2024 Predications

As we approach 2024, it appears that the path ahead is marked by increased certainty and reduced volatility. Anticipating global growth prospects, it is evident that overall growth will likely soften, with the exception of the United States, which is expected to maintain robust economic expansion. Opportunities abound in both the rates and FX spaces for strategic trades. However, on a broader scale, the global macroeconomic landscape still suggests a search for stability. Against this backdrop, it is noteworthy that the United States is poised to sustain its relatively strong economic prospects, followed by the UK, Germany, and France. Conversely, Canada and Italy are expected to face greater economic challenges. This dynamic will undoubtedly influence capital flows, as well as FX and rates markets. Additionally, it is worth noting that Emerging Markets (EM) are anticipated to perform well in the latter half of the coming year.

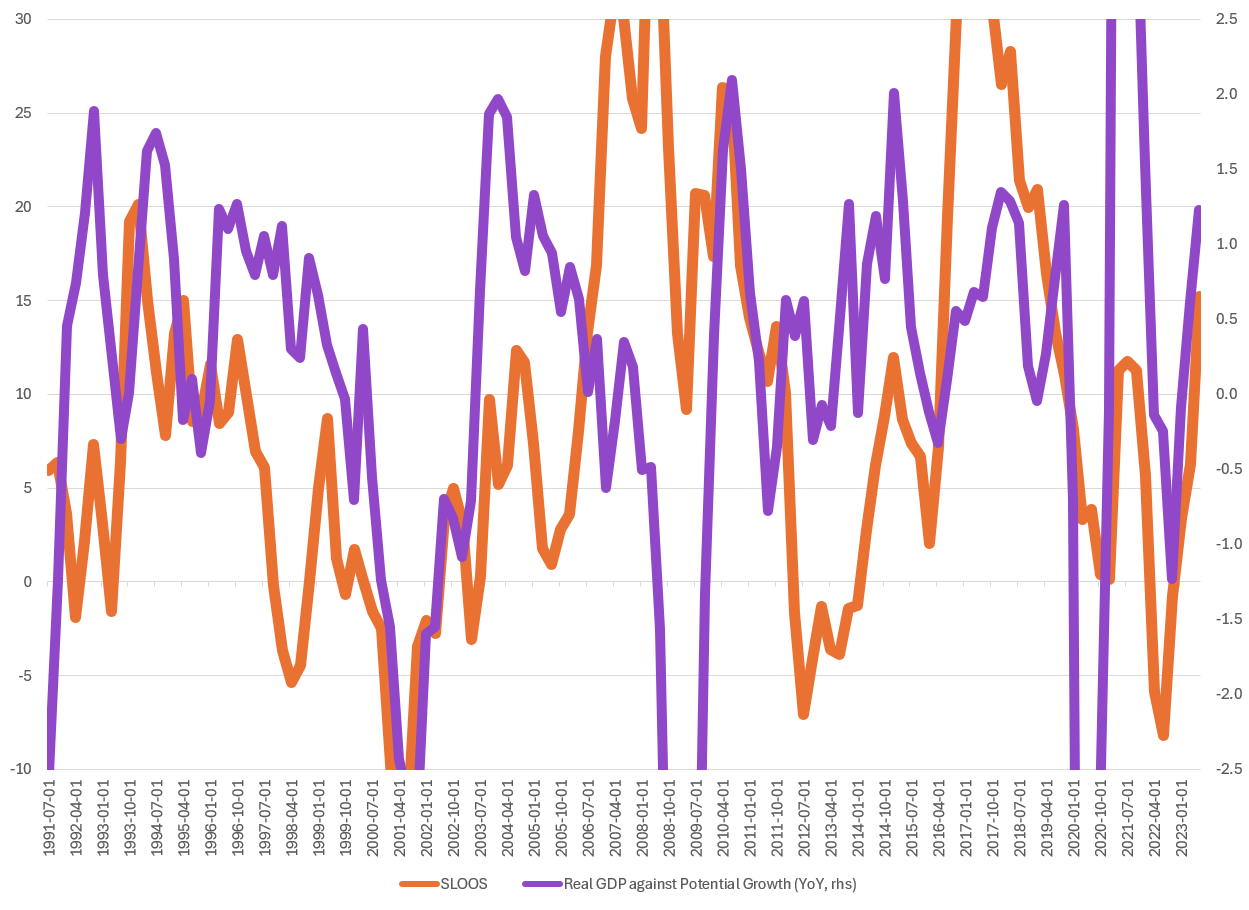

Examining the growth trajectory of the United States, it is evident that real GDP has consistently outpaced potential GDP. Some would argue that where we are seeing SLOOS we should be seeing weak economic growth. Some observers argue that this indicates a positive output gap, suggesting inflationary pressures and an economy operating beyond its potential output. However, I would disagree with this, and think we are seeing a shift in the production possibilities frontier for the United States.

However, I posit that certain dynamic factors, including investment patterns, gross fixed capital formation, and total factor productivity, have effectively shifted the production possibilities frontier to the right. In light of these dynamics, I anticipate that the United States will continue to operate at a higher output level compared to many other economies globally. Consequently, I expect the US GDP to grow at an annualized rate of approximately 1.5% to 1.8%.

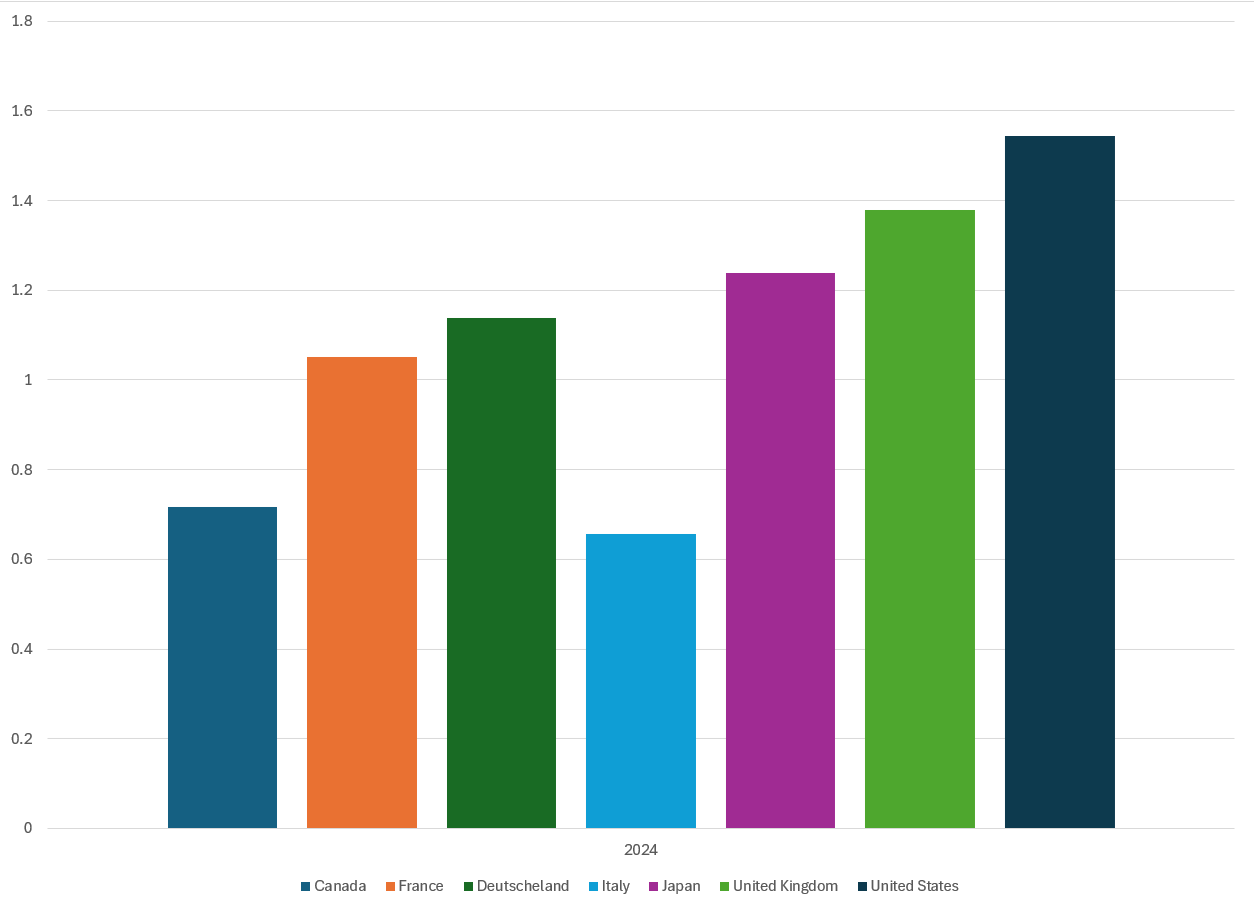

Below, I analyze the anticipated GDP growth for the United States, Germany, France, Italy, Japan, and Canada. This assessment is grounded in the national income identity for GDP, expressed as GDP = C + I + G + NX. The approach involves forecasting expectations for consumption (C), investment (I), government spending (G), and net exports (NX) for each respective nation, and subsequently utilizing these forecasts to project GDP growth. The results highlight that the United States is poised to lead the G7 in terms of expected GDP growth into the year 2024.

It is important to remember that forecasting GDP is rarely accurate, so this estimate should be taken with a grain of salt, as it is obviously exposed to revisions. All of these predictions are based on current expectations from governments and observations of current trends.

In Germany, I expect consumption to be a relatively strong component of the economy into 2024. I also anticipate a tick up in gross fixed capital formation, which will help drive GDP upwards towards the end of 2024. Domestic demand and stronger exports into 2024 are expected to boost German GDP.

Regarding Canada, as discussed earlier, I believe weaker growth is attributed to a lack of gross fixed capital formation, a softening labor market, and lower consumption trends due to labor market softening. The overall domestic output picture remains weak for Canada compared to its peers in the G7, leading to slower output for the Canadian economy overall.

For the United States in 2024, I believe the main drivers will be consumption, government investment, and overall higher GDP growth. If the current trend continues, especially in consumption and investment, the United States is poised for strong growth, leading the G7 into 2024.

In France, I expect domestic demand to continue driving growth, as it has been a significant contributor in 2023. Further drawdown on savings from the French population is anticipated to drive consumption, adding to GDP growth in 2024. While consumption in 2023 has been somewhat constrained, I expect the savings buffer to dwindle as consumer preferences shift towards a more optimistic view in 2024. Investment, however, may remain subdued but should start to appear as a growth variable in the latter half of 2024 as monetary policy uncertainties fade.

Japan has planned tax cuts coming into the next year, expected to boost domestic demand, and continued strong external demand will offset any lackluster domestic consumption that Japan may experience. Given these variables, I expect fiscal measures and external demand to be significant drivers of Japanese growth into 2024.

In the United Kingdom, expectations of rate cuts next year should help loosen the constraints seen in household consumption in 2023. Government spending is also expected to drive GDP in 2024. With the normalization of supply chains and rate expectations, I believe investment should increase in the UK in the latter half of next year. However, the uncertainty lies in how trade buffers with the EU pan out in 2024, potentially requiring a downward revision of GDP for the United Kingdom.

As for Italy, I anticipate weakness. Italy had tax credits that supported housing renovations, but these ended abruptly in the second half of 2023, leading to a massive contraction in GDP. While there will be some carry-over impact, it is unlikely to provide the same boost as seen from 2022 to the second half of 2023. Despite wages rising faster than the rate of inflation (barring geopolitical risks causing a resumption of inflation in Europe), private consumption will likely remain muted overall. Gross fixed capital formation may receive a boost from RRF-supported investment, but this might not be sufficient to push Italy's growth above +1% into 2024. The fall in investment, particularly in housing, along with weaker consumption and what appears to be overall lower government spending, will be the primary constraints on Italy's economy in 2024.

Looking forward to the overall rates outlook, it does appear that most global central banks will start cutting interest rates in a very synchronized fashion. Any marginal differences observed among certain Central Banks, where one is tighter or looser than the rest of the banks in the G7, should be disregarded (with the exception of Japan). Despite posturing, all of these banks are expected to continue cutting and reducing rates at a similar speed as growth readjusts and inflation begins to mitigate. The chart below illustrates that the path of rate cuts and the slope have a very similar trajectory, and, as mentioned above, I expect this trend to continue into 2024.

Now, considering that we should witness overall lock-step moves in the cutting of rates for developed markets, we anticipate volatility starting to normalize within the rates complex. As monetary uncertainty becomes less pronounced, and the market begins to rationalize that the hiking cycle is behind us, we should observe a decrease in rates volatility throughout developing markets. This trend should favor 10s30s steepeners across the board

On the rates front, one area that does seem to be attractive is emerging markets. Given the higher starting point, many emerging markets around the world have already begun their cutting cycle. We are observing this trend in LATAM countries like Chile and Brazil, and we have started to see Mexico considering the cutting of interest rates as well. In Europe, Emerging European Markets are doing the same, with Hungary, Poland, and now the Czech Republic on board. In Asia, we are now seeing Indonesia discussing rate cuts into 2024.

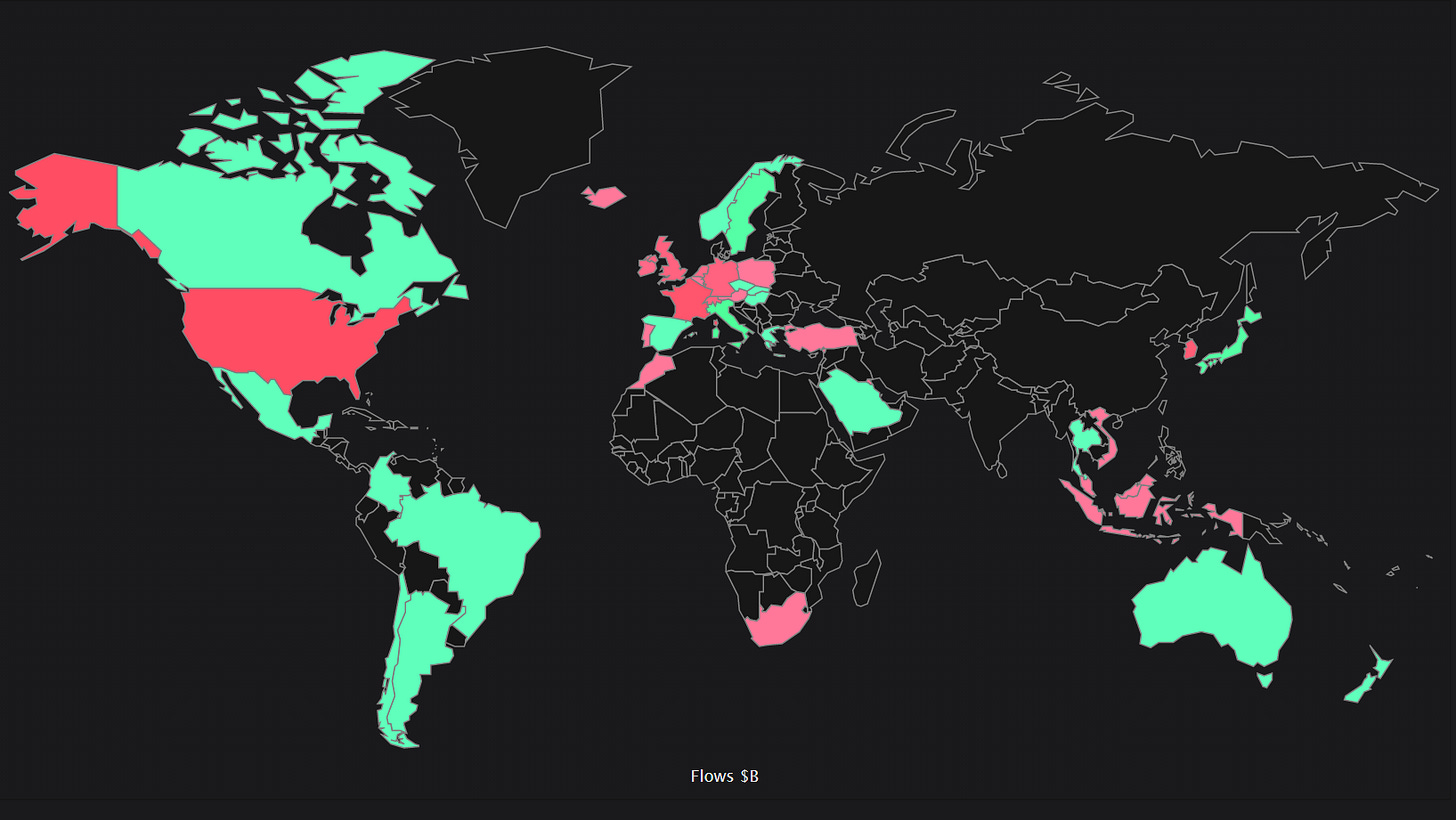

Thus, we are witnessing an end to the global hiking cycle. This can be depicted below, where 16 out of 79 central banks have started cutting rates. I expect this trend to continue into 2024 and become further amplified, especially on the emerging market front, with more central banks opting for interest rate cuts.

Brazil, in particular, remains of interest to me. We are currently witnessing 50 basis points (bps) of cuts per meeting as appropriate and expect this policy to continue for the next couple of meetings. Thus far, they have implemented over 200 bps of cuts after raising the rate to 13.75% to address the inflation problem the nation was facing.

I also expect loose monetary policy to help bring flows back into Brazil, which have been weakened on the back of slow Chinese growth. I believe lower rates will somewhat fuel Brazilian domestic consumption and contribute to improving terms of trade, favoring the Brazilians in the next couple of quarters into 2024. This should help boost GDP growth for Brazil and lead to net capital inflows.

Over the past week, we have started to see a resurgence in global fund flows, with investments pouring into emerging markets. Positive flows are evident in Brazil (+), Argentina (+), Chile (+), Colombia (+), Thailand (+), Saudi Arabia (+), Greece (+), Hungary (+), the Slovak Republic (+), and the Czech Republic (+). The re-emergence of the emerging market trade is apparent, and I believe that there will be a significant increase in fund flows into many of these markets throughout 2024. Eventually, I anticipate that more Asia-Pacific (APAC) markets, especially Indonesia and Malaysia, will be added to the list of those experiencing positive fund flows.

The reason for the bullish outlook on Malaysia and Indonesia is rooted in the structure of their societies; they do not have high levels of leverage. As we have witnessed increased build-out and investment flow into these nations, I believe that over the next year, they will return to experiencing positive flows, benefiting these markets greatly into 2024.

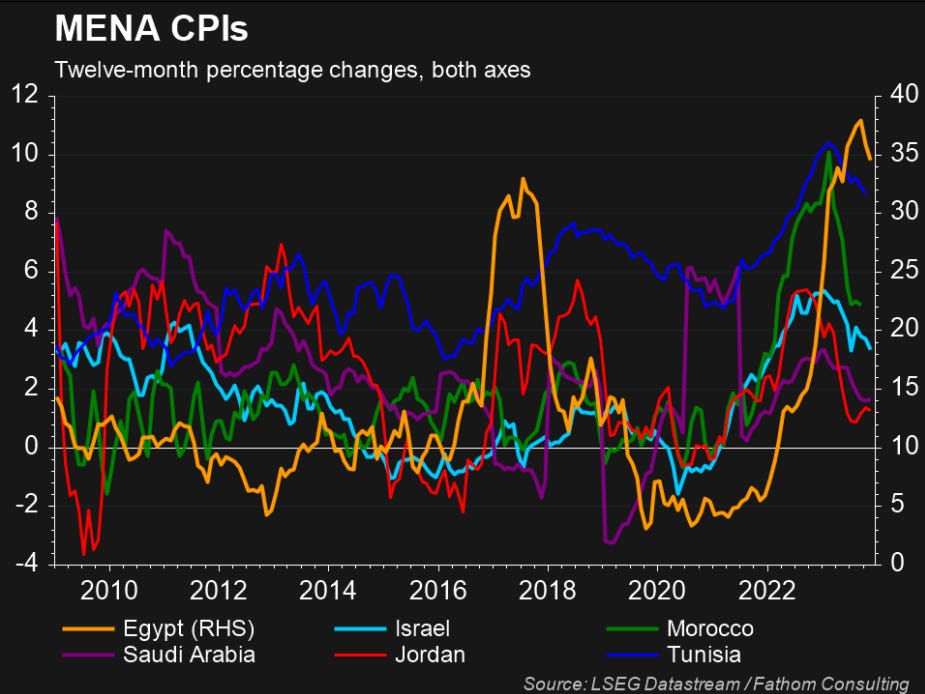

For most emerging markets, I anticipate disinflationary forces to be the primary driving factor into 2024. Upon examining the various emerging markets below, it is evident that many nations comprising these markets have experienced a rapid decrease in inflation. Given that nominal interest rates in many of these countries still remain well above current rates of inflation, I believe this should act as a relief on the foreign exchange (FX) rates. This, in turn, should be another bullish sign for emerging markets into 2024.

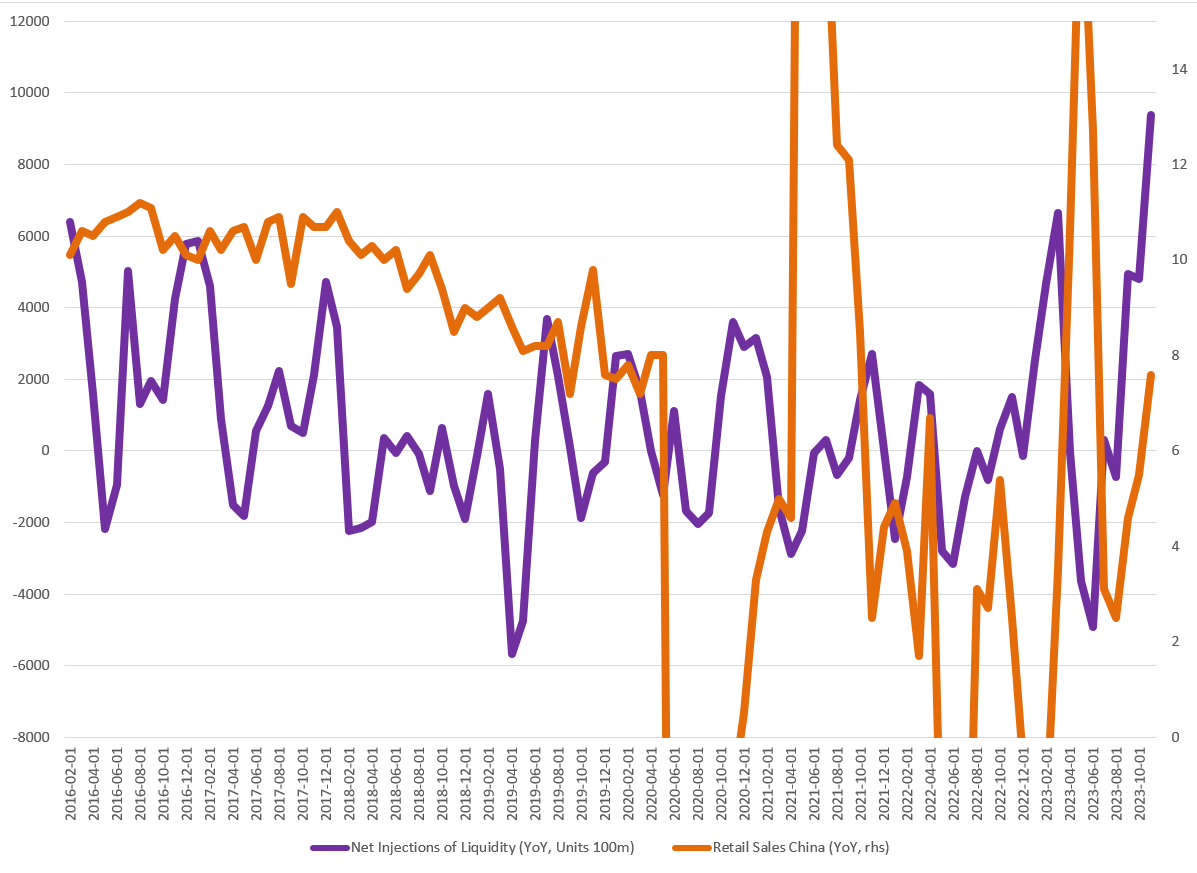

I expect China to continue weakening, and as it stands right now, I anticipate its GDP growth to fall below expectations, possibly reaching around 4%. Despite the massive infusion of liquidity into China, we have not witnessed a significant boost in GDP. China appears to be attempting to stimulate consumption through loose monetary policy, but this has had little impact on aggregate consumption. We have seen retail sales increase somewhat, but those are just coming back in line with trend prior to pandemic.

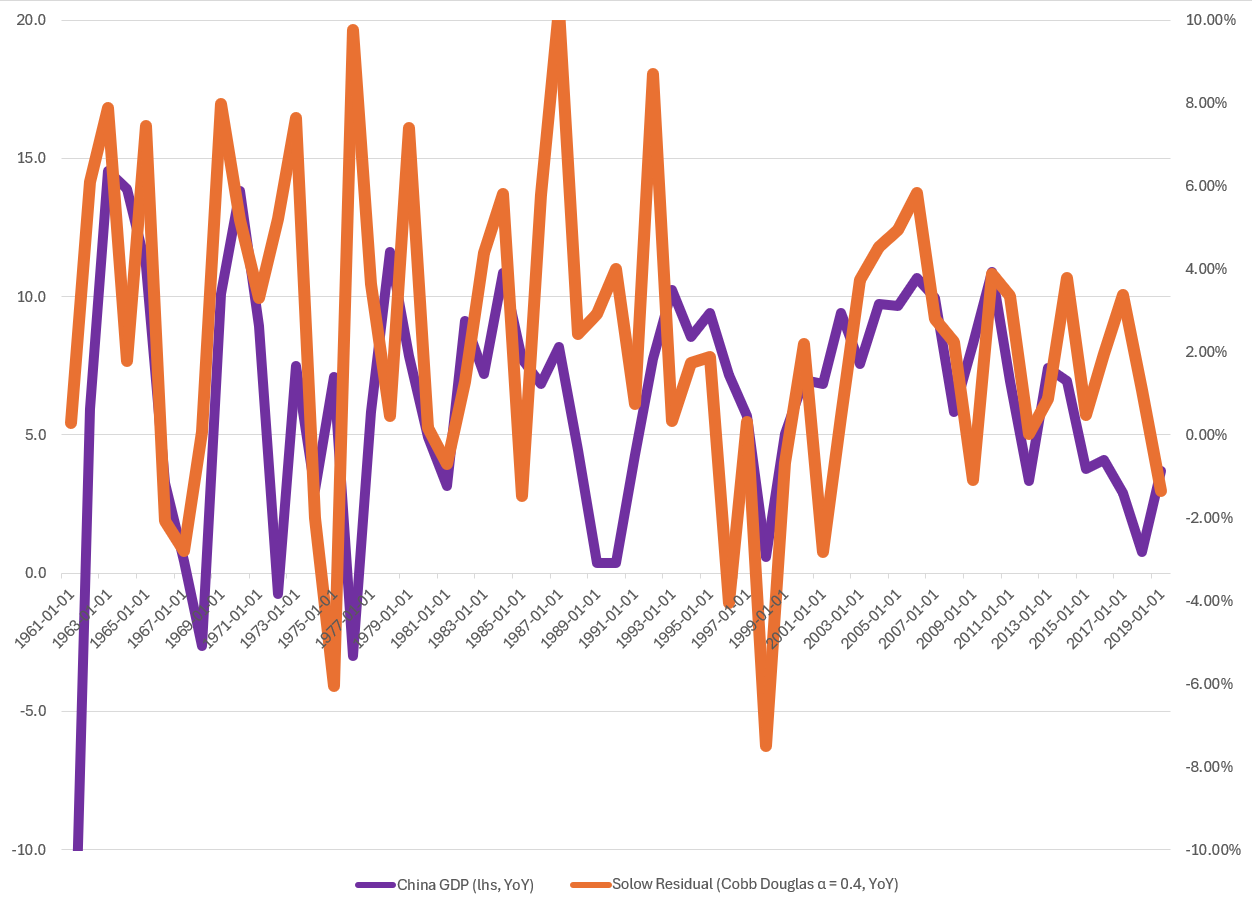

In the 1980s until about 2000, China led the world in Total Factor Productivity (TFP) growth. Many people were amazed by their growth. However, we must distinguish between catching-up growth and cutting-edge growth. China was starting from a much lower base, and as a result, its growth was much more rapid, even from the standpoint of technological advancement contribution to growth (i.e., Solow residual). Looking over the last few years, China's residual or technological advancement toward output has been flat to declining. What we are seeing is the topping out of China's growth and the blow-off top on the catching-up phase of growth. Looking forward to China's future, given the rapid decline in the residual below, and considering the fact that the overall contribution of technological advancement is declining, this points to a China that will experience much slower and weaker growth in the next decade than we have seen before. This means China will require more and more debt to fuel its economic growth, and that growth is not going to come from efficiency in output or technological advancement contribution to growth. Given this, my opinion is to remain short on Chinese growth (long-term) as its growth phase seems to have faded out.

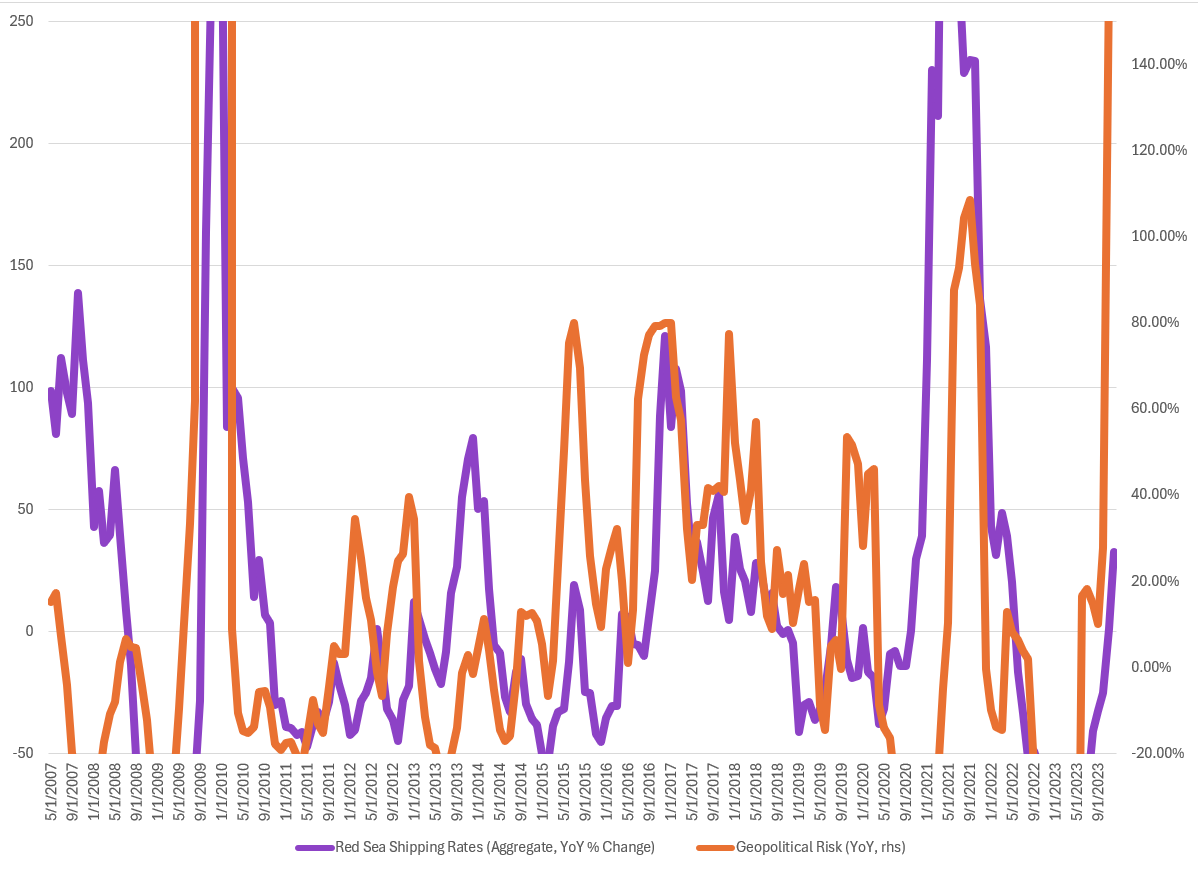

Now, looking forward to geopolitical risks, we observe high levels, particularly around the Red Sea. Additionally, there seems to be a rising concern around the Strait of Hormuz. This issue continues to take center stage when considering commodity prices. Presently, there is ongoing worry about potential events such as a shutdown of the Suez Canal or an increasing probability of the Strait of Hormuz being closed. Currently, while throughput into the Suez Canal has slowed, it remains relatively busy. However, any further deterioration of geopolitical tensions could exacerbate this situation.

Considering the current trading position of oil, it appears to be significantly mispriced, given the substantial increase in geopolitical risk. It seems that oil traders are discounting the risks posed to global trade flows. As of the time of writing, the Islamic Republic of Iran has reportedly struck an Israeli-linked ship in the Arabian Sea. This event not only adds further pressure to oil markets but also exerts upward pressure on shipping rates.

The Geopolitical Risk Index has gone absolutely parabolic, currently sitting at its highest reading in the last 15 years—marking the highest level since the Arab Spring. Given the persistent geopolitical risks, oil and shipping are both significantly mispriced as we approach the year-end and the first half of the next year.

Given the current scenario, I believe continuing to hold positions in oil and shipping stocks remains attractive into the first half of 2024. Shipping rates are nowhere near where they should be, considering the current risks to these trade routes, given the heightened tensions in the Red Sea and the Arabian Gulf. This renders shipping stocks extremely attractive, and being long on both shipping and oil seems to be a strategic move. The potential closure of the Strait of Hormuz, as mentioned, is probable and could lead to a skyrocketing price of oil, along with increased shipping rates. Considering these dynamics, one should view the mispricing of geopolitical risk as a massive buying opportunity.

Now, finally ending on FX. First, let's look at USD/JPY. Throughout 2023, JPY has been absolutely hammered. However, looking ahead, I believe that throughout 2024, the dollar will weaken against the yen. I think this will occur on the back of the unwinding of carry strategies, which should not perform well from a return standpoint in 2024. Considering differentials going into the year 2024, I believe that US rates will start to come down, but JPY rates will rise. This shift is expected to bring capital back to Japan for higher domestic yields.

With that being said, it looks like the overall supply and demand dynamics that have driven flows into the DXY will start to taper off into 2024. However, the decline will not be rapid, and I would expect a more gradual decrease in the overall DXY index into 2024. There will be some aspects where you will continue to see demand for US assets, especially stocks, etc. Given the overall geopolitical uncertainty, there should continue to be some demand for the dollar into 2024. However, overall, the demand will be much weaker, and as spreads start to normalize against the world, the DXY should start to ease.

Looking at the best supply/demand signal for the overall shortage or surplus of dollars involves examining the cross-currency basis swap. I calculated a simple average of all the cross-currency bases among the G7, and what we are observing is that the basis is tightening. This suggests that there is not a significant shortage of dollars, and as a result, it also plays a role in the overall weakness of the dollar. Additionally, given the lower demand for dollar assets, we are observing this factor contributing to a tighter basis.

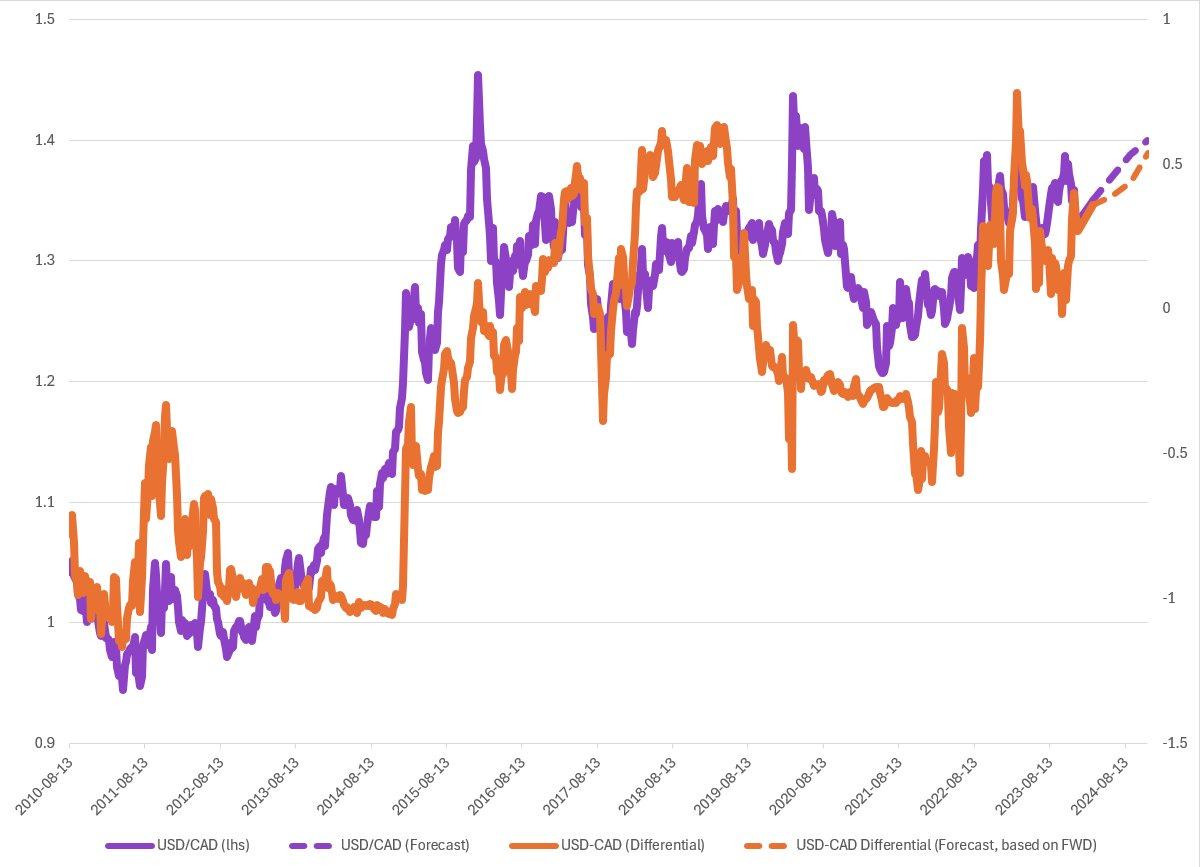

Looking at CAD and considering the current pricing differentials between the Canadian dollar and the USD, I would expect there to still be some weakness in the Canadian dollar, given the weak growth prospects discussed earlier from a GDP standpoint. I anticipate that Canadian investors will continue to find the US a much more attractive opportunity, shunning Canadian assets that appear less appealing both from a yield and total return standpoint. Consequently, I believe the S&P should continue to outperform the TSX, maintaining a premium on the dollar relative to the CAD into 2024.

Looking at the carry-to-vol ratio as well, we can see that the front-end volatility for CAD is near lows, and risk reversals have started to tighten for CAD as well. This appears to be a reflection of what was mentioned above, indicating that investors continue to express weakness in the overall CAD. The carry-to-vol for CAD options is reaching levels that we have not seen for a while in Canada, and I believe this is a reflection of the overall macroeconomic weakness being priced in.

Before concluding, let's touch on oil. In the first half of 2024, I foresee oil being range-bound, with occasional spikes from geopolitical tensions increasing overall volatility. Demand in the first half should weaken, and non-OPEC producers are expected to bring more supply online during this period. As we move towards the end of 2024, stock draws are anticipated to strengthen, leading to tightening within the market. Consequently, I expect oil to experience some upward movement, but given the overall backdrop, I would project oil to be around 80-85 for most of the year.

As we look into 2024, there is much to be optimistic about. Overall economic growth appears promising, both globally and within financial markets. Several factors make trades interesting, with geopolitical risk taking the forefront and likely driving significant commodity volatility. Looking ahead, I anticipate numerous opportunities emerging in the FX markets and within emerging markets (EM) in 2024. Positioning is expected to shift in favor of some EM, which were largely shunned in 2023, providing ample opportunities. With that being said, it promises to be an interesting year.