China Forex and Rate Update

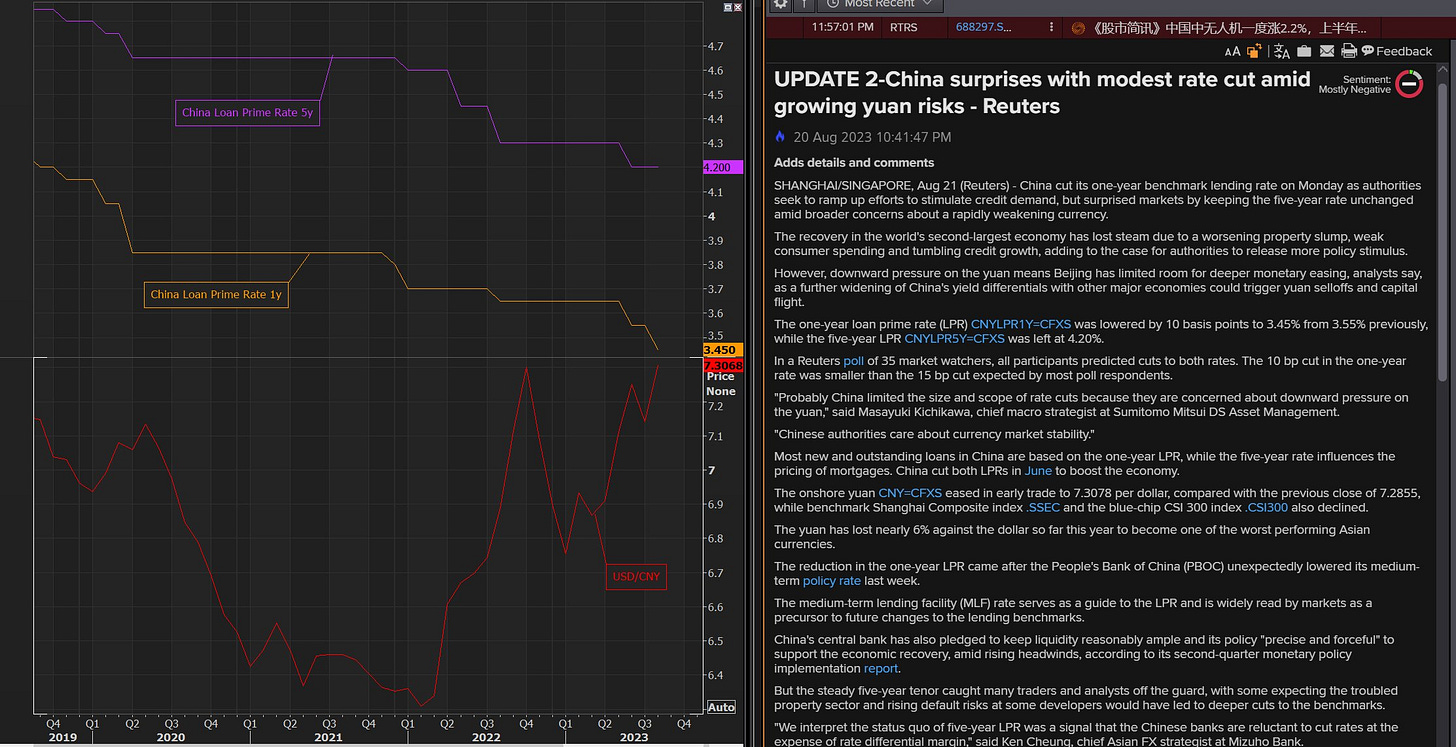

I'd like to provide a quick update on the latest news from China. Once again, China has decided to lower its prime lending rate (1-year) by 10 basis points. The country's intent is to stimulate growth through a loose monetary policy, but as I highlighted in my last Substack post, this approach appears to be yielding no results. It seems that China might be caught in a liquidity trap. The yuan's value is continuing to decrease, and when the news broke last night, USD/CNY had risen by approximately 33 basis points. As of my writing, this currency pair has risen by about 4 basis points.

An additional intriguing development is the significant rise in two key risk indicators: implied volatility of the Chinese yuan (CNY) and 25 delta risk reversals. The Chinese 5-year credit default swap (CDS) has experienced a sharp upward trajectory, accompanied by notable movements in implied volatility for the CNY. This heightened volatility is a sign of increased sovereign risk for the CNY, as is the upward movement of the 25 delta risk reversal.

Various risk indicators are displaying upward trends due to concerns about currency devaluation, challenging economic prospects, the potential for a liquidity trap, and the ongoing outflow of capital as investors withdraw their funds. Given these factors, the cost of implied volatility is remaining high and is likely to escalate further as investors seek risk mitigation strategies within the Chinese economy. While risk reversals are not currently showing a significant impact, it's worth keeping them in mind for the future.

Moreover, we're observing an uptick in demand for swaption volatility, as investors seek protection. This demand is also impacting rates volatility. Overall, uncertainty about China's upcoming economic policies and the direction they will take in the coming months has led to an increase in rates volatility. Investors are seeking hedges, and this is causing volatility to rise rapidly across various sectors in China.

The current outlook for China appears unpromising from my perspective, and it's certainly something to bear in mind as we move into the next few weeks.