductions that come with higher TFP. This, in turn, allows the company to scale its operations, reduce production costs, and increase its margins, further solidifying its position at the forefront of the technology and innovation landscape.

On the earnings front, the percentage of companies currently beating earnings is above the historic mean. Companies continue to surprise to the upside, with roughly 74% of those that have reported exceeding earnings expectations. Economic resilience and consumer spending should continue to support earnings for some companies. On the financial front, improvements in loan volumes, as well as the inversion of the yield curve, should boost Net Interest Margins (NIM). Most sectors appear poised to continue seeing robust growth, and markets tend to react positively to earnings beats. This should support the market's continued upward movement, given the improving economic backdrop in 2025 (our base case). This should be a strong driver, and the improvement in productivity—which leads to higher profits—should continue to boost earnings.

Higher productivity means that more goods or services are produced with the same or fewer resources. If a company can increase its output without significantly increasing costs (e.g., labor, materials, overhead), this can lead to higher profits because the cost of production remains lower than the revenue generated from the additional output.

Productivity improvements often come from better processes, technology, or worker efficiency. These factors lead to lower production costs, which increase the margins between revenue and expenses, thereby increasing profits.

When a company becomes more productive, it can increase its output, which can lead to higher sales or revenue. As long as the increase in costs does not outpace the increase in revenue, this can result in higher profits.

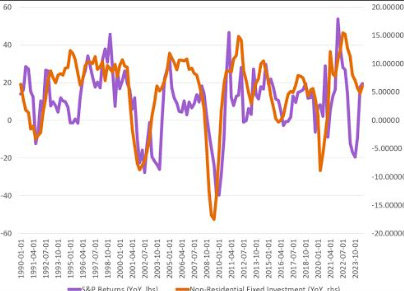

Cyclicals should continue to outperform during this period. Given the current growth backdrop and robust consumption, we should continue to see cyclicals (risk-on) outperform. This will drive higher orders and allow earnings to beat expectations.

However, when we anticipate a slowdown, consumption tends to weaken, leading to fewer orders due to reduced demand. This creates greater concern about profits and earnings, which drives outperformance in defensives relative to cyclicals.

Given the rebound we've seen in cyclicals lately, it seems that the market is moving away from recession concerns and favoring a continued growth trajectory in the U.S. Additionally, consumption trends are strong. Real consumption in the latest GDP print came in stronger than both the initial and second revisions.

This suggests that the consumer shows no signs of slowing down, and therefore, one should avoid being overweight in defensives in their portfolio at this time.

On the Magnificent Seven front, we continue to see that the Magnificent Seven's share of the S&P, according to LSEG, is at 34% of the index’s total value. These heavyweights should continue to perform well in a risk-on environment.

Nvidia has been doing well, with EPS rising to $0.78 in their latest quarter. They continue to see quarter-over-quarter growth in EPS. However, there are some risks for Nvidia, as they have highlighted that they expect revenue growth to ease, with a forecast of only 50% growth in 2025, compared to the 200% growth seen throughout 2024.

Tesla has seen profit margins, excluding regulatory credits, tick up slightly, coming in at 17.05%. This improvement comes on the back of falling input costs for Tesla and suggests a positive easing of the higher input costs that have been prevalent since the pandemic.

Tesla also saw gross profit per vehicle sold during Q3 of 2024 tick higher, rising for the first time since Q1 of 2022. So, from a fundamental perspective, things look to be improving for Tesla as well.

Another area that looks positive for the S&P is the overall investment outlook. Growth continues to be a key factor here, and the overall backdrop for what is anticipated into 2025 is optimistic.

The potential rollbacks in the corporate tax rate should be a major driver for higher levels of investment. In 2025, equities should continue to benefit from strengthening capital investment.

There have been concerns about tariffs, a slowdown in employment, and reduced investment given the backdrop, but I am not 100% certain that these will materialize. That does not mean there won’t be volatility as markets try to gauge the path forward for policy, but the overall backdrop looks optimistic for equities and risk assets heading into 2025.

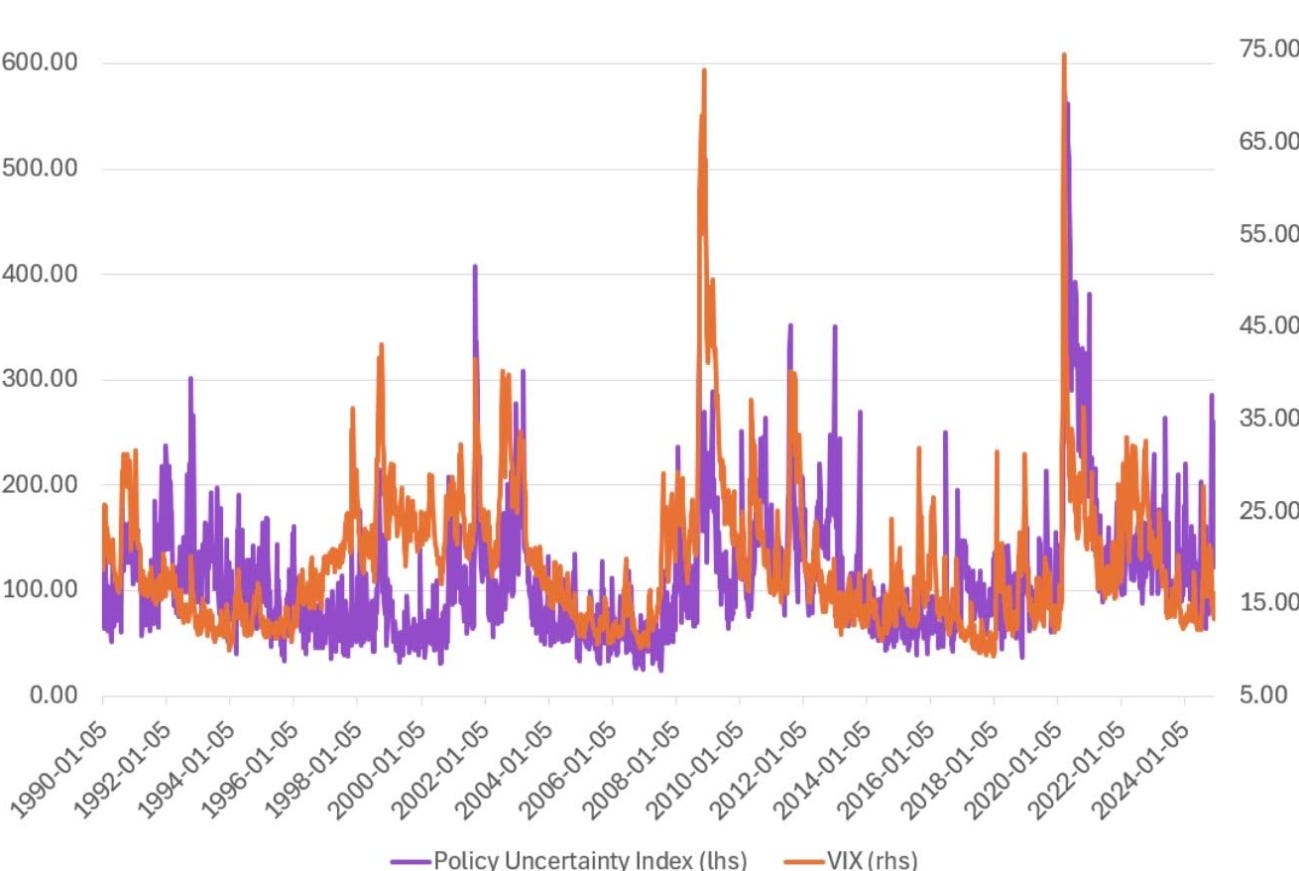

Sticking with the uncertainty aspect, the rising uncertainty at the beginning of the election caused volatility to increase due to concerns about the trade outlook for the United States. However, that has since eased drastically as markets began to digest the policy outlook.

Again, it seems that the market (at least the equity market) is fading the idea of higher tariffs causing any significant shock to equity markets. I believe one should continue to view the path forward optimistically. Any sort of tariff, if it does materialize, would most likely be offset by increased capital flows into the United States.

When tariffs tend to be implemented, they typically lead to a stronger dollar, which makes U.S. assets more attractive to foreign investors. Therefore, the overall volatility picture should not be a major concern, and we can expect volatility in the equity markets to remain moderate.

If tariffs do materialize, they could potentially be positive for consumer discretionary stocks, which often see rises when the U.S. Nominal Effective Exchange Rate (NEER) increases. To understand why, it's important to delve into the economic dynamics behind this relationship.

The U.S. Nominal Effective Exchange Rate (NEER) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies, weighted by the trade importance of those countries. A rising NEER indicates a stronger U.S. dollar, meaning that the dollar is appreciating relative to the currencies of its major trading partners.

A stronger dollar can have several key effects on the economy that benefit the consumer discretionary sector. For one, a stronger dollar reduces the cost of imports. As the dollar appreciates, it takes less U.S. currency to purchase foreign goods and services, which lowers the price of imported products. For companies within the consumer discretionary sector that rely on imported goods, such as electronics, apparel, and vehicles, a stronger dollar can lead to reduced input costs. This allows these companies to maintain or improve their profit margins, and, in some cases, pass on the savings to consumers through lower prices.

Additionally, a stronger dollar can increase the purchasing power of U.S. consumers abroad. With a more valuable dollar, U.S. consumers may feel wealthier and more confident, encouraging them to spend more on discretionary items, such as luxury goods, travel, and entertainment. This higher consumer spending benefits companies in the consumer discretionary sector, as their products and services are often non-essential items that consumers are more likely to purchase when they have greater financial flexibility.

Moreover, the consumer discretionary sector is sensitive to overall economic health, and a stronger dollar can reflect economic stability or growth, which can improve consumer sentiment. When people are confident in the economy and feel secure in their jobs and income, they are more likely to indulge in discretionary spending. In this sense, the rise of the NEER can signal an environment of stability and growth, both of which are conducive to stronger demand for consumer discretionary goods.

Conclusion

The backdrop in the United States continues to look optimistic, with various economic indicators pointing toward sustained growth. Fading this optimism or betting against it would likely be an incorrect move, given the strength in the U.S. economy and the broader global context. The U.S. is experiencing outsized growth relative to other major economies, which is expected to drive both higher interest rates compared to other G7 nations and continued outperformance in equity markets.

The U.S. economy has shown resilience, with robust consumption, investment, and a labor market that remains relatively strong despite global uncertainties. This strength in the economy is likely to lead to interest rates that remain elevated compared to those in other developed economies, where growth prospects are more subdued. Higher rates in the U.S. typically result in stronger capital flows into U.S. assets, which support the dollar and make U.S. equities more attractive to investors. In turn, this can continue to fuel outperformance in U.S. equity markets, particularly in sectors that benefit from the growth environment, such as technology and consumer discretionary.

Moreover, the global backdrop is also important. While other G7 countries are dealing with slower growth, rising inflationary pressures, and in some cases, tighter fiscal policies, the U.S. is benefiting from a more dynamic economic environment. This creates a favorable divergence, where U.S. assets, including equities, outperform relative to their counterparts in Europe and Japan. In this context, betting against the U.S. growth story would not only miss out on potential upside in the U.S. equity markets but could also result in being on the wrong side of global capital flows, which are likely to favor the U.S. in the near term.

Therefore, the outlook for the U.S. remains optimistic, and the market's focus should be on continuing to capitalize on the growth potential and the relative strength of U.S. assets. Fading this trend would seem to be an unwise move, as the combination of strong economic growth, higher rates, and U.S. equity outperformance sets a favorable stage for continued positive returns.