Introduction

Given the overall uncertainty in global capital markets, the broader picture has become increasingly muddled. The S&P 500, long considered the darling of equity indices, has had a rough start to the year. Rates volatility remains elevated, as the market continues to grapple with the Federal Reserve's path forward—leading to frequent shifts in expectations around the number of rate cuts.

Corporate credit markets have started to present some compelling opportunities; however, there are still domestic warning signs in the United States that warrant close attention.

The purpose of this commentary is to identify potential opportunities, explore ways to diversify away from specific risks, and highlight key factors that investors should monitor heading into the second half of 2025.

Equities

In the long-run, earnings remain the most important driver of equity prices.

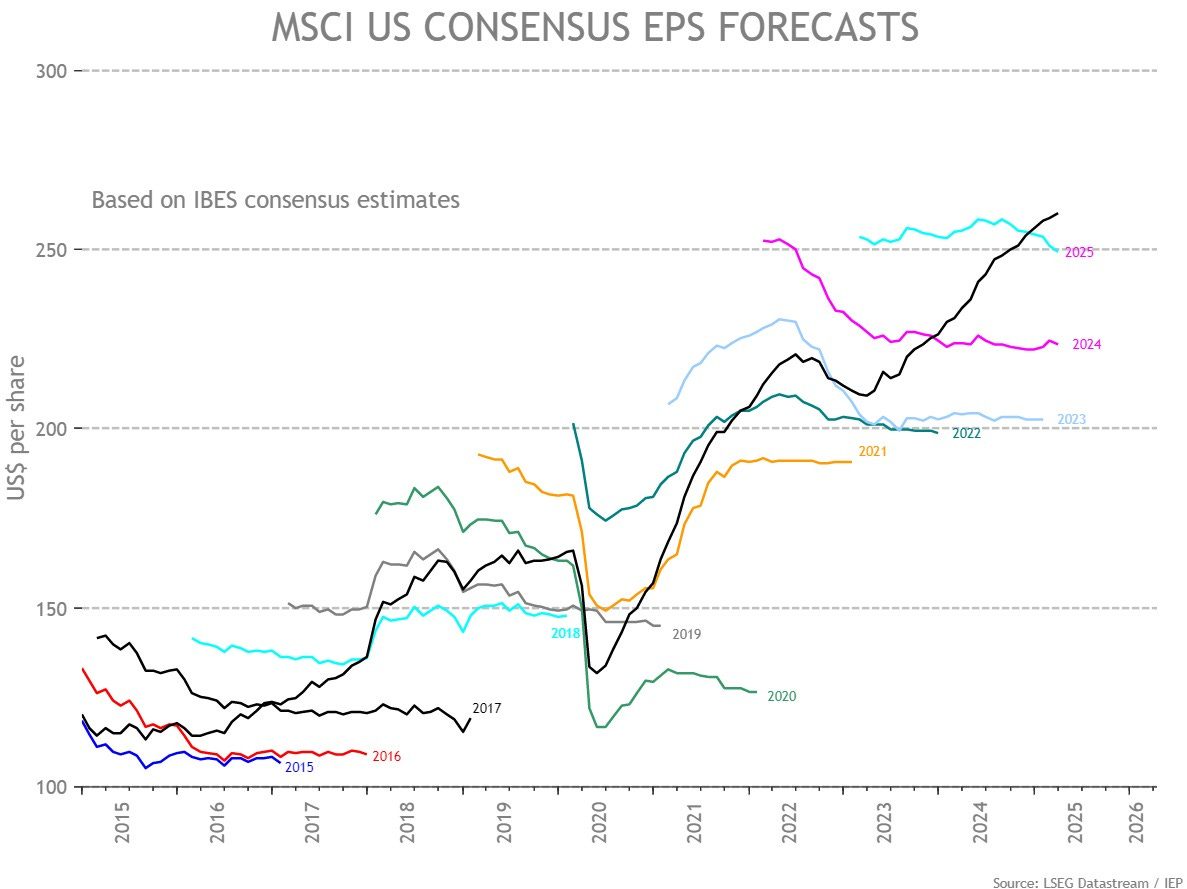

We often see a range of earnings projections from Wall Street analysts, which can influence investor sentiment and impact short-term price movements. However, as the chart below illustrates, much of the sell-side commentary tends to be noise. The variability in analyst estimates—what appear as "squiggles" on the chart—highlight how projections shift frequently as analysts respond to new data points. Yet, these forecast paths rarely align with actual realized EPS outcomes.

Another reason to remain constructive on the United States lies in corporate pricing power—a critical but often underappreciated factor supporting profit margins.

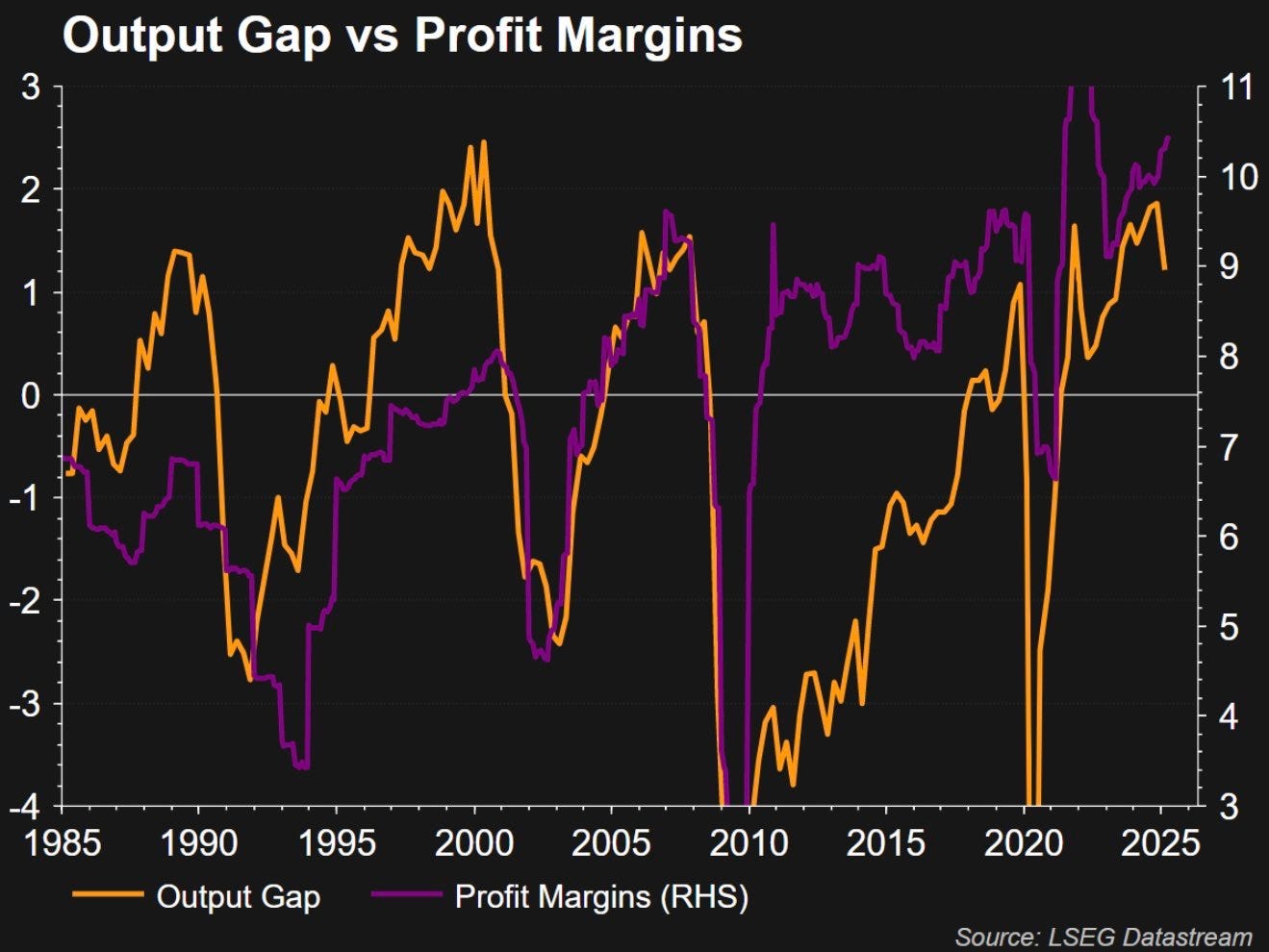

To understand this, we need to briefly revisit a key concept in economics: the output gap. The output gap measures the difference between actual economic output and potential output—the economy’s capacity to produce without generating inflation. When demand outpaces supply, we operate with a positive output gap. In such an environment, firms typically gain pricing power, enabling them to pass higher costs onto consumers and protect, or even expand, their profit margins.

However, pricing power doesn’t just come from tight capacity—it also depends on the elasticity of demand, or how sensitive consumers are to price changes. When demand is relatively inelastic (consumers aren’t quick to cut back when prices rise), companies can raise prices with less risk of losing business.

Conversely, a negative output gap, where supply exceeds demand, creates a more competitive environment. Firms have less room to raise prices, and profit margins tend to compress as they fight for market share.

As we evaluate the landscape heading into the second half of 2025, monitoring the balance between demand and supply—and the sectors where pricing power is holding firm—will be key to identifying where equity strength is most sustainable.

Earnings revisions are ultimately a function of where profits can be optimized.

Keynes offered valuable insights into this dynamic: he emphasized that there is a ceiling to how much output—and by extension, corporate profits—can grow, regardless of supply-side efficiency, due to the limitations of aggregate demand.

In other words, businesses can only optimize profits up to the point where total spending in the economy—by consumers, businesses, and the government—supports that level of production. Beyond this point, additional investment or output won’t lead to higher revenues or profits because there isn’t sufficient demand to absorb the extra goods and services.

For corporate profit optimization, this means firms must balance operational efficiency with realistic expectations for demand growth. Profit margins can't expand indefinitely through cost-cutting or increased investment if aggregate demand remains weak.

This insight is particularly relevant during periods of economic uncertainty or policy shifts—such as tariff increases or tighter monetary policy—that may suppress overall demand.

While earnings revisions have recently skewed to the downside, I’m not particularly concerned about the broader strength of the U.S. economy. Structural resilience and ongoing consumer spending continue to support a solid foundation, even amid cyclical pressures.

Finally point on the US is the 800 pound fiscal gorilla. According to sectoral balances accounting, the public sector's deficit corresponds to the private sector's surplus. Thus, sustained government deficit spending—such as post-pandemic investments in infrastructure, technology, and healthcare—has directly bolstered private incomes and corporate profits. The U.S. economy's strong growth and elevated profit margins in recent years are largely attributable to persistent federal deficits averaging 7% of GDP, even several years after the COVID-19 crisis.

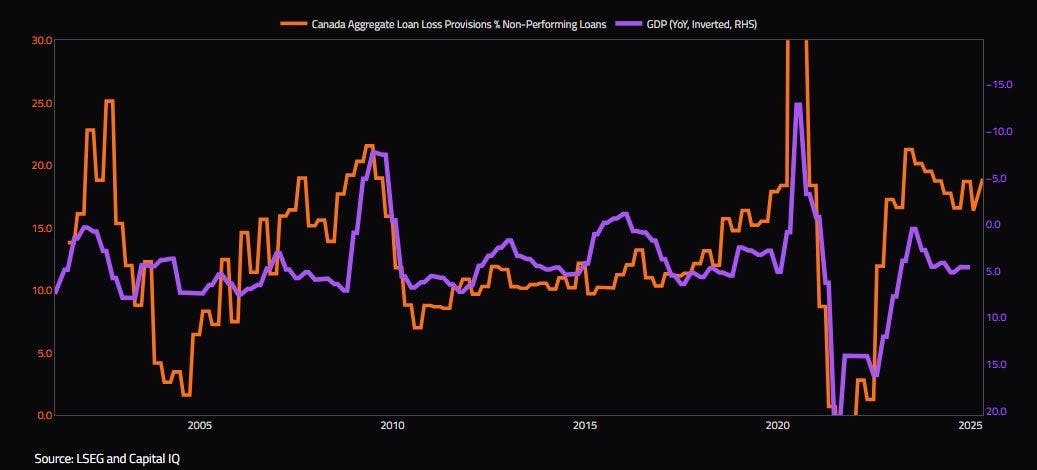

Switching gears—the Canadian economy is showing signs of slowing, and RBC recently missed earnings estimates.

Royal Bank's miss was largely driven by higher provisions for loan losses. Credit losses totaled $1.4 billion, with nearly $600 million in provisions recorded for Q2.

Loan-loss provisions are inherently counter-cyclical. This inverse relationship reflects the pro-cyclicality of the banking sector’s risk appetite and the broader health of the real economy. During economic expansions, fewer provisions are needed, which supports credit growth. Conversely, during downturns, provisions increase—often restricting lending and potentially amplifying the slowdown. It’s a dynamic that central banks and regulators monitor closely.

To be clear, I’m not suggesting shorting Canadian banks. As Steve Eisman once noted, “You can’t short an oligopoly,” and it’s no easy task. That said, with the TSX being heavily weighted toward financials, underperformance from the banking sector could drag on overall index returns—especially as rising loan-loss provisions continue to weigh on bank earnings.

Another sector worth highlighting is European insurance. While investor attention has largely centered on Aerospace and Defense (A&D), the European insurance space has quietly posted strong gains—up approximately 30% year-to-date. This performance has been supported by significant tightening in European credit spreads and robust capitalization levels across insurers, underscoring the sector’s financial strength.

Looking ahead, Europe continues to present compelling relative valuations, particularly within the A&D and insurance sectors. These segments are well-positioned to benefit from both structural tailwinds and ongoing risk repricing across global markets.

Rates

Turning to market sentiment, we’ve begun to see a notable shift. As sentiment has improved, the number of expected rate cuts priced into the rates market has steadily declined. This repricing reflects a broader reassessment of the macroeconomic outlook by market participants, who are now beginning to price in a more resilient economic environment.

A key driver behind this adjustment has been the recent improvement in economic surprise indices. While the overall level of economic data surprises remains slightly negative, the rate of change has turned more favorable. This suggests that, although data is still coming in below consensus expectations in aggregate, the magnitude of downside surprises is moderating. In other words, the data is becoming less negative, which in financial markets can often be just as impactful as a full reversal.

This dynamic is important for forward rates pricing. When downside risks appear to be diminishing and incoming data starts to stabilize or beat expectations, the urgency for policy easing diminishes. As a result, fewer rate cuts are priced in across the curve, especially in the front end, reflecting a recalibration of expectations for the path of monetary policy.

Building on this theme, we’ve also seen a significant upward revision in the Atlanta Fed’s GDPNow estimate, which has added to the growing optimism around Q2 2025 growth prospects. The GDPNow model is a real-time, high-frequency estimate of U.S. GDP growth, updated as new economic data is released. Unlike traditional forecasts, it uses a "nowcasting" methodology—essentially a running tally of GDP based on incoming macroeconomic indicators such as retail sales, industrial production, employment, and housing starts. As each new data point is released, the model adjusts its estimate, providing a near real-time picture of economic momentum.

The recent upward revisions in GDPNow suggest stronger-than-expected growth in Q2, reinforcing the narrative of economic resilience. In response, markets have adjusted their expectations for monetary policy. Rate markets have begun pricing out previously anticipated cuts, with only 50 basis points of easing now priced in for the remainder of the year. If incoming data continues to surprise to the upside, we could plausibly see this reduced by another 25 basis points, reflecting a further dialing back of Fed accommodation expectations.

A current favored approach in expressing a view on interest rates is through the 2s5s7s butterfly trade. Depending on your expectations for the Fed’s next moves, there are two primary positioning strategies to consider.

If you anticipate the yield curve becoming more humped—that is, with the belly of the curve (e.g., the 5-year) richening relative to the wings (2-year and 7-year)—you would sell the belly and buy the wings. Conversely, if you believe the curve will flatten out and become less humped, the optimal position would be to buy the belly and sell the wings.

Ultimately, the trade structure hinges on your outlook for the most probable path of rates and the shape of the curve. By incorporating market-based forecasts and macroeconomic data, you can build a more informed view of expected yield curve dynamics and structure the butterfly accordingly.

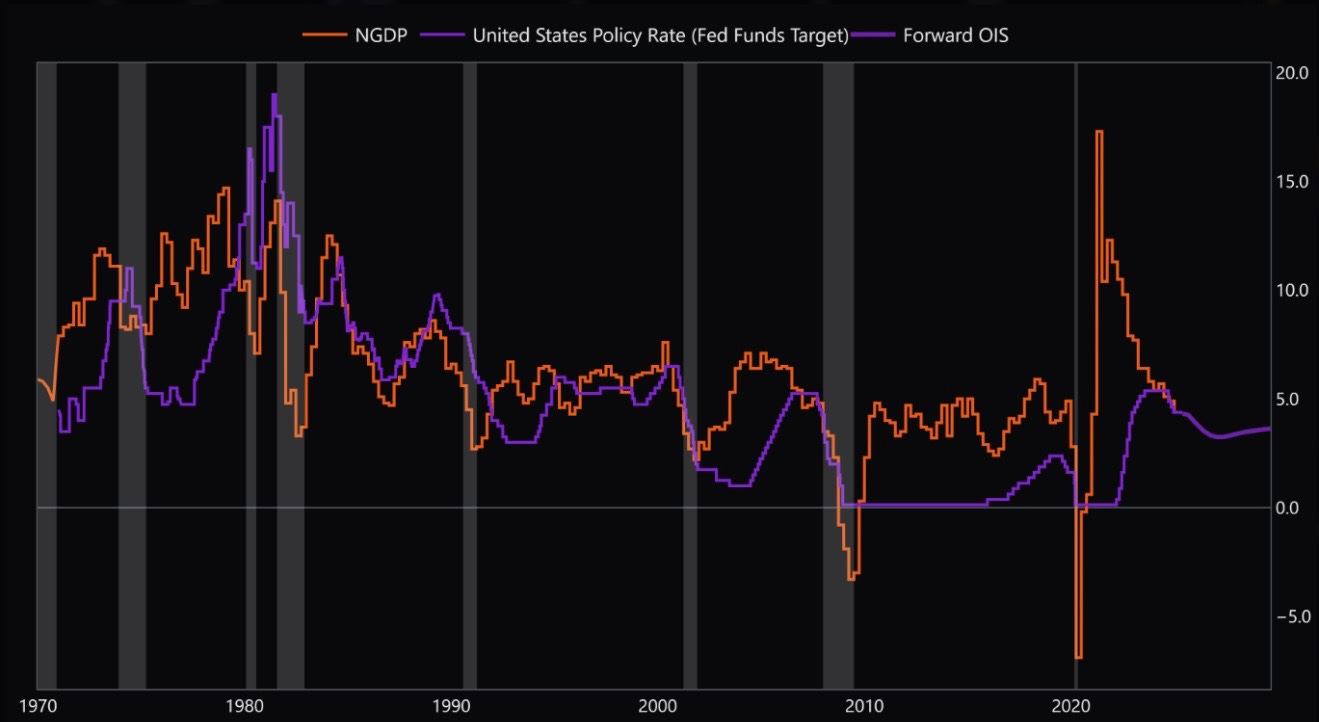

At the moment, U.S. growth remains robust, with nominal GDP (NGDP) outpacing the federal funds rate—setting aside the Q1 anomaly.

Historically, over the past two decades, the Federal Reserve has typically kept the target rate below NGDP following a recession to support the return to full employment. In this context, NGDP is measured by M2 multiplied by velocity, with the rate of change taken to reflect growth. A period of monetary normalization would involve raising the federal funds rate above NGDP, signaling that full employment has been reached and that any positive output gap needs to be addressed.

Historically, when the federal funds rate exceeds NGDP, a recession often follows, as tighter policy begins to constrain economic activity. Currently, with NGDP running approximately 75 basis points above the federal funds rate and a positive output gap still present, it suggests that full employment has not yet been achieved and the economy is operating above potential.

Credit

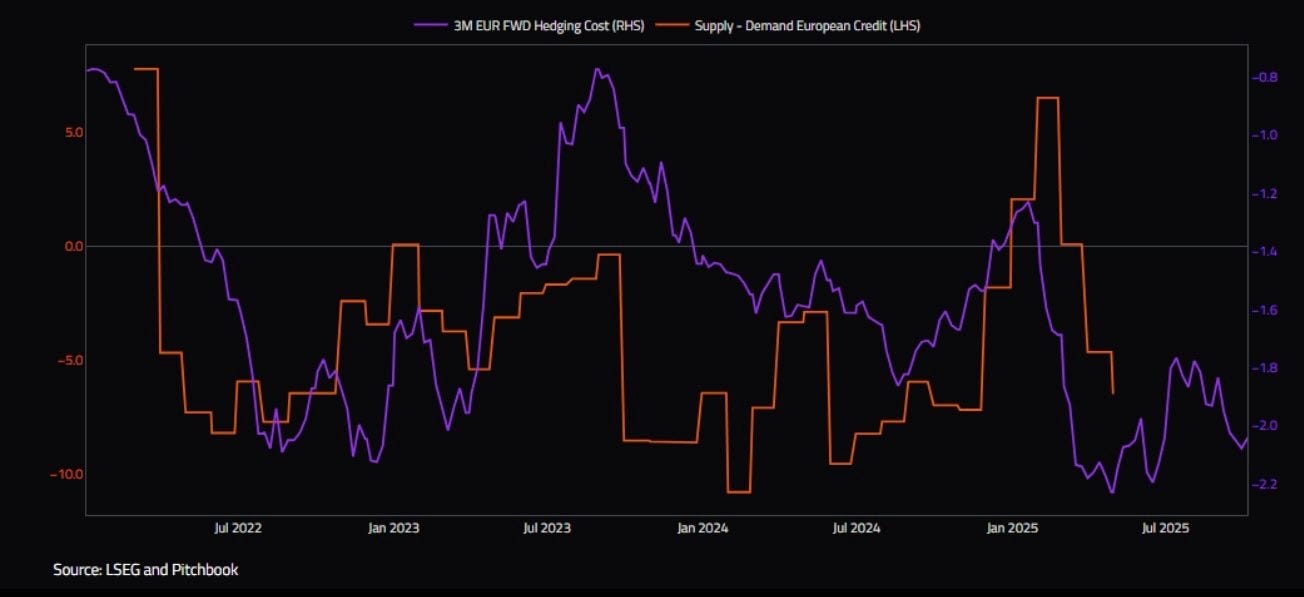

Dollar-denominated debt has become increasingly less attractive to European investors as FX hedging costs have risen significantly. When the cost of hedging USD exposure is elevated, the yield pickup from U.S. assets is often fully offset—or even rendered negative—by the associated currency hedge, making the relative value proposition unattractive.

As a result, we've continued to see strong relative demand for euro-denominated debt, particularly among institutional investors, as they seek to avoid the drag imposed by unfavorable cross-currency basis swaps. This trend reflects a broader shift toward currency-matched investments amid a persistently wide interest rate differential and tight FX basis markets.

Reverse Yankee issuance refers to U.S.-domiciled companies raising debt in euros rather than dollars—effectively tapping European capital markets for funding. This trend has gained traction in recent months, driven by a combination of domestic funding uncertainty, elevated U.S. interest rates, and favorable cross-currency (xCcy) conditions.

When the EUR-USD cross-currency basis is tight, it lowers the cost of swapping euro proceeds back into dollars. This makes issuing euro-denominated debt more economically attractive for U.S. corporates, especially when compared to higher all-in yields in the U.S. domestic market. In effect, EUR-denominated spreads are often tighter, and when adjusted for hedging, the all-in cost of capital can be materially lower than issuing in USD.

As a result, we are seeing a growing pipeline of Reverse Yankee issuance—particularly from investment-grade U.S. corporates seeking to optimize funding costs and diversify their investor base. Given current market conditions, and as the xCcybasis remains relatively tight, we expect this trend to persist, with continued growth in Reverse Yankee supply.

This shift also reflects broader capital market dynamics, where currency-hedged relative value opportunities and global investor appetite for yield-efficient paper continue to shape issuance decisions.

Investment-grade (IG) companies typically rely on positive coupon carry to refinance maturing debt without adversely impacting EBITDA.

However, with current yield-to-worst (YTW) levels exceeding the par-weighted average coupon, refinancing costs are rising. This increase may lead to potential earnings dilution and negatively affect shareholder equity.

Historically, this dynamic has coincided with widening credit spreads, particularly within the BBB-rated segment of the IG universe.

Currently, yield-to-worst (YTW) exceeds the par-weighted average coupon across much of the corporate credit market. As companies begin to refinance maturing debt under these conditions, interest expense will increase, putting pressure on earnings and free cash flow.

As we approach the refinancing wall, we anticipate a meaningful widening in credit spreads—first in the investment-grade (IG) space, particularly within the BBB-rated cohort, and increasingly across the high-yield (HY) segment. This pressure is especially acute in IG junior capital and hybrid capital structures, where refinancing costs are likely to rise sharply.

What’s particularly concerning is that this dynamic could constrain even fundamentally sound businesses, especially those with high cash interest obligations and limited senior debt capacity. In such cases, junior capital solutions—including mezzanine debt, preferred equity, or structured hybrid instruments—can offer more flexible refinancing options. These structures alleviate the burden of fixed debt service and can preserve capital for growth initiatives.

As a result, we expect to see an increase in private credit activity, especially in bespoke financing deals that can bridge the gap between stretched traditional credit markets and borrowers' capital needs—an area where private lenders may find attractive risk-adjusted returns.

Conclusion

There is a fair level of uncertainty, but overall, conditions appear stable. We’re beginning to see some signs of stress in credit markets—mainly related to refinancing—but nothing significant at this stage. Larger fiscal deficits and current equity market projections remain supportive. The overall rates picture reflects growing optimism about U.S. growth. All in all, there appear to be plenty of opportunities stateside.

Very clear!