Introduction

The foreign exchange (FX) markets have experienced significant volatility over the past few weeks, creating substantial opportunities for tactical trading. This heightened volatility has primarily been driven by trade wars and shifting macroeconomic outlooks. In this article, we will explore the current trends shaping the FX landscape and provide insights into where traders should focus their attention moving forward.

EUR/USD

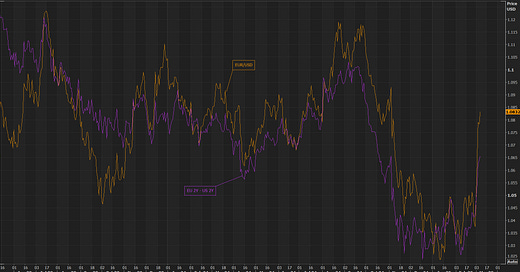

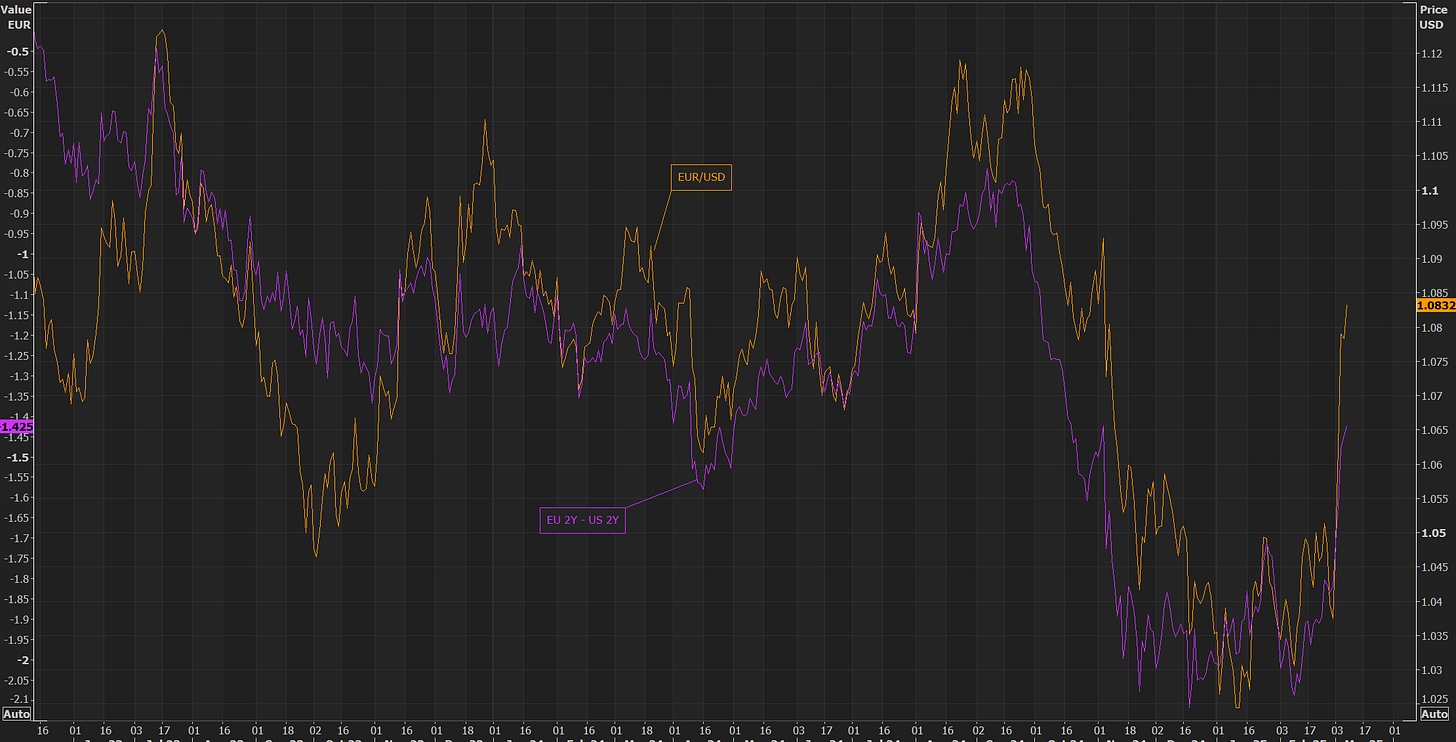

Over the past week, we witnessed one of the worst sell-offs in 25 years in the EU, driven by investors bracing for an increase in debt supply from Germany, which aims to boost fiscal spending. Germany is planning a €500 billion fund for infrastructure and intends to exclude defense investments from its debt rules. This shift has led to two main market reactions: first, greater optimism about growth prospects, and second, concerns about rising inflation in the EU. The change in these differentials, triggered by the EU sell-off, resulted in a significant boost to the EUR.

Based on the below, we observed a massive unwind of EUR shorts, as indicated by the CFTC contracts in purple in the bottom panel. This also led to options traders selling the dollar and bidding on the EUR, as shown by the 3-month risk reversal. The unwind of those EUR shorts resulted in short covering. Positioning was skewed against the EUR last week, and as mentioned earlier, this move led to a significant unwind, which was favorable for the EUR.

Looking ahead, with Lagarde’s comments last week and the possibility of increased policy uncertainty, it is difficult to see much upside for the EUR. The rise in yields we saw last week will likely help support EUR/USD. However, I wouldn't say the dollar’s move is over. If data continues to surprise or come in better than expected, as we saw with the NFP (151k), it’s hard to be outright bearish on the dollar. Given that US growth remains resilient, we could start to see the dollar regain some ground.

DXY

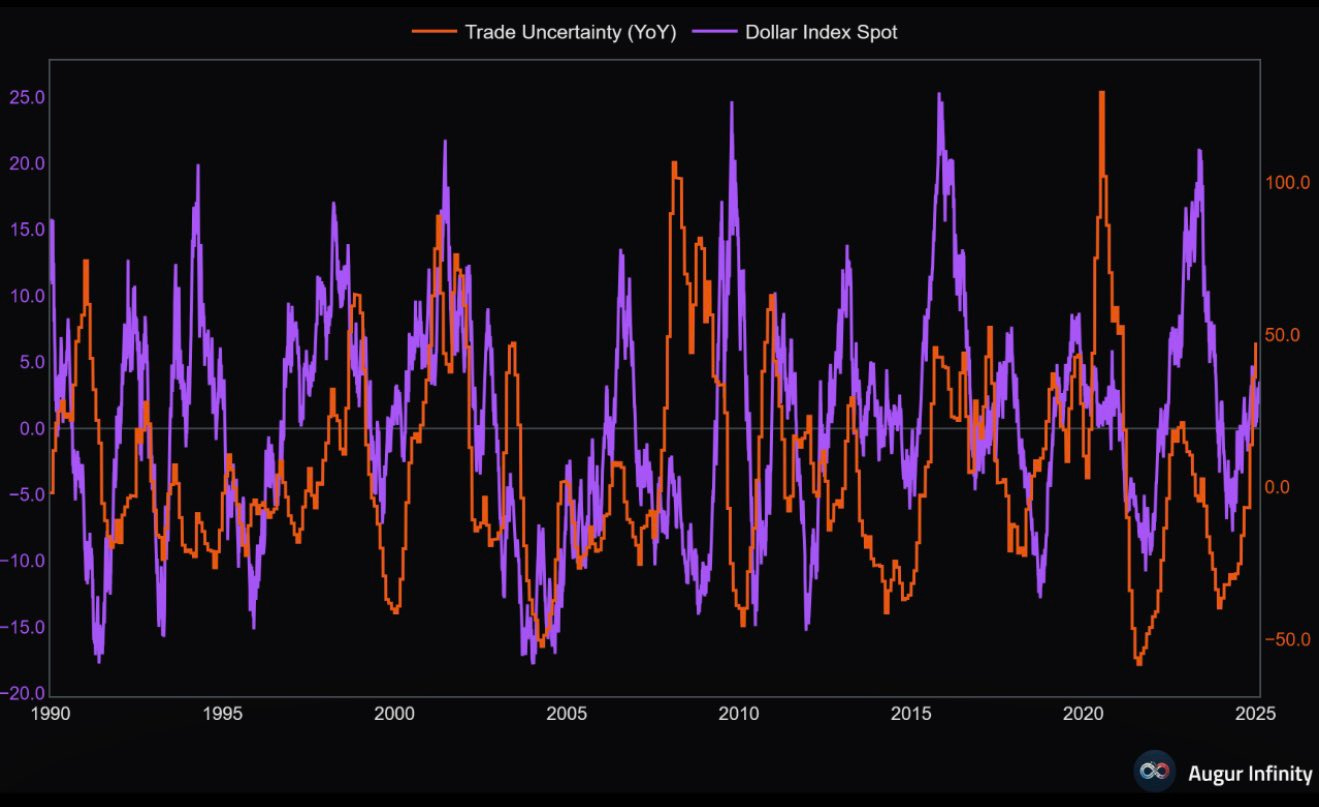

Sticking with what we saw last week, the DXY was hammered pretty hard, even from a historic standpoint. There was a 350bps drop in the DXY, marking the most significant decline since 2022. Looking at the chart below, you can see just how rare this is. This was the third-largest drop since the GFC, and it seems extremely overblown given the current underlying resilience of the United States economy.

Some "disappointments" in economic data also seem to have contributed to the weakness in the DXY. While I believe these "weaknesses" are overblown, we have generally seen tariff announcements lead to dollar strengthening. However, the overall impact of trade war announcements has been relatively muted. The discussion surrounding the trade war has also led to concerns about economic growth prospects, which I am not currently worried about. Still, this, combined with the aforementioned disappointments, has weighed on the DXY over the past few days after a significant run.

As mentioned earlier, there is currently a high level of trade uncertainty, which is having a significant impact on market sentiment. Trade tensions and the unpredictability surrounding trade policies contribute to an environment of risk aversion, where markets are waiting for more clarity before making decisive moves. In my previous analysis on tariffs, I highlighted that if there is greater clarity and fewer changes in trade policies, particularly surrounding the trade war, it could ultimately benefit the dollar.

When trade policies are in flux, it creates a sense of instability in the global economy. However, once that uncertainty is reduced and there is a clearer understanding of the trajectory of these policies, the markets are likely to respond positively. A stable and predictable trade environment allows businesses to make more informed decisions, reducing risks, and fostering greater investor confidence. This would support the dollar, as the U.S. economy could benefit from stronger trade relations and less disruption.

Additionally, during periods of uncertainty, there is typically a flight to safety, with investors seeking assets perceived as more secure, such as the U.S. dollar. The dollar is often seen as a safe haven during times of geopolitical or economic turmoil, due to its status as the world’s primary reserve currency and the relative stability of U.S. financial markets. In these times, demand for the dollar increases, providing upward pressure on its value. Therefore, once trade uncertainties subside and clearer policies emerge, we could see the dollar regain strength, as investors seek the relative safety and stability that the U.S. dollar offers.

In summary, reducing trade uncertainty and providing more clarity around trade policies could significantly boost investor confidence, leading to increased demand for the dollar. Until that happens, however, the market is likely to remain cautious, with the dollar facing some downward pressure as it waits for more concrete signals.

The probability of the Federal Reserve holding rates steady in March stands at 98%. This decision is supported by signs of persistent inflation, strong consumption, robust hourly earnings, and a labor market that remains resilient. These factors have collectively provided a boost to the dollar in recent weeks. However, while the dollar is currently fading, this seems to be more a result of markets awaiting greater clarity on the direction of trade war policies and their potential impact on the economy. Until these uncertainties are resolved, we may see some volatility in the dollar's movements. If rates can remain high relative to rest of G7, and data continues to be decent as mentioned above should breath some life back into the dollar.

CNY

Dollar supplies onshore have fallen as borrowing in yuan has become more attractive.

However, foreign exchange deposits have grown rapidly. Unless China improves and confidence is restored, deposits will likely continue to rise.

Another interesting development is the collapse in the loan-to-deposit ratio, with more bank deposits being directed away from the private sector.

These funds are then channeled into unproductive sectors, further decreasing the velocity of money, which will exacerbate China’s deflation.

USD/CNY Not Pricing In Devaluation. The selling of dollars in China, combined with the expectation that China won’t devalue its currency, has helped keep the yuan relatively stable in the forward market. However, I believe this narrative will change. As China faces mounting economic pressure, there is a strong likelihood that they will begin to devalue the yuan further in an attempt to boost exports and stimulate economic activity. I think the forward market is currently underestimating this potential shift, and it may be getting this one wrong.

Carry Trade

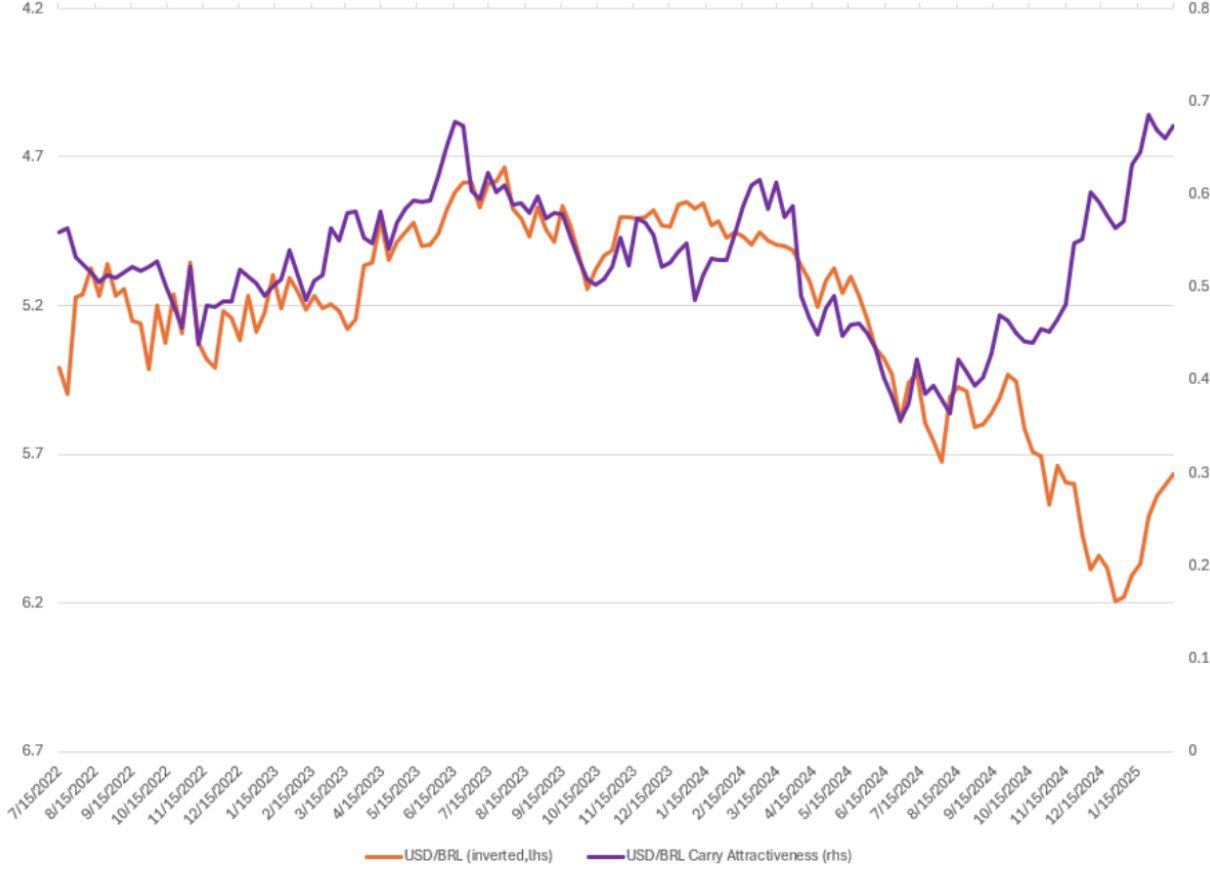

The USD/BRL carry trade continues to look attractive, as Brazil offers relatively high interest rates, which provide an opportunity for investors to earn a favorable return. There are more rate hikes currently priced into Brazil’s interest rate expectations, which could further strengthen the Brazilian real (BRL) in the near term. However, this could present a risk to the carry trade, as a stronger BRL would reduce the returns generated from holding the USD/BRL position.

The recent strength of the BRL has been supported by a delay in tariffs and the recent increase in global yields, which have boosted investor sentiment toward emerging markets, including Brazil. Higher yields in Brazil make the currency more attractive to investors looking for higher returns, contributing to the BRL's appreciation in the short term. However, the Brazilian real remains vulnerable to a number of risks that could weigh on its strength. Concerns about the ongoing trade war, potential fiscal deterioration, and weak economic growth in Brazil could limit the sustainability of BRL gains. Trade war uncertainty could lead to disruptions in global trade, affecting Brazil’s export-dependent economy, while fiscal issues could undermine investor confidence in the country’s long-term financial stability.

Despite these risks, the carry trade in USD/BRL remains attractive. The potential for higher interest rates in Brazil continues to offer strong returns, and as long as Brazil maintains its relatively high yields compared to other countries, the BRL should remain appealing to investors seeking higher returns. While BRL strength could weigh on the carry trade, the ongoing attractiveness of Brazil's interest rate differential with the U.S. means that the carry still presents an opportunity, even with the potential for some short-term volatility. As such, the balance between these risks and rewards will likely continue to make the USD/BRL carry trade a popular choice for investors in emerging market currencies.

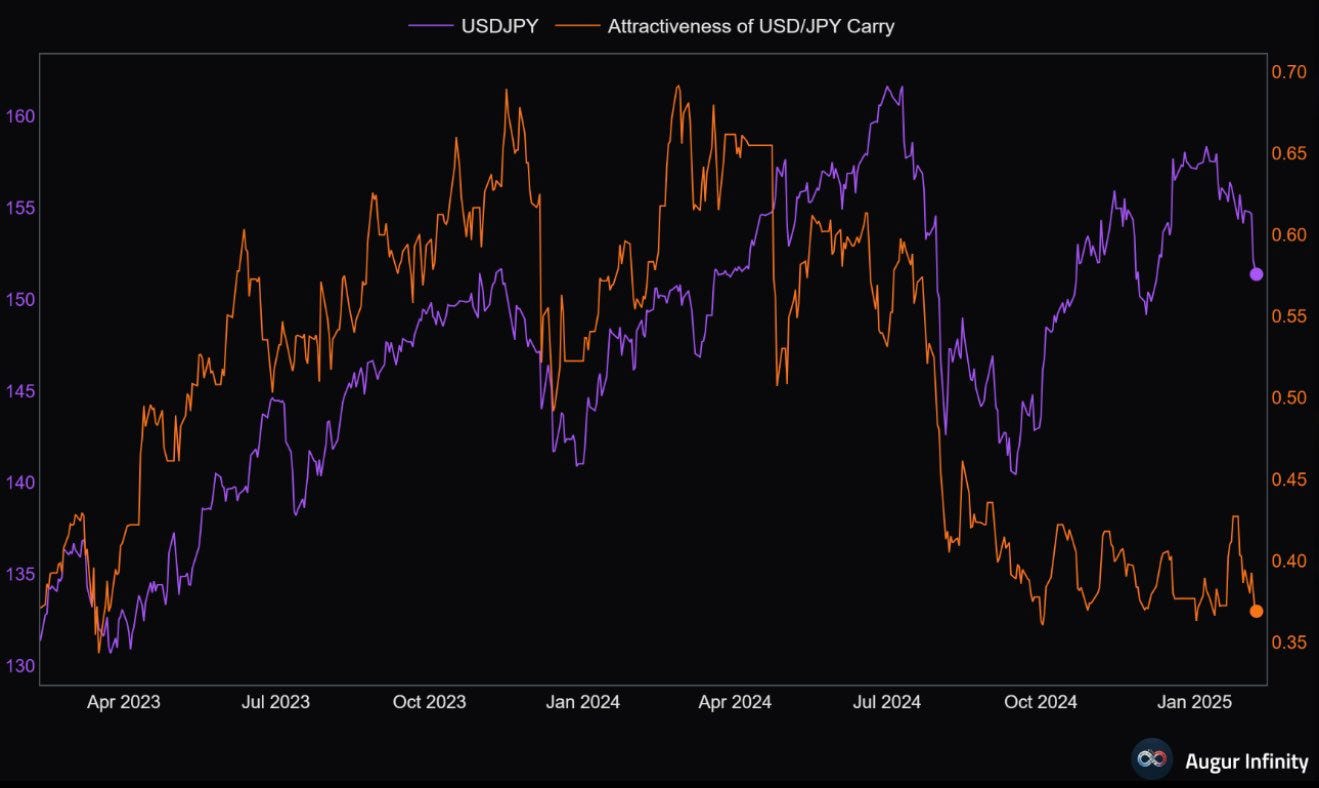

The USD/JPY carry trade, once a staple for investors seeking high-yield opportunities, has lost its appeal in recent months. Broadly speaking, this trade has not been attractive since July 2024. A narrowing of yield spreads between the U.S. and Japan has made the carry trade less enticing, as the differential between the two countries' interest rates is a key factor in determining the profitability of such trades. In simpler terms, as the gap between U.S. yields and Japanese yields shrinks, the incentive for investors to hold the yen against the dollar diminishes, making the trade less rewarding.

Additionally, the ongoing trade war has created increased uncertainty in global markets, and this uncertainty is reflected in the carry trade landscape. The potential for further escalation in trade tensions is a risk factor that traders must factor in, as it could influence global economic growth and impact the relative performance of different currencies. At the same time, the cheapening of hedging costs for domestic Japanese investors could lead to capital outflows from Japan, as these investors look for better returns abroad, potentially exacerbating the pressure on the yen.

Another critical factor contributing to the weakening attractiveness of the USD/JPY carry trade is the impact of these outflows on Japan’s Government Bond (JGB) yields. As Japanese investors move funds out of the country, the demand for domestic government bonds decreases, which in turn puts upward pressure on JGB yields. This dynamic could create a feedback loop, where higher JGB yields attract more capital inflows into Japan, but at the same time, the increased cost of hedging and greater risks associated with the global economic environment continue to limit the appeal of the yen as a funding currency for carry trades.

Looking ahead to 2025, the fundamental outlook for the yen appears to have room for strengthening. Japan’s economic recovery, potential shifts in monetary policy, and changes in global trade dynamics could all play a role in supporting the yen. The Bank of Japan may also shift its approach to monetary policy over time, particularly if inflation targets are met and economic conditions improve, providing more support for the yen. Therefore, while the USD/JPY carry trade has been a popular strategy in the past, the narrowing yield spreads, trade war risks, and potential outflows suggest that the opportunity is no longer as attractive. With the possibility of a stronger yen ahead, the dynamics surrounding the USD/JPY carry trade may change significantly over the coming year.

The Turkish lira (TRY) carry trade remains attractive due to the relatively high interest rates offered in Turkey compared to other countries. Borrowing in USD and investing in Turkey allows investors to earn a favorable return through the interest rate differential. However, the downside to this trade is the potential for TRY strength. The Turkish Central Bank (TCMB) has been supplying more lira into the market, which puts downward pressure on the currency (positive for carry). The TCMB's tendency to oversupply the lira, often as part of efforts to manage FX reserves by using lira to purchase FX reserves, can lead to the devaluation of the currency over time. This ongoing oversupply of the lira increases inflationary pressures, making the currency weaker and less stable. As the lira depreciates, the carry trade becomes more profitable for investors who are borrowing in a weaker currency and earning returns on investments in higher-yielding assets in Turkey. Therefore, while there are risks involved, the potential for the TCMB’s actions to lead to further lira depreciation may make the carry trade even more appealing in the long run.

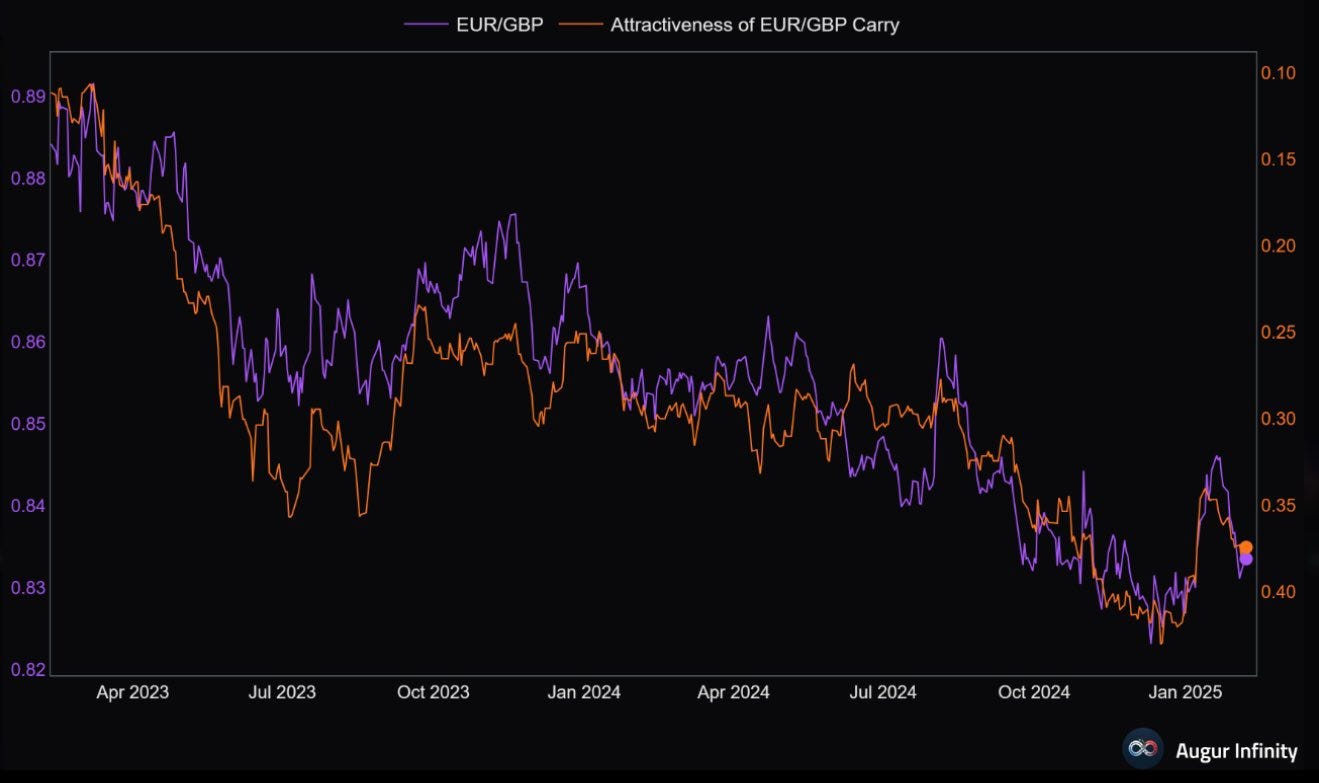

Higher yields in the UK are creating an attractive carry trade opportunity, making the carry trade more appealing against the EUR. The yield pick-up should also help boost the GBP against the EUR. This continued yield advantage offers an enticing opportunity for investors, as the carry trade remains attractive due to the potential for higher returns from the UK’s relatively higher interest rates. Despite the sell-off in EU rates expect this to remain a decent carry.

The easing of policy rates in Switzerland, combined with the expectation that US Fed funds will be in the 375-400bps range one year out (according to OIS), is creating interesting opportunities. The carry trade potential with CHF looks appealing, and the anticipation of a potential devaluation of the Swiss franc makes it an even more attractive carry trade. The strategy would be to borrow in CHF and invest in USD, capitalizing on the interest rate differential and the potential for CHF depreciation.

CAD

The reason I remain short on CAD comes down to the flow of capital. When analyzing the Canadian dollar, many focus on interest rate differentials, but the data set used often lacks predictability when it comes to CAD's movements. Canada is currently experiencing net leakages that are greater than net injections, meaning more money is flowing out of the country than is coming in. This suggests that domestic capital is leaving Canada at a faster pace than foreign investment is entering, leading to a reduction in demand for the Canadian dollar. With less demand for the currency, this creates downward pressure on CAD, which could result in further weakness. Simply put, the outflow of capital from Canada signals a lack of confidence or attractiveness in the Canadian economy, which makes the currency more susceptible to depreciation.

xCcy

The total return of a rolled carry position on USD/JPY has generally tracked moves in the cross-currency basis. The Japanese yen has traditionally been favored as a funding currency for FX carry trades, but as the attractiveness of using JPY for carry trades has diminished, so too has the cross-currency basis. This shift in market dynamics reflects a decrease in the appeal of JPY as a low-cost funding currency, resulting in weaker performance for the basis and carry trade positions linked to it.

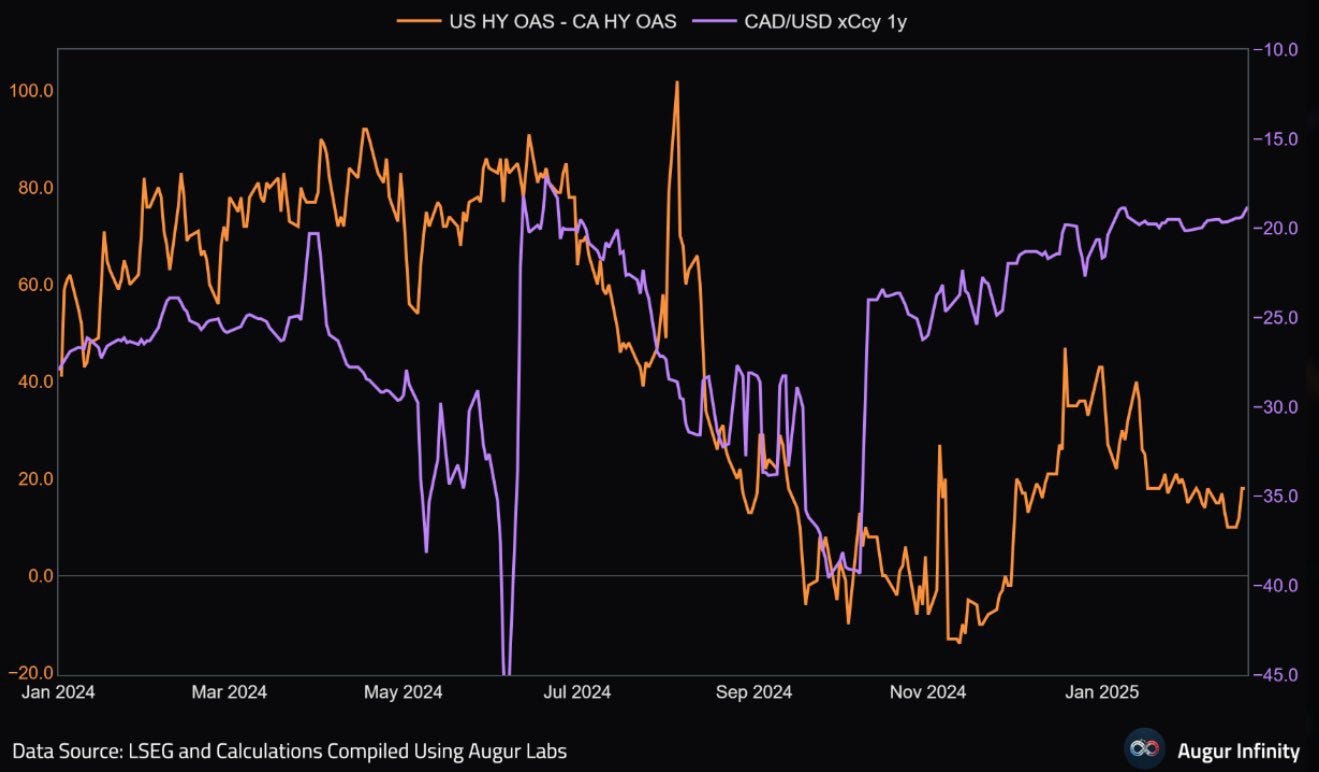

When the cross-currency (xCcy) basis widens, it signals liquidity stress in Canada. This occurs because the widening indicates increased demand for USD funding relative to CAD, causing higher costs to swap CAD for USD. During times of liquidity stress, investors struggle to access USD, which drives up credit spreads. As the xCcy basis widens, Canadian high-yield (HY) credit spreads also tend to widen, reflecting heightened risk and tighter liquidity. Currently, the spread is around 20bps, and while the USD/CAD xCcy is relatively flat, it is negative. Nevertheless, there are no signs of impending stress at this time.

Conclusion

In conclusion, the uncertainty unfolding across global markets will make FX pairs highly interesting throughout 2025. With ongoing volatility in the U.S., EU, and other regions, coupled with shifting macroeconomic conditions, trade tensions, and central bank policies, currency markets are primed for tactical trading opportunities. As economic growth slows in some areas and accelerates in others, the changing landscape will provide investors with opportunities to capitalize on short-term moves driven by fluctuations in interest rates, geopolitical risks, and global liquidity. Whether it's adjusting positions in response to trade war developments, anticipating central bank actions, or navigating the complexities of regional economic shifts, the heightened uncertainty around the world will continue to create dynamic and potential opportunities for tactical trades throughout the year.

Why would you expect the dollar to strengthen due to the current instability when it's done nothing but show you a heavy sell-off during the most unstable policy environment in years?

Maybe you should look outside the obvious playbook and understand what's going on with capital repatriation as a result of US foreign policy, how the fiscal in Germany most likely set the dollar top and how every single country of each currency in the DXY is has been attacked or criticized by the POTUS in one form or another.