Macro Update

Introduction

The global macroeconomic landscape continues to evolve as central banks recalibrate policy in response to inflation dynamics, growth prospects, and shifting geopolitical risks. Interest rate decisions remain front and center, with diverging paths between developed and emerging markets reflecting varying stages of the economic cycle. This post will touch on what we are seeing across different asset classes as tides shift.

Commodities

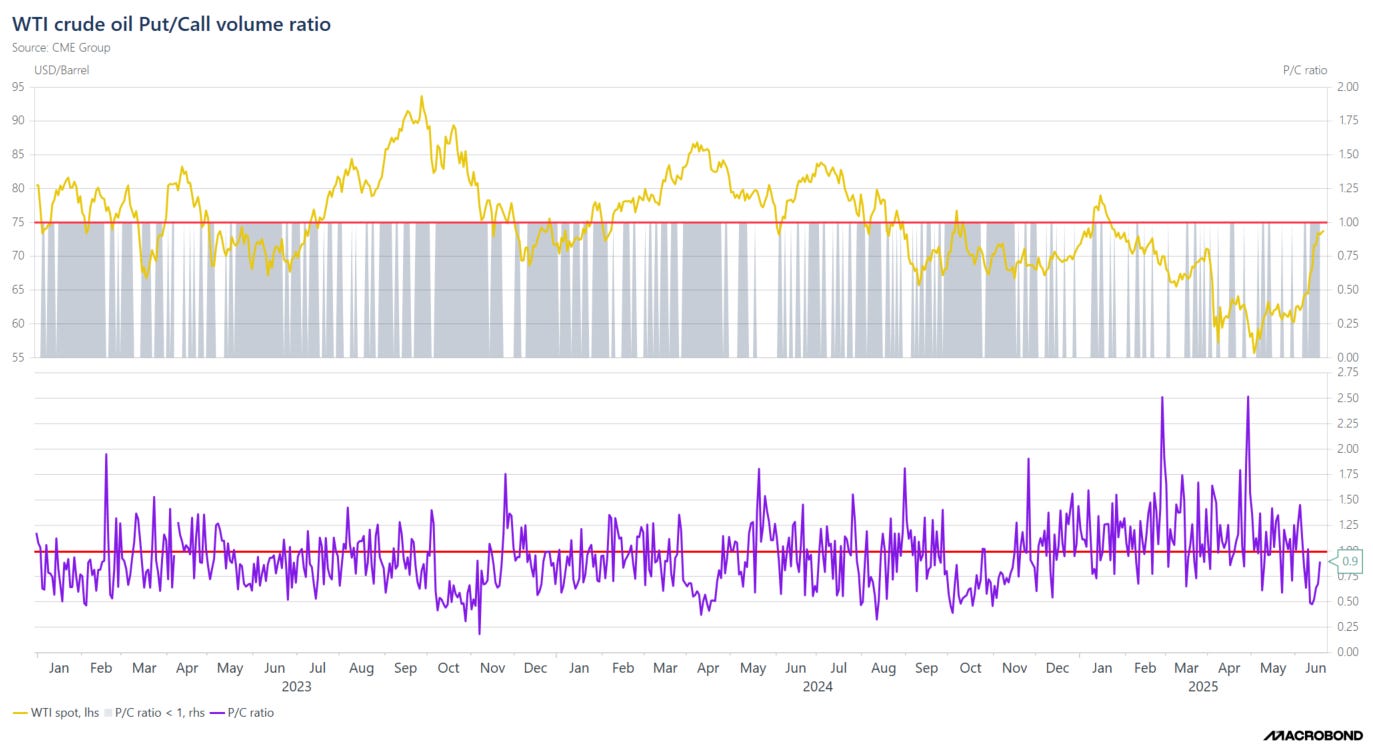

Starting with the options market, we have seen a significant increase in the ratio of put volume to call volume. This suggests that we could begin to see further downside price risk for WTI.

The put/call ratio has been moving back toward 1, climbing from around 0.5 to approximately 0.9. As shown in the top chart below, when the put/call ratio was below 1 (shaded area), crude prices tended to rise. This inverse relationship highlights how increased hedging or bearish positioning in the options market may be signaling a shift in sentiment around oil prices.

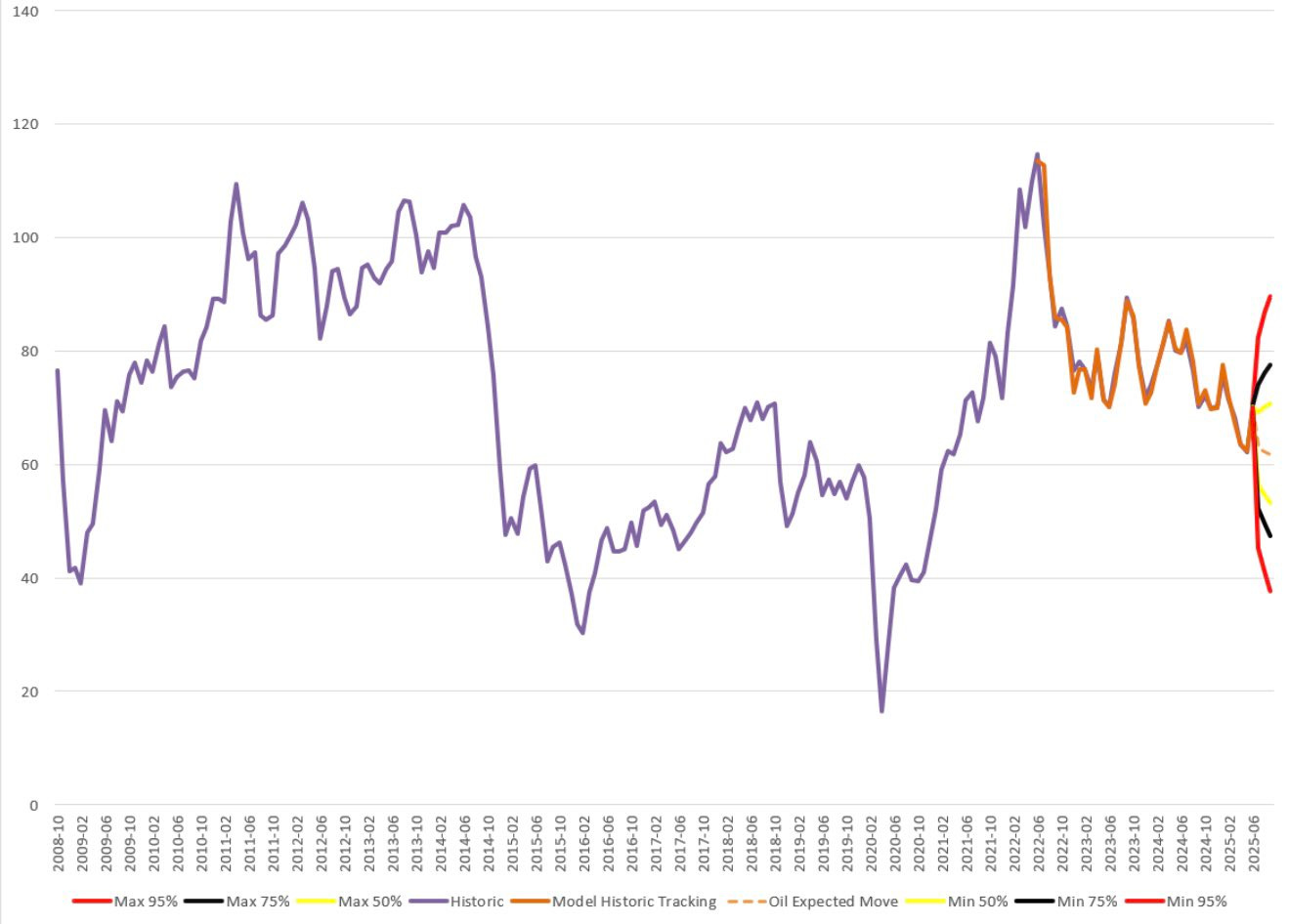

Now, as it relates to the geopolitical premium in oil: absent a major supply disruption, we expect oil to move somewhat higher in the near term before fading.

The geopolitical risk premium in oil has largely dissipated, and the only sustainable path for prices to move higher would be through a meaningful disruption in supply.

Over the next 1–2 months, we expect oil to settle in the mid-$60s range.

Strong demand for EV should continue to help boost copper prices. As the sale of EVs continues to be strong specifically in China this should help in a few ways. The average EV contains around 130ish pounds of copper if you compare this to hybrids or ICE vehicles even contain significantly more copper than other vehicles. Copper is also a huge component in EV recharging stations. As more cars are on the road (i.e. more sales) this by default as well increases the demand for charging stations. All of these things combined will help be something to keep copper prices somewhat bid going forward.

Precious metals show divergent price trends when standardized against their 30-year history.

Rates

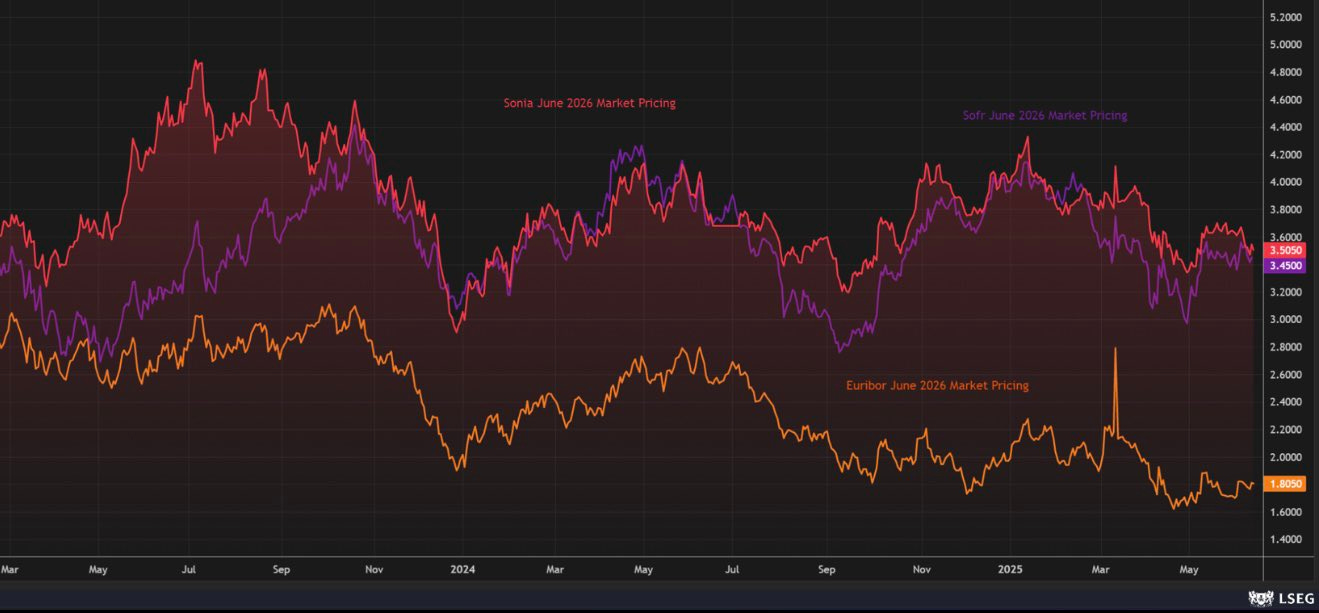

The ECB appears to have more room for rate cuts, given subdued growth, moderating inflation, and a relatively strong euro. These factors provide the ECB with continued justification to ease policy further.

The Federal Reserve is in a trickier position, facing strong economic growth, a positive output gap, stickier inflation, and a weaker U.S. dollar. These dynamics make the case for near-term easing less compelling.

The Bank of England is expected to remain tighter in the short term, but there is growing anticipation of rate cuts should economic growth continue to weaken.

Below is the number of hikes and cuts by the U.S. Fed. With markets currently pricing in around two cuts for the year, I believe this expectation is likely to fade given the resilience of current U.S. data and the absence of any clear signs of a significant slowdown in the economy.

On this point as well, I continue to believe that market pricing should be faded. The market often gets it wrong and tends to be overly sensitive to incoming data. Time and again, it has attempted to forecast the rate path with little accuracy.

As it relates to the 10-year and GDP, I believe GDP will continue to surprise to the upside following the weak Q1, with growth anticipated to be around 2.5%. I’ve included the model’s previous accuracy for both the 10-year yield and real GDP. Based on this, I expect real GDP to remain relatively robust before easing into 2026, which leaves room for the 10-year yield to sell off.

Equities

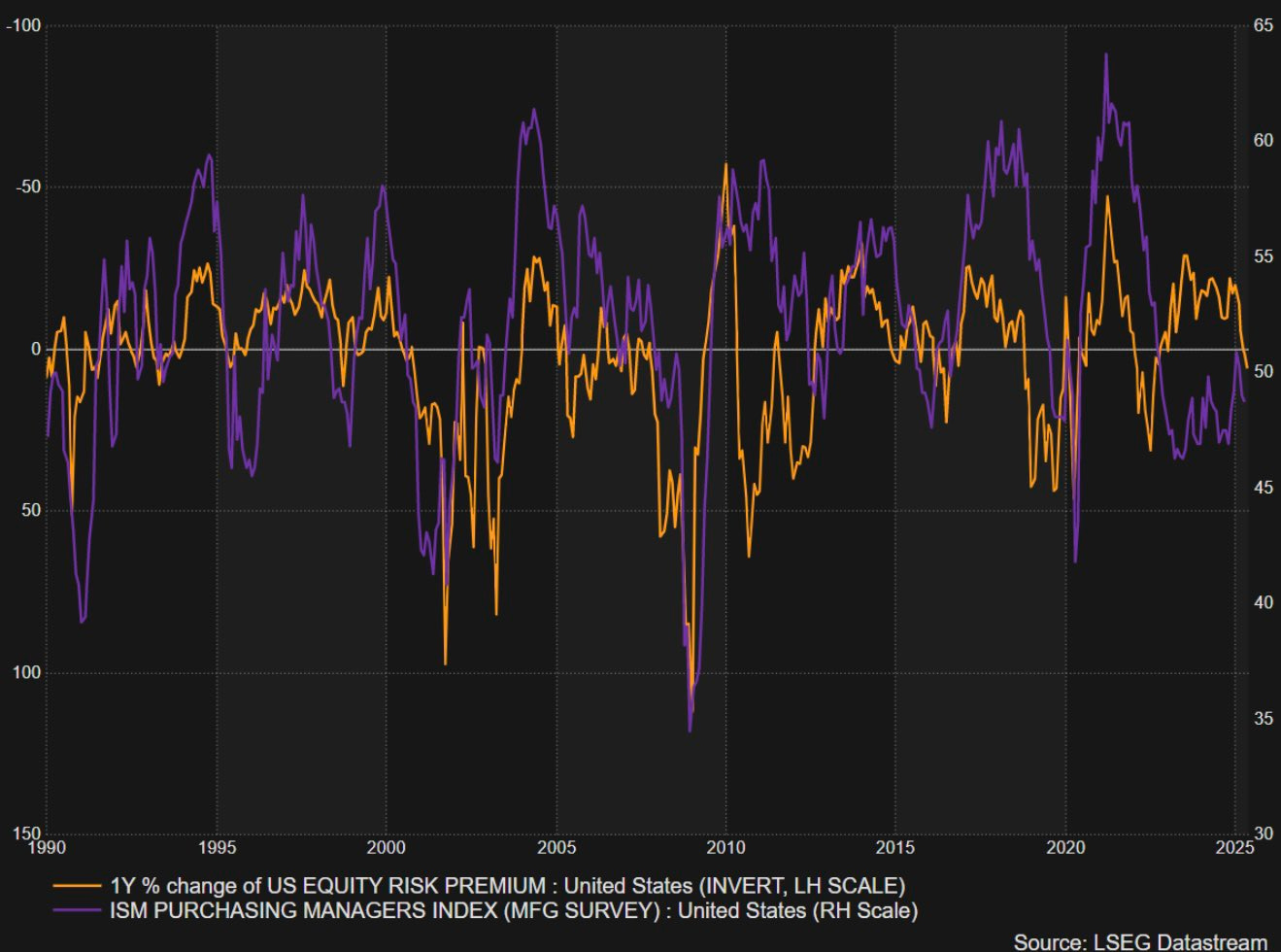

Equity markets and macro fundamentals are coming back into line after the divergence we saw.

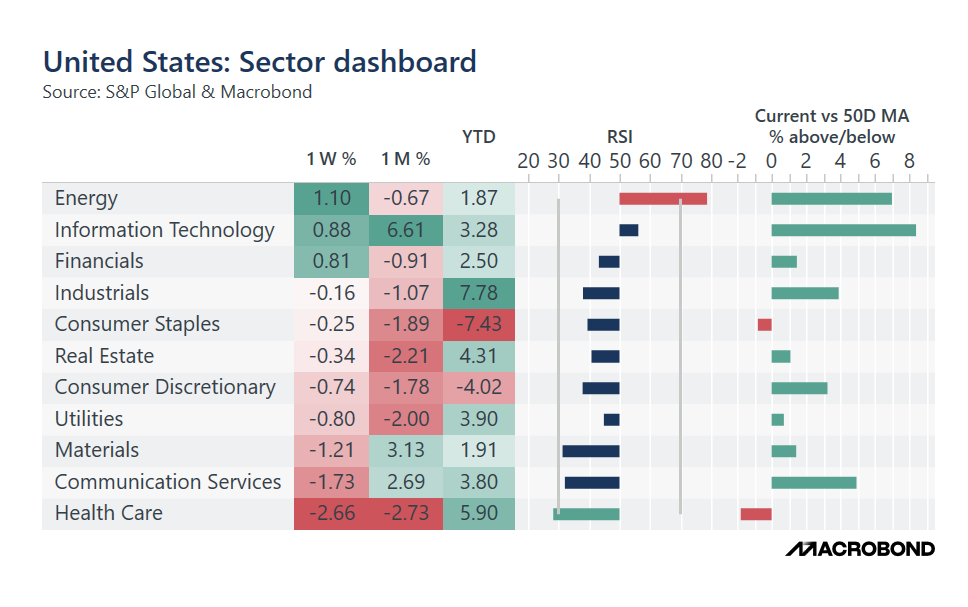

The chart below helps paint a picture of which sectors are currently helping boost/drag down performance in the S&P. Currently the drag has come from Healthcare and Consumer Discretionary.

Current sector dashboard YTD everything is up except consumer discretionary and consumer staples. Going through the remainder of the year in a time of uncertainty expecting sectors that fall under defensive to continue to outperform.

Conclusion

In conclusion going forward still think there are many opportunities for allocation. Throughout the remainder of the year expect things to be noise on geopolitical and data front. However, this I think should be faded (outside of a trading perspective) and think the macro fundamentals for the remainder of the year are still relatively strong.