No Recession and Forecasts

Introduction

The outlook for the U.S. economy remains optimistic heading into the second half of 2025. Real GDP is expected to grow above trend, supported by resilient economic fundamentals. Equity markets have also begun to reflect this improving sentiment. Despite persistent concerns over divergences between soft and hard data, there are currently no clear signs of an impending slowdown. This post highlights key indicators that continue to point toward sustained economic strength.

Macro Indicators

The Atlanta Fed’s GDPNow model is currently tracking Q2 GDP growth at 2.9%, down slightly from 3.4% on June 18th. The negative contributions are primarily driven by inventories and residential investment. The contribution from net exports has increased to 3.49%, up from 2.07%, while inventory investment has declined sharply to -2.22% from -0.42%. Meanwhile, S&P 500 buy ratings stand at 56.4%, the second-highest level since June 2022.

Currently our expectation is for Real GDP growth to reaccelerate into Q2. This will be driven by investment and consumption.

Currently, the change in federal receipts indicates a strong pickup in government revenue generated from corporate and personal income taxes. A decline in revenues would typically signal a slowdown in economic growth. Historically, federal receipts and economic growth have exhibited a close correlation, and at present, there are no signs of deterioration in economic activity.

Spending is often credit-financed, implying that demand is largely a function of new borrowing within the current period. Therefore, aggregate demand is driven by the flow of credit rather than the stock of existing credit. As a result, GDP growth is more closely linked to the growth rate of credit issuance rather than the total outstanding debt. Currently, the acceleration in the flow of credit suggests rising credit creation, which should help support and sustain domestic demand.

A strong economy is typically associated with lower deficits, as robust growth generates higher revenues and creates room for fiscal consolidation. However, despite a relatively strong output gap, deficits are widening—indicating continued, sizable fiscal stimulus to the private sector. The deficit is now at historically high levels, which should continue to support employment, demand, and overall economic growth.

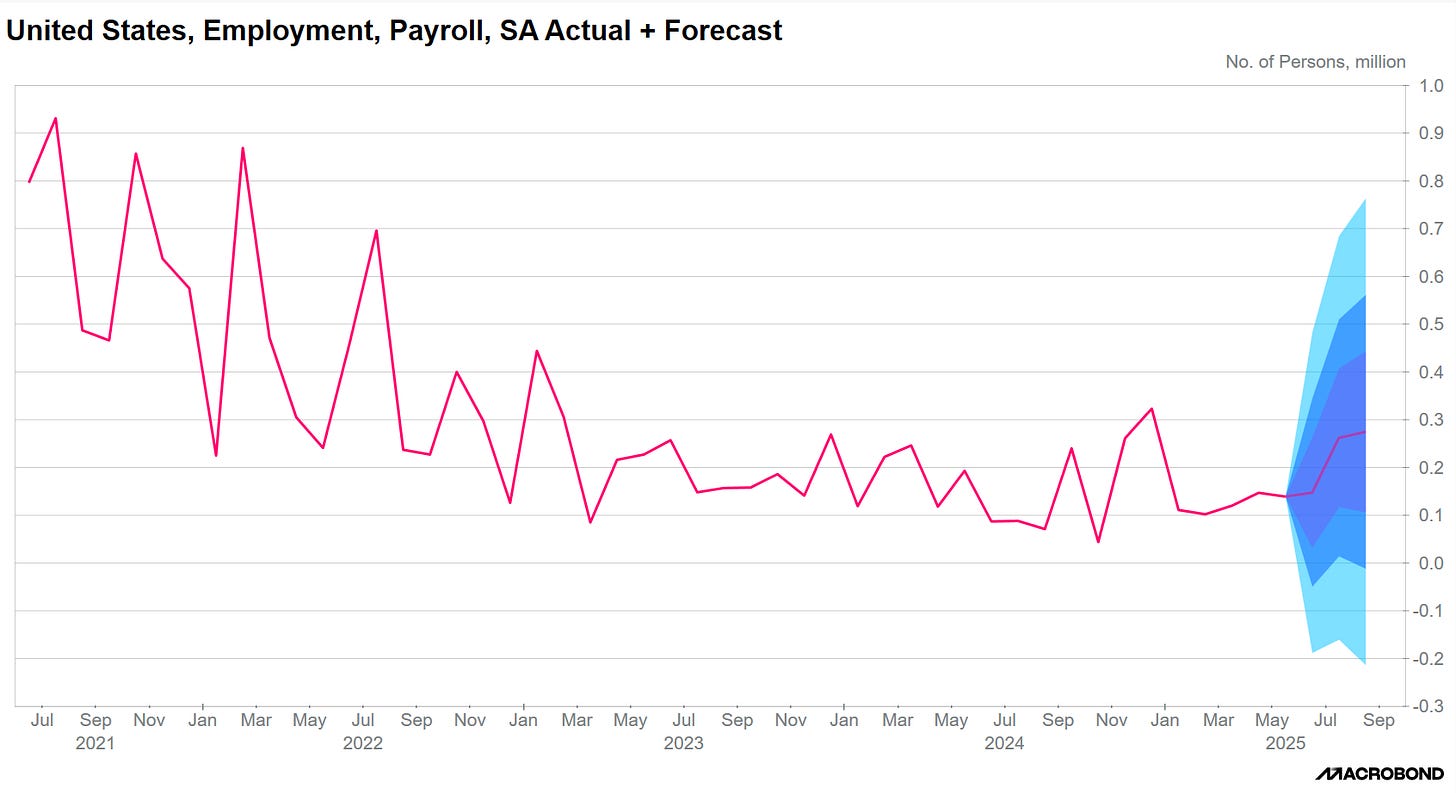

Our forecast for Nonfarm Payrolls (NFP) anticipates an increase, indicating that more people are gaining employment. This supports the view that businesses are continuing to hire and that the economy—given the positive output gap—is expanding. In line with our broader theme, this should further support consumption.

Believe given currently elasticity of demand companies will have more pricing power, and some of the bite of the tariff’s will start to flow through next forecast for Core PCE MoM is for Core to come in at 0.172% MoM

Equities

The EPS and revenue breakdown provides a glimpse into how Q1 2025 results came in relative to expectations. Looking ahead, I expect Technology to continue driving more than half of the EPS growth. The remainder of the growth in the second half of the year will likely come from 'defensive' sectors.

Going into Q2 anticipation is for EPS to come around 60 for Q2. The profit growth should be helped by continued optimism and spending from consumers. Unless we see a rapid shift in the consumer expect decent earnings into Q2.

QoQ growth rate for EPS should continue to be strong as well helping. Again should be driven by Tech and “defensive” sectors.

"Gross margins into the current quarter are expected to come in around 33% and continue to expand through the end of the year. I believe sectors with limited pricing power—such as automotives—will begin to experience margin compression. Similarly, areas where demand is relatively elastic will also have less pricing power. However, in the aggregate, I do not expect overall margins to compress just yet. This is largely due to the inventory overhang. Until pre-tariff inventories are drawn down, companies can continue to expand margins, even in sectors like automotive, before margin pressure begins to set in. We've already seen this reflected in the data, where car prices have declined despite the implementation of tariffs. I believe this is because current inventories have, for the most part, not yet been affected by the new tariffs.

Below is QoQ gross margin growth expecting it to grow around 2.5%, so still seeing margin expansion, as companies still take advantage of consumer’s still willing to consume despite potential modest price increases.

Rates

Looking ahead, I do not expect the Fed to begin easing until September, where a 25bps cut is currently priced in. Depending on incoming data—and if the thesis outlined above holds—I believe we will see only one additional rate cut in 2025. Therefore, the extra cuts currently priced in should be faded.

Given the potential rise in inflation on a year-over-year basis, the expectation is for the 10-year yield to move higher as markets shift away from growth slowdown concerns. This move would also reflect easing inflation fears and a repricing for a stronger-than-expected second half, along with a slight increase in the aggregate price level.

Conclusion

Taking into account all of the current economic indicators, market dynamics, and forward-looking data, I do not see any substantial evidence pointing to a declining U.S. economy at this time. Employment remains strong, consumption has held up, and everything remains stable.