Prenote Thanks: I would like to give a huge thank you to Augur Labs (@augurinfinity) on X. I have utilized their platform to build out the graphs within this Substack. The overall breadth of data, ability to customize graphs, and find data within their platform made the data analysis part of this Substack seamless. Check them out and give them a follow!

Introduction

China is currently going through an economic slowdown, which I’m sure many are aware of. There is an inability to stimulate growth, and economic growth has been relatively weak. This post will examine the overall macroeconomic backdrop for China and whether or not China is still a “fade” or looks more attractive on the short side.

Liquidity Trap

Currently credit is not robust in China this is seen by the credit impulse. This measures the amount of new credit issued as a percent of GDP. This metric will be utilized often within this post.

Monetary stimulus has become ineffective, and loan growth as a percentage of GDP remains relatively weak.

Differentials are consistently causing stress on China and the CNY. Further easing will only worsen this situation.

Historically, as the country has eased, it has coincided with an increase in loan demand. However, we are now seeing that additional easing is doing little to stimulate loan growth. It appears that Chinese citizens would rather hold cash than increase consumption.

New loans as a percentage of GDP are declining despite lower reserve requirements. Typically, a cut in reserve requirements would increase the amount of money available for lending, lowering borrowing costs and potentially boosting loan demand. With more funds in the banking system, banks can lend more freely, and lower interest rates can make loans more attractive to both consumers and businesses. However, despite these expectations, loan demand has plummeted. This could be due to underlying issues like a low marginal propensity to consume (MPC) in China, where individuals and businesses are more inclined to save rather than borrow or spend, thus dampening the effectiveness of the stimulus.

Loan demand has plummeted despite the decline in short-term yields (using par yield).

This explains a large portion of China’s stimulus, as they are trying to offset the liquidity trap.

The problem is that traditional stimulus seems to be muted for China, as the nation tends to have a low MPC, somewhere in the ballpark of 0.5–0.6.

My expectation is that the real "guns" haven’t been brought out yet, and China is waiting for tariffs and anticipated policy decisions before taking any large-scale actions on the stimulus front.

Potential Bad News for Commodities Complex

China is one of the largest consumers of most commodities globally. Given the build-out of infrastructure and the housing boom in China, there was a significant demand for raw materials.

Given the growth plans, it’s no surprise that constant flows of credit and access to financing are needed to facilitate this, as well as to help companies finance their need for raw materials.

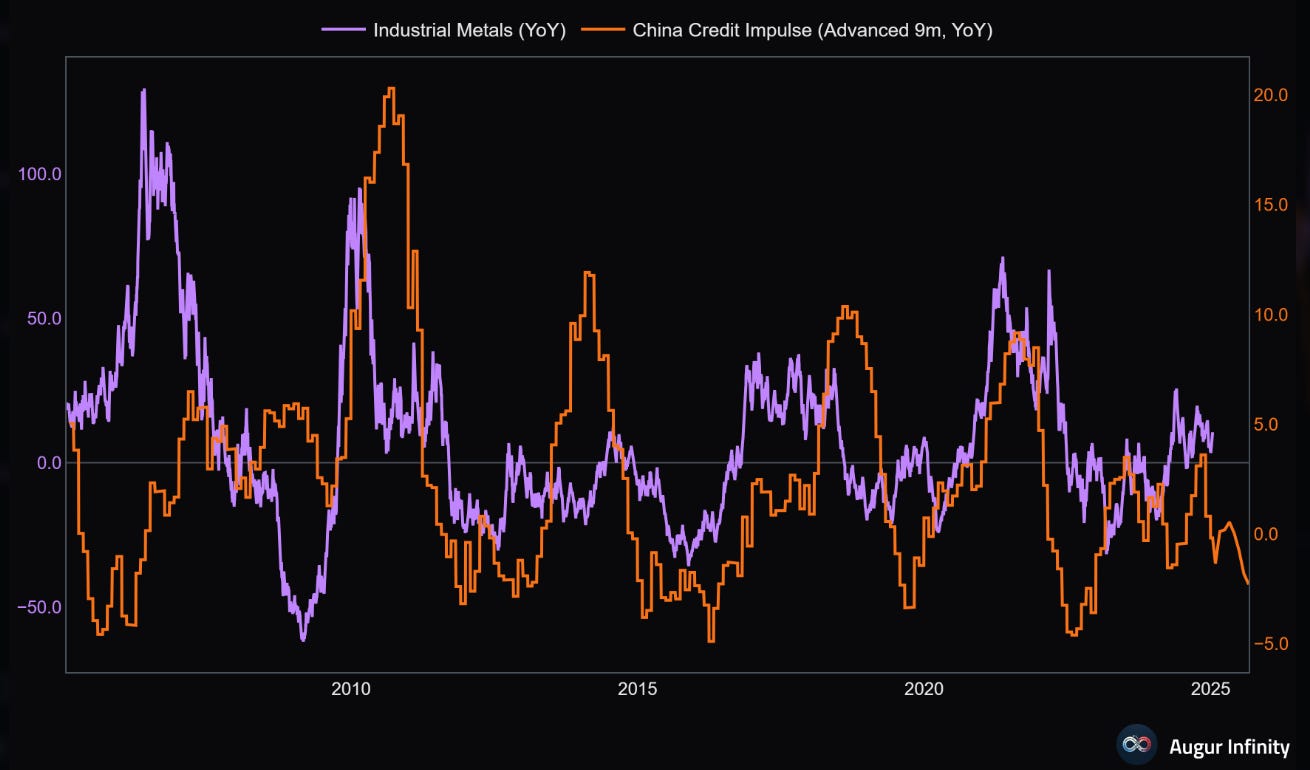

Given the points above, with the rollover in credit impulse, which tends to lead to a rollover in commodities, I do not see commodities—outside of a few (such as gold)—being attractive at this point. The risk looks tilted to the downside.

The same can be said for industrial metals, and weakening demand should put downward pressure on them. The lack of demand for credit looks like it will continue to weigh on industrial metals as well.

Credit impulse is closely tied to industrial metals because it reflects changes in borrowing, which drives investment in infrastructure and production. When credit growth slows, businesses reduce their demand for raw materials, putting downward pressure on industrial metals. Therefore, as credit impulse weakens, we can expect weaker demand for industrial metals as well.

Global Manufacturing

It’s no surprise that China is a global manufacturing powerhouse, and this is not really up for debate. However, the credit impulse signals potential headwinds for global manufacturing, suggesting that slowing might be ahead.

The change in credit impulse gives us insight into what could potentially lie ahead. As the credit impulse typically leads to increased investment and consumption, it plays a crucial role in the global manufacturing cycle.

Given that China’s economy is closely tied to manufacturing and that credit impulse tends to lead manufacturing trends, it looks like the sector could soften over the next six months.

This would further harm China domestically and likely require additional stimulus, though it may not have much impact, to try to stimulate growth. The already slow manufacturing sector will be further weakened by the continued downturn in the credit cycle.

China Output Gap

A slightly negative output gap in China suggests that the economy is operating below its potential, with resources such as labor and capital being underutilized. This will weigh on industrial production as factories and production facilities operate at less than full capacity. The result is lower industrial output, as companies reduce production in response to weak demand or underuse of available resources. Given the importance of manufacturing to China’s economy, this slowdown in industrial production could further hinder economic growth.

Additionally, a negative output gap often signals reduced demand for goods and services, prompting businesses to scale back investment in new production capacity or innovation. This lack of investment, combined with weaker demand for industrial goods, creates a vicious cycle where industrial production continues to decline. With the labor market under pressure and wages stagnating, consumer spending weakens, which further dampens industrial output. In this environment, China’s manufacturing sector is likely to face prolonged slowdowns, stalling broader economic recovery.

A slightly negative output gap in China, even though modest, can put significant pressure on industrial profits. When the economy operates below its potential, businesses often face lower demand for goods and services, leading to underutilized production capacity. With less demand, companies may be forced to lower prices to remain competitive, which directly erodes profit margins. As industrial production slows and excess capacity builds up, firms struggle to maintain profitability, making it more challenging to achieve growth in an already sluggish economy.

This scenario can also lead to disinflation, where the rate of price increases slows down. With weaker demand and reduced consumer spending, companies face less upward pressure on prices, which can dampen inflationary trends. The negative output gap means that economic growth is weaker than expected, and with businesses focusing on maintaining profitability rather than raising prices, inflationary pressures are subdued. This disinflationary environment can persist as long as the output gap remains negative, further challenging China’s industrial sector and overall economic recovery.

Trade Ideas

The worry around tariffs and a potential trade war opens up some ideas, one of which is to short the CNY. My expectation is that, in response to the anticipated tariffs, China will allow the currency to devalue further. When the USD strengthens against the CNY, we tend to see this flow through to other EM currencies.

This means more and more EM currencies will devalue against the dollar. Another trade would be to short the INR, as well as the BRL.

Another strategy is to short EMs and overweight the US. While many people argue that the P/E ratios are attractive, which is true, the overall macroeconomic situation is working against them in terms of seeing a rapid rise in their equity markets.

As the saying goes, when the USA coughs, the rest of the world catches a cold. This is similar for China and the EMs—when China coughs, the rest of the EMs tend to catch a cold. Additionally, with loan growth slowing in China, we have seen EM P/E ratios fall more sharply compared to the US.

Given that China is one of the largest EM markets people tend to invest in, this likely means more downside for the CSI 300 unless China introduces massive stimulus in response to the trade war and tariff concerns.

However, I still believe that, on the whole, EMs continue to be shorts, especially those countries in LATAM that are highly linked to Chinese growth.

Conclusion

Thinks in China are looking overall relatively weak. I continue to believe that China is currently not investable at least in terms of how markets go. I think until we see more stabilization and a huge uptick in growth it is best to avoid.